As Bitcoin (BTC) shows an edge near the psychologically significant $100,000 milestone, some technical and chain metrics suggest that major breakouts may be on the horizon. One such metric, the obvious demand for Bitcoin – shows strong rebounds, showing strong rebounds in the market, renewed interest and sustained accumulation.

Bitcoin is seeing a rapid rebound in obvious demand

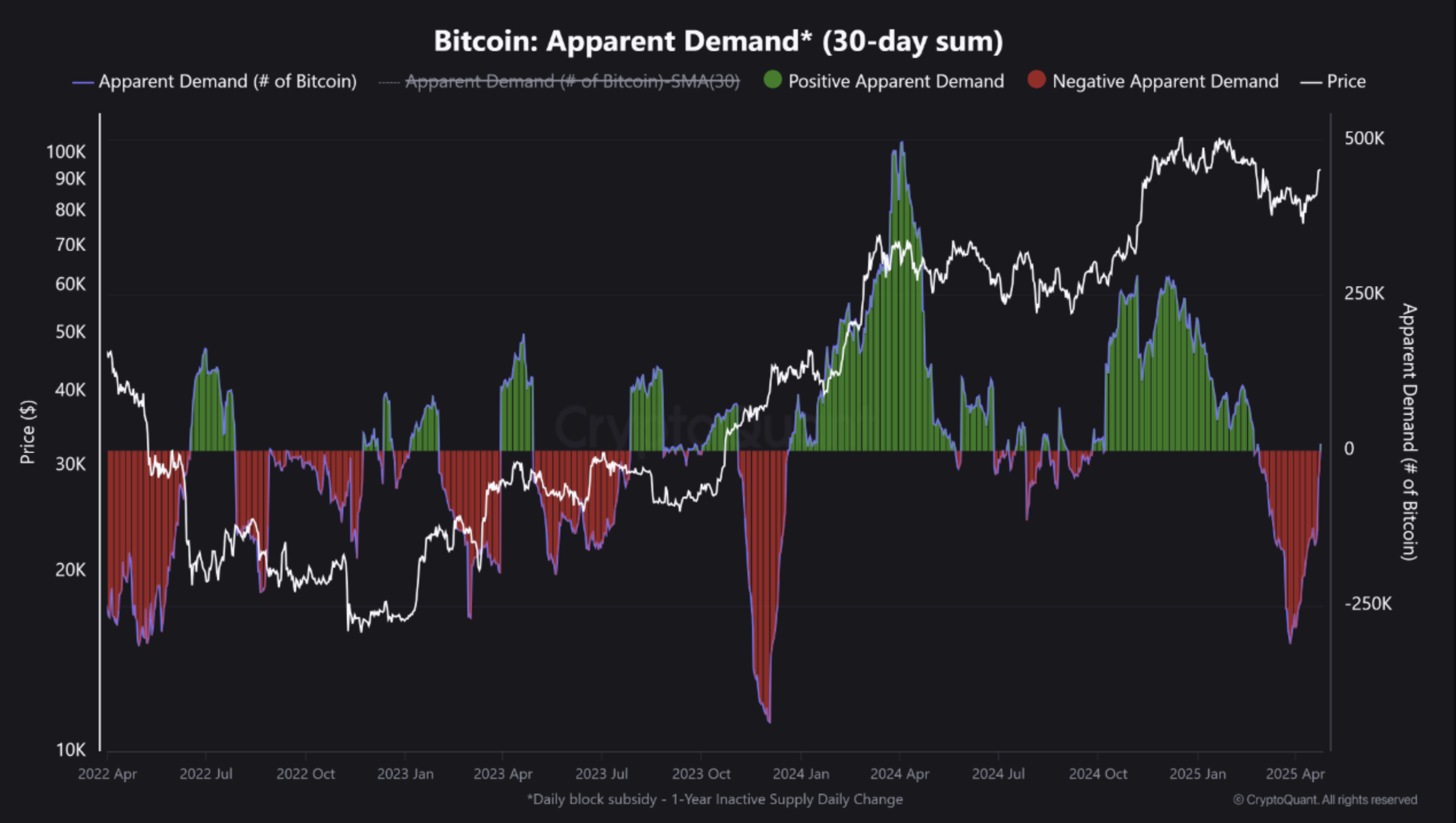

According to a recent encrypted Quicktake post, IT Tech pointed to a significant increase in the obvious demand for BTC. Most notably, this key indicator has been spent several weeks in the red for a row before returning to positive territory.

For beginners, the apparent demand for Bitcoin (30-day total) measures the cumulative net demand for BTC over the past 30 days by tracking wallet accumulation and exchange outflows. This rapid increase in metrics suggests strong and sustained purchasing pressure. This can show bullish sentiment and potential price increases.

The following chart shows this rebound in the obvious demand for BTC. This essentially reflects the net change in inactive supply over the year adjusted by daily block rewards.

Previously, this metric had fallen deep into negative territory – below -below 200,000 (highlighted in red) – suggesting a decline in demand. However, recent reversal to positive territory suggests long-term capital has flowed into the market. As mentioned in the post:

Demand pivots are closely matched with recent price rebounds above $87,000, meaning this recovery is supported by actual on-chain behavior rather than purely speculative flow.

This marks the first positive apparent demand reading since February, consistent with an increase in flow into Spot Bitcoin Exchange Funds (ETFs) and an increase in accumulation by long-term holders.

Data from SOSOValue shows that the US-based Spot BTC ETF has recorded net positive influx for five consecutive days, totaling over $2.5 billion. The cumulative net inflow into Spot BTC ETFs is currently impressive at $38.05 billion.

Can you see the BTC rally?

IT Tech noted that past reversals in apparent demand have preceded either historically significant gatherings or strong price support. If the current trend continues, BTC could have the momentum needed to challenge the $90,000 level in the short term.

However, analysts should note that Bitcoin needs to keep its current support at around $91,500. Upwards Momentum. This level is particularly important as it is close to the realised price of short-term BTC holders. According to Encrypted contributors to CrazzyBlock.

In addition to this outlook, the well-known crypto analyst Rect Capital Emphasised That Bitcoin needs to secure a weekly deadline of over $93,500 and collect it as support to establish a clear pass to $100,000. At press time, BTC trades at $94,492, an increase of 2% over the past 24 hours.

Featured images from Unsplash, Cryptoquant and TradingView.com charts