The Bitcoin (BTC) derivatives market is gearing up for a potential blow to overexchange buyers if prices change in the wrong direction.

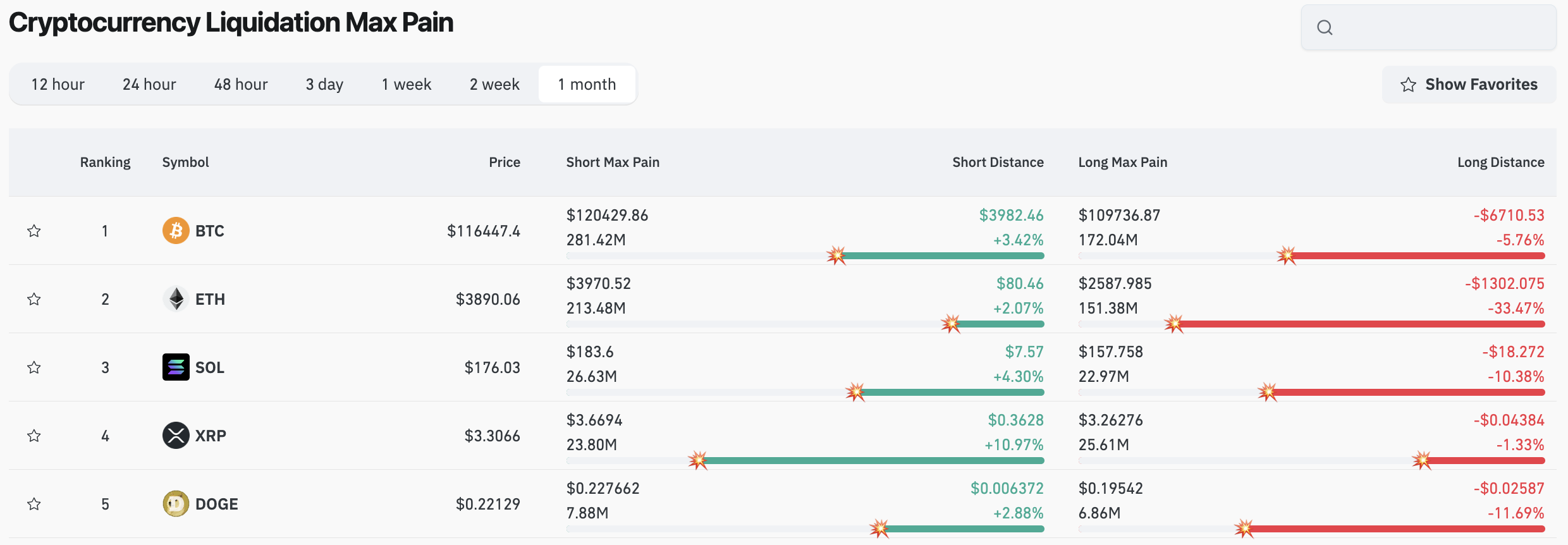

According to fresh Coinglass data, if BTC falls into the monthly “Maximum Pain” zone currently located near $109,736 and is about 5.8% below the current trading price, a long position of about $172 million could be at risk. This level marks the point where a rapid decline causes flooding of forced liquidation and can escalate sales pressure within minutes rather than hours.

Over the past month, the market has grown between two issues, with short exposure peaking at $120,429, roughly 3.36% above current spot prices. A high sudden push could put a short bet of $281 million at risk, but the current situation suggests that the risk of downward movement is more imminent.

Liquidation data for the past 24 hours supports this. This erased a longer position of $93.09 million on the short side, compared to $191.5 million. This indicates that volatility affects both sides, but the leaves are only a few bad mites that are long from the trouble.

Crypto liquidation: Status

The larger heat map reveals that Ethereum was the biggest casualty of the day, with $133.05 million being liquidated. It’s well over $2,884 million for Bitcoin and $2,752 million for XRP. It also induced Solana, Dogecoin and other large coins, resulting in a total liquidation tally of $284.59 million from over 101,000 traders.

The biggest hit was an ETH/USDC position worth $3.29 million, which was closed at Binance.

On the four-hour chart, Bitcoin struggled to hold the $117,000 level and retreated to around $116,500 on the last check. Support levels near $115,254 and $114,887 are important. Losing these opens the way to a high-risk liquidation zone.

If the market is shifting slightly, the chain reaction can be rapid.