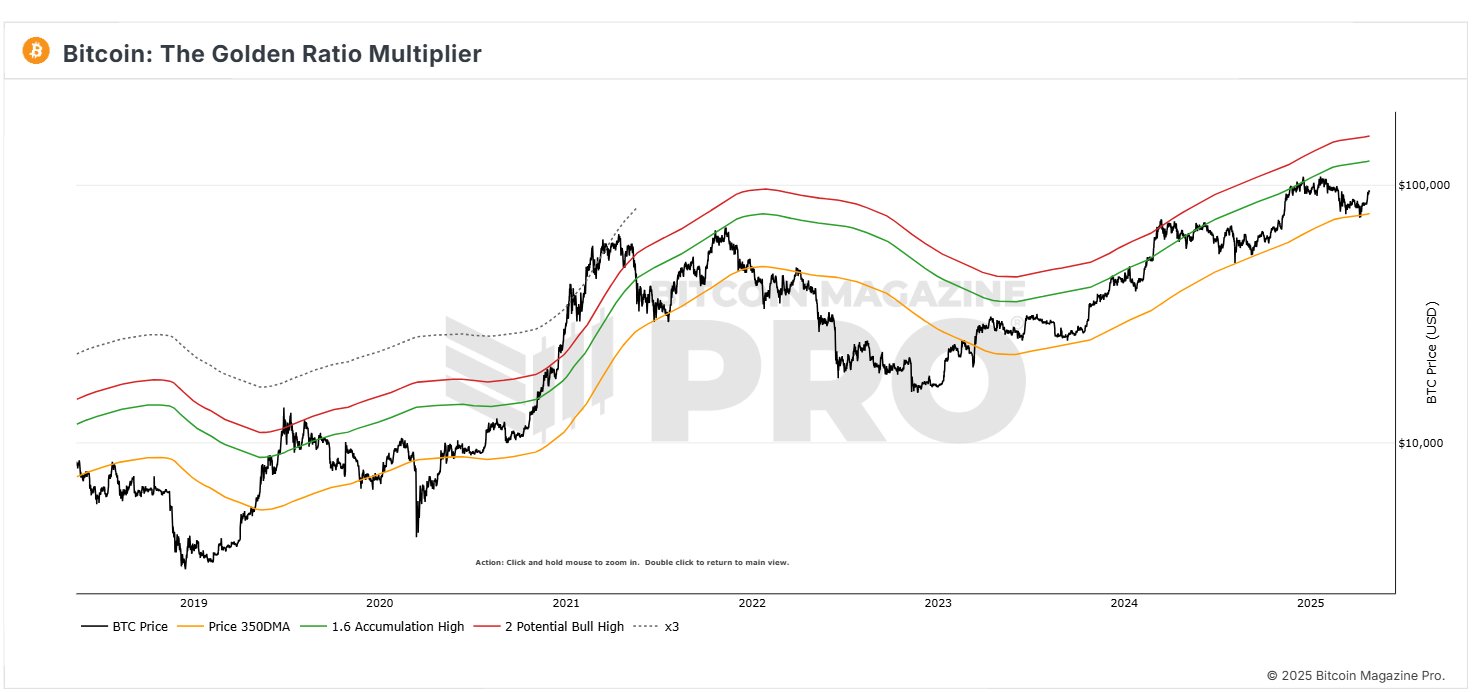

Famous Crypto analyst Burak Kesmeci has tilted Bitcoin (BTC) to achieve its $124,000 price target based on data from the Golden Ratio Multiplier Price Model. This bullish forecast comes after an impressive price surge last week, suggesting that the best cryptocurrencies may have room for immediate price growth.

Can Bitcoin return to its accumulation peak target of 1.6x?

In an X post on April 26th, Burak Kesmeci shared the latest updates to the Bitcoin Golden Ratio Multiplier Price Model, looking at data from Bitcoin Magazine Pro. In the context, the Golden Ratio multiplier model can help identify possible overestimation or underestimation of BTC using moving averages and Fibonacci ratios, thereby indicating possible market top or good accumulation opportunities.

According to the chart below, Bitcoin recently retested its 350 daily moving average (350DMA) at $77,000. As the name suggests, 350DMA tracks the average price of BTC over the last 350 days and acts as an important support zone. Touching or temporarily soaking under this level often indicates potential long-term purchasing opportunities.

Bitcoin has recently rebounded 350DMA. The price then dropped to $75,000, followed by two price increases, the same as $96,000.

Along the price range of Golden Multiplier ratios, BTC is currently at 1.6x accumulation, or 1.6x 350 DMA, currently at $124,000. Therefore, despite continued price integration, BTC could generate another price rallies based on the Golden Multiplier Ratio pricing model.

Interestingly, when Bitcoin moves near or beyond this level, it often marks the end of the accumulation stage and the beginning of a stronger bullish trend. Therefore, reaching BTC to $124,000 only paves the way for further price increases in line with the lofty goals of some market analysts.

BTC Minor has earned $186 million

In other news, another top crypto analyst, Ali Martinez, reports that miners have recently taken advantage of Bitcoin’s impressive price rallies, recognizing profits of nearly $186 million as prices rose above $94,000.

This realised profit spike highlights that early miners are strategically profiting at these high price levels. However, it is worth noting that despite this sales pressure, Bitcoin holds a strong bullish momentum driven by multiple factors, including a strong influx into spot ETFs.

At the time of writing, BTC was valued at $94,393, reflecting a 0.76% price drop on past days.

Investopedia featured images, TradingView charts

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.