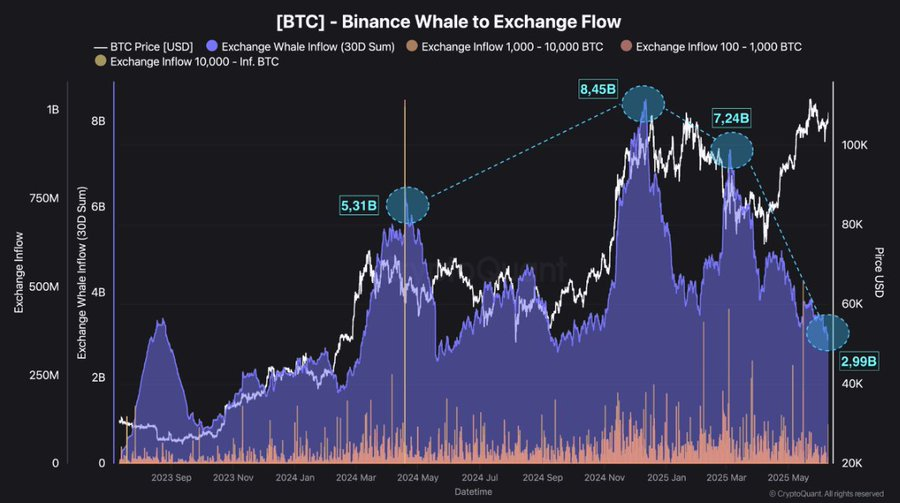

- The whale influx has fallen to a minimum of $2.999 billion since early 2023, bringing sales pressure down.

- Bitcoin forms a bull flag breakout, projecting an upward target of around $144,000.

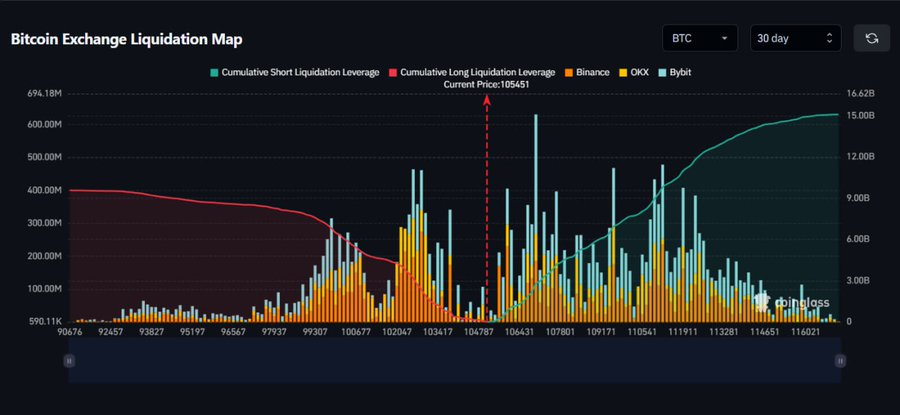

- If BTC increases by 10%, derivative skew indicates the risk of large short apertures.

Whale’s Bitcoin inflows into Binance have dropped to $2.99 billion, the lowest since early 2023, as crypto has pointed out. Data shows a critical change in behavior, where inflows of more than $5 billion in the past, are a precursor to a rapid revision. At the top of the last two cycles, Binance experienced $53.1 billion, $8.45 billion and $7.24 billion in 30-day whale influx, followed by price corrections.

Source: x

Bitcoin is currently changing hands over $110,000, 2% below its all-time high of $111,970. However, large owners are shunned. Their reluctance to sell at a higher level is a positive indication that they will increase their confidence in higher upside down.

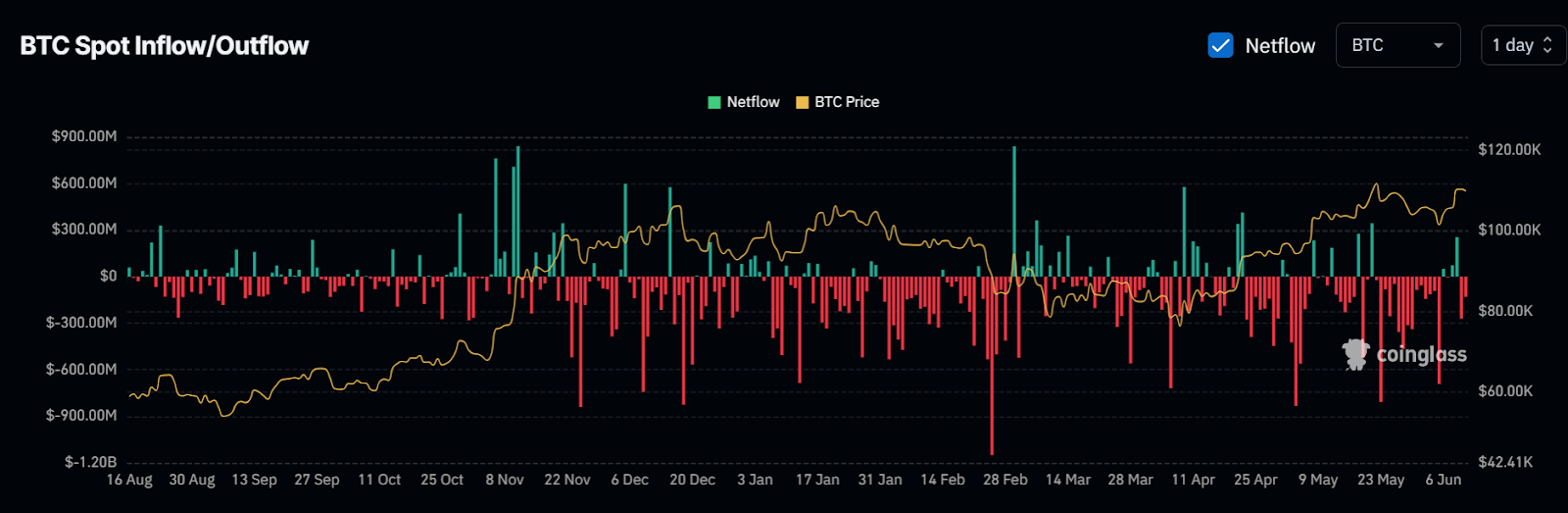

Meanwhile, the influx of spots has settled. Bitcoin has been traded for over $109,000, but Coinglass’ recent Netflows shows that the leak continues to dominate. The huge lack of accumulation, particularly on binance, suggests that whales are not on sale.

Source: Coinglass

The peak of $7 billion to $8.5 billion inflows seen at the top of the past cycle has not been repeated, and the current trend remains at around $3 billion. This continuous decline in supply in exchanges could reduce sales pressure in the short term, and bullish cases become stronger as price momentum arises.

Bull Flag Breakout Project $144K Goal

Bitcoin has completed its breakout. Bull flags are a continuation pattern that tends to turn powerful movements upside down. The flag height counted between the $105,000 rise and the recent breakout area marks a target of around $144,000.

As long as BTC holds its previous consolidated area between $98,000 and $102,000 above the $98,000, the breakout remains valid, according to analysts such as trader Merlijn. Fibonacci’s expansion level and historic momentum setup are consistent with the price structure, and the possibility of continuation of the assembly is increased indeed. Over the past seven days, BTC has risen by 4%, but is being met by resistance at the $111,000 level.

Starting $btc flag

Bitcoin has completed the perfect Bull Flag.

Target: $144,000Prices are already pushing for breakouts.

This is the beginning of the parabolic movement. pic.twitter.com/syvifmosgc

-Merlin The Trader (@merlijntrader) June 8, 2025

Derivative imbalances and whales’ strategic backlary

In derivatives, the clearing data shows a significant imbalance in the benefits. If Bitcoin rises 10%, the risk is even higher on the side of short sellers, where more than 151.1 billion shorts are settled. Conversely, a comparable decline would only result in a long liquidation of $9.58 billion. This skew means that a price explosion can lead to shorter throttles, which will continue to generate momentum.

Additional evidence of this arrangement is the atypical tranquility of the Binan Skudhale. These entities have historically abandoned large holdings at pricetop. In early 2024, exchange inflows exceeded $5.3 billion. That figure is down significantly today. Their decision to continue holding instead of selling means confidence in future benefits.

The technical indicators are also advantageous for rally papers. The Daily Chart recently gave Golden Crosses at 50-day moving average intersections, over 200 days. When this last happened, BTC fell in the short term and then rose 60%. It is possible that the same placement occurred in the second quarter of 2025.