Major crypto investors have significantly expanded their short positions in Bitcoin and Ethereum, deepening their bearish mood as the overall market struggles to regain momentum.

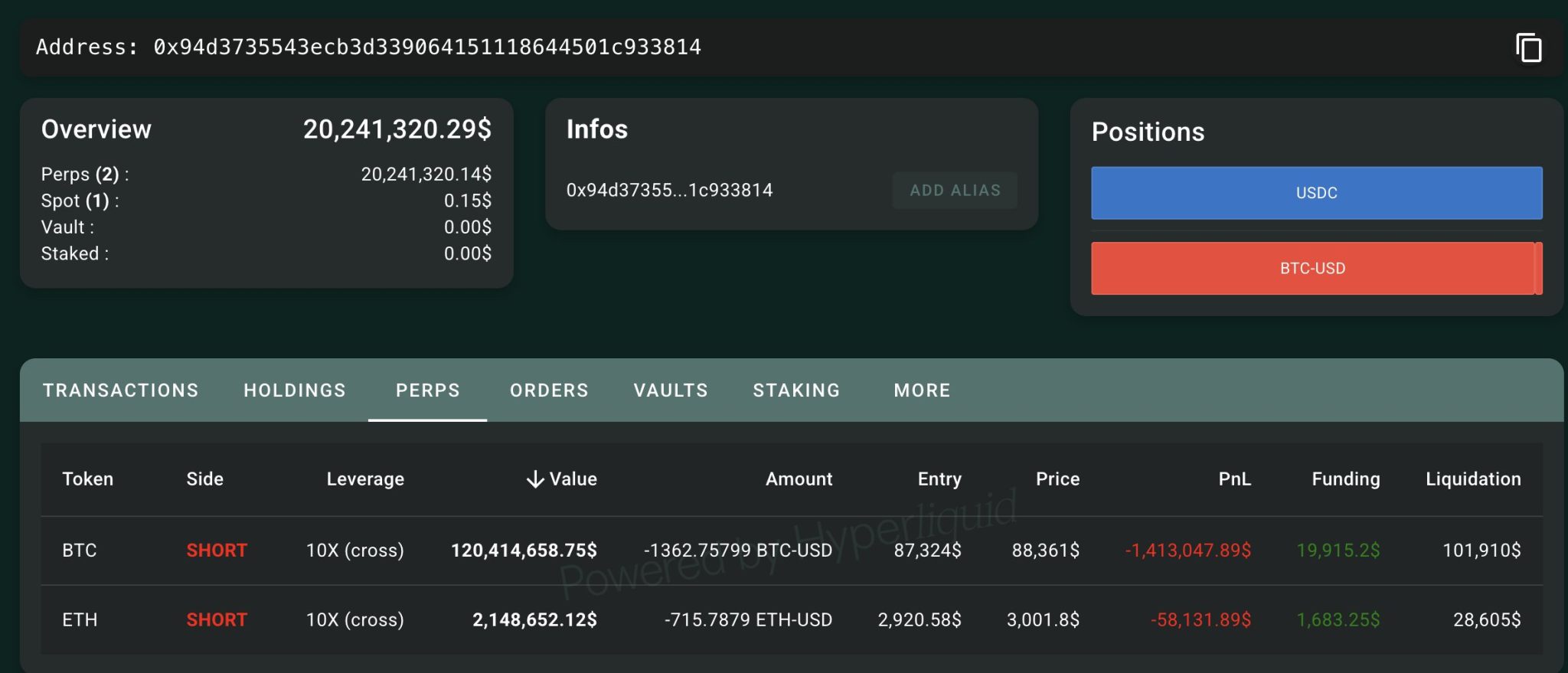

On-chain data shows that the whale wallet, identified as 0x94d3, continues to accumulate downside exposure after significantly reducing its Bitcoin holdings earlier in the week. The move confirms growing belief that the recent market recovery may be fragile.

Last Friday, the wallet sold 255 BTC for $21.77 million, for an average price of $85,378 per Bitcoin, according to blockchain analytics firm Lookonchain. Immediately after exiting part of the spot exposure, wallets aggressively pivoted into leveraged short positions.

Leveraged shorts expand into Bitcoin and Ethereum

According to Lookonchain data, whales opened 10x leveraged shorts in both Bitcoin and Ethereum on Friday. Specifically, the initial Bitcoin shorts totaled 876.27 BTC with a notional amount of approximately $76.3 million. At the same time, the wallet shorted 372.78 ETH, worth approximately $1.1 million.

Rather than reduce risk, the trader added to these positions on Monday. An additional 486.49 BTC and 343.01 ETH were placed on the short side.

As a result, the total Bitcoin short exposure increased to 1,362.76 BTC (worth $120.41 million), and the Ethereum short position now stands at 715.79 ETH, for a total value of approximately $2.15 million.

Position indicator shows initial drawdown

On-chain metrics provide further insight into the risk profile of your transactions. For example, the average entry price for a Bitcoin short is estimated at $87,324 and liquidation at nearly $101,910.

Bitcoin is currently trading at around $88,361 and the position represents an unrealized loss of around $1.41 million.

Ethereum data paints a similar picture. ETH shorts were entered near $2,920 and the liquidation level was well above $28,605. If the market price is close to $3,001, the unrealized loss is estimated to be $58,131.

On-chain metrics for short positions in Bitcoin and Ethereum

These aggressive bearish bets come just as the broader crypto market is stabilizing following a prolonged slump in October. Prices have shown a cautious recovery, but analysts warn that underlying weaknesses remain.

Several technical indicators suggest that the rebound could face new pressure.

Technical analysis suggests downside risk

Cryptocurrency analyst CryptoOnchain highlighted these concerns in a recent post on X, noting that selling pressure continues to dominate Bitcoin’s price structure.

Bitcoin is currently trading near the Point of Control (POC), an important level where recent trades took place and often acts as support or resistance.

The analyst warned that if the stock fails to recover from previous highs, the risk of a fall towards $70,000 to $73,000 increases.

The bearish divergence in the RSI further raises concerns about a deeper pullback.

Traders should keep an eye on the $72,000 level for signs of a potential pullback, but sustaining levels above $70,000-$73,000 is essential. Anything below this could result in an even bigger adjustment.

Citi’s outlook remains cautious

This technical outlook is consistent with Citigroup’s recent forecasts. In a research note, the bank outlined a wide range of possible outcomes for Bitcoin over the next year.

Under a bearish scenario, Citi predicts that Bitcoin could fall to $78,000. Conversely, a bullish case could send the price up to $189,000, highlighting the extraordinary degree of uncertainty facing the market.