As the Bitcoin (BTC) market price steadily recovers, a popular market analyst under the username KillaXBT predicts another significant correction in the coming days.

Historical Bitcoin data reveals that the price has repeatedly fallen by 8% every month.

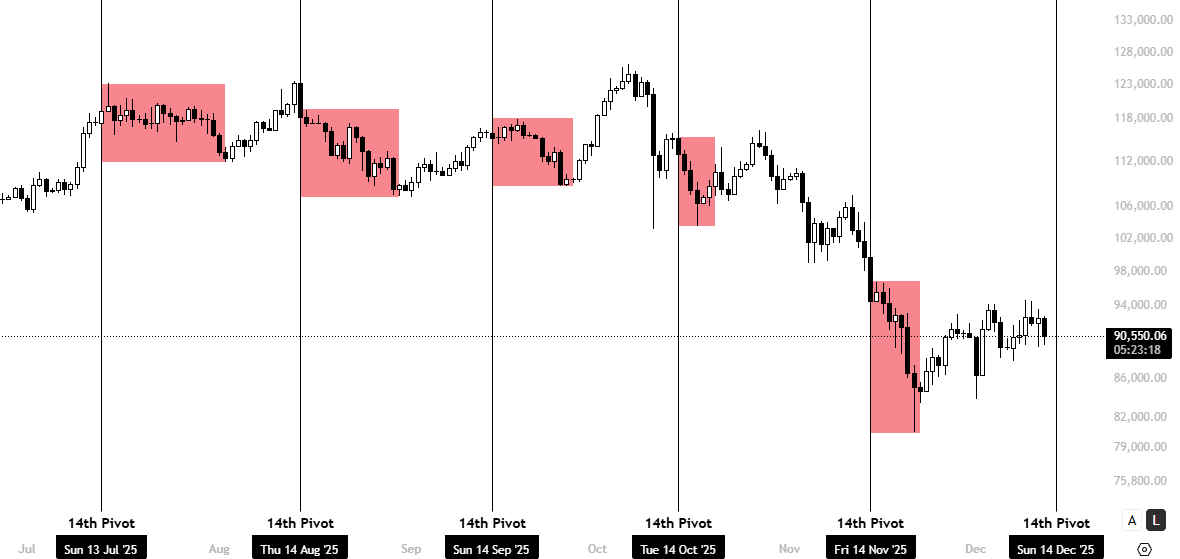

In a Dec. 12 post on X, KillaXBT outlined cautious market insights that suggest Bitcoin is headed for a price decline. According to renowned analysts, this top-tier cryptocurrency has consistently recorded an 8% price decline since 14 days out of the past five months. KillaXBT describes this observation as the 14th pivot, which has important implications for Bitcoin in the short term. Since hitting a low of $80,000 in late November, BTC has formed an upward channel, repeatedly recording stable lows and highs.

However, KillaXBT’s prediction is that it could break out of this channel and halt the initial uptrend. Analysts say that based on regular price patterns, Bitcoin investors should expect a price decline of at least 5% after December 14th. This suggests the possibility of retesting the $85,000 to $86,000 price range.

Given the asset’s broader bullish market structure, such a move could only be a short-term pullback. However, the prolonged correction seen early in the fourth quarter is already precedent-setting, leaving room for further declines if momentum weakens.

Will BTC drop below $50,000?

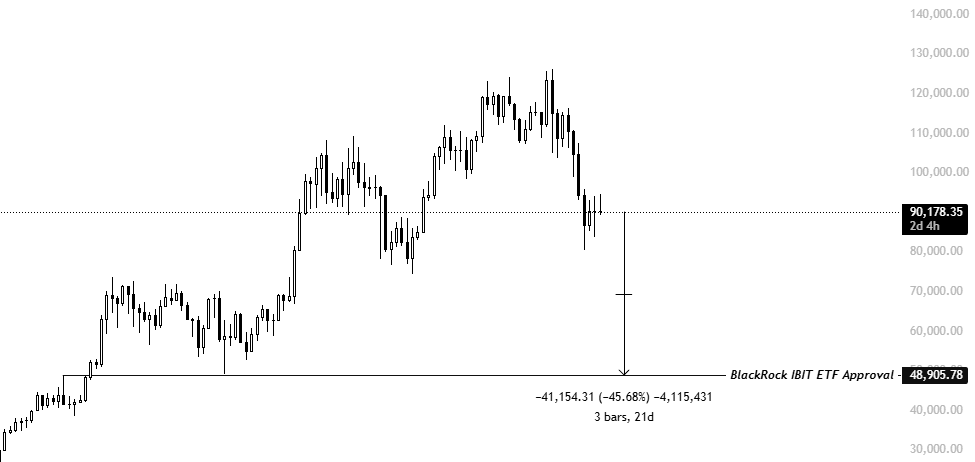

In another X post, KillaXBT shares a more bearish prediction for the Bitcoin market. This time, experienced analysts predict that the cryptocurrency market leader will reach a price floor of $48,905, despite the recent price rise. KillaXBT’s floor target represents the Bitcoin price at the time the BlackRock IBIT ETF was approved along with 11 other Bitcoin spot ETFs in January 2024. This prediction can be attributed to the common rationale that the current bull market is largely supported by inflows from institutional investors.

In particular, the Bitcoin Spot ETF has been at the center of these institutional investors’ inflows, with total net assets of $119.18 billion. BlackRock IBIT holds more than half of this traction as the undisputed market leader with net assets of $71.03 billion and cumulative net inflows of $62.68 billion.

If Bitcoin returns to its pre-ETF approval price level, it would represent an estimated 46% drop from its current market price. Such a move would likely signal a sharp reversal in the positions of financial institutions, suggesting that sustained ETF outflows, rather than retail capitulation, could be the main catalyst for a new crypto winter.

At the time of writing, Bitcoin continues to trade at $90,348, reflecting a decline of 2.18%.

Featured images from Pexels, charts from Tradingview

editing process for is focused on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is carefully reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance, and value of your content to your readers.