Bitcoin prices have been an interesting performance in 2025 so far, and this year marks the year. However, the flagship cryptocurrency ended the first quarter of that year, with over 15% of its value being scraped off in those three months.

BTC prices appear to be stable within the combined range, but the prognosis may not all look positive for the world’s largest cryptocurrency. This explains why some short-term investors are getting frustrated and, as a result, are withdrawing from the market.

Is Bitcoin trying to raise it?

In a new post on the X platform, an analyst on the chain with the DarkFost pseudonym revealed that certain classes of Bitcoin holders have lost their assets. According to Crypto Pundit, the sale has occurred at a rate that has not been seen since the FTX collapse.

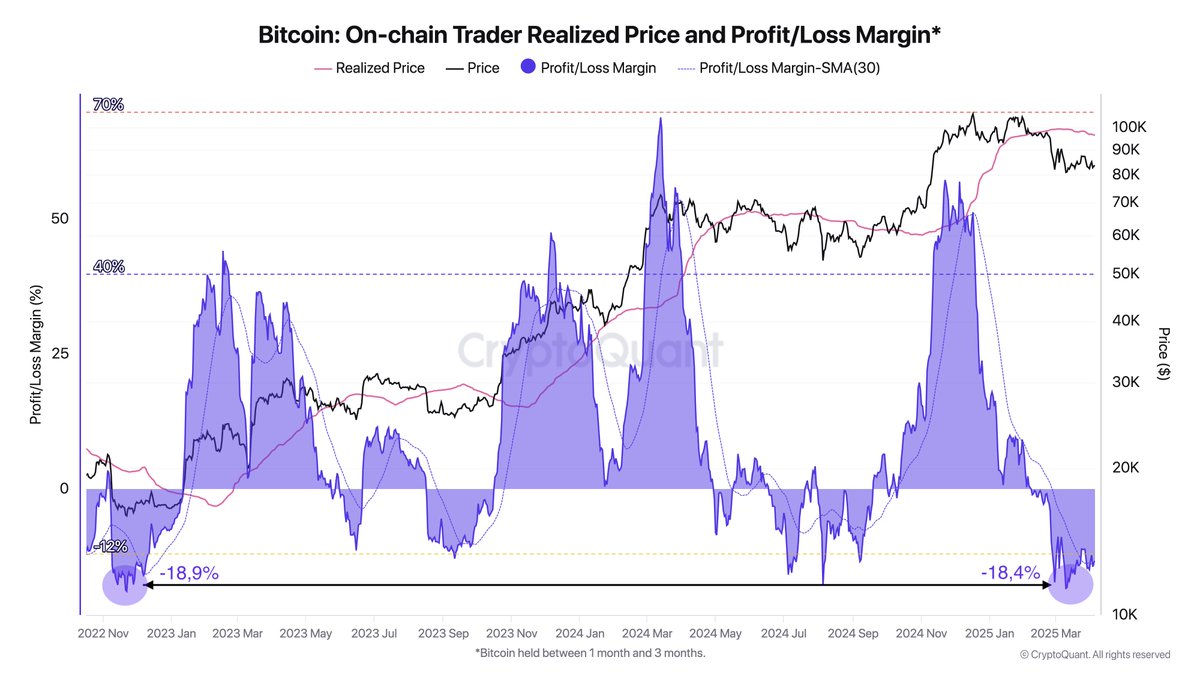

This on-chain observation is based on a significant drop in profit/loss margin and tracks investor profitability by comparing the purchase price with the current price of cryptocurrency. This metric provides insight into whether the market is in an unrealized state of profit or loss.

Specifically, DarkFost’s analysis focuses on Bitcoin investors (also known as short-term holders) who have held BTC for 1-3 months. These traders are considered the owners of the most reactive class, the traits highlighted by recent activities.

Source: @Darkfost_Coc on X

According to DarkFost, short-term BTC holders have been offloading coins with losses since early February. These realized losses are now at the level last seen in the FTX crash, even higher than the losses recorded during the 2024 price pullback.

Historically, the realisation of significant losses by short-term Bitcoin holders has preceded a significant rise in price movement, especially when long-term holders continue to accumulate. Therefore, the persistence of this trend means that long-term investors will remove coins from weak hands before the next bullish jump.

BTC price a glance

At the time of writing, the price of BTC is around $83,700, and does not reflect any major changes over the past 24 hours. According to Coingecko data, market leaders have grown by 1% over the past seven days.

The price of Bitcoin is thickening around the $84,000 level on the daily timeframe | Source: BTCUSDT chart on TradingView

ISTOCK featured images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.