Bitcoin (BTC) remains within the tough trading range, following recent pullbacks from the all-time high. At the time of writing, the world’s largest cryptocurrency price was $118,570, reflecting a 0.3% increase over the last 24 hours.

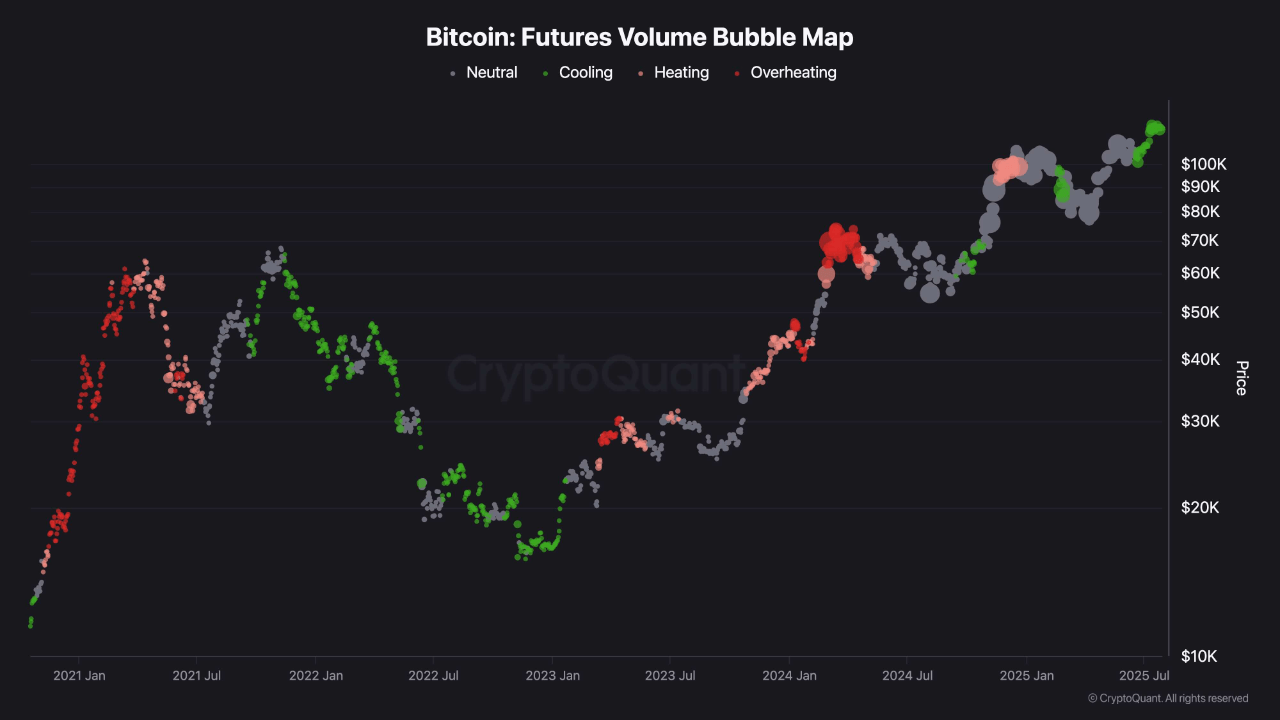

A recent analysis shared by Shayanmarkets, a market contributor on Cryptoquant’s Quicktake platform, highlights a significant change in Bitcoin’s futures market activity.

Analysts say previous price surges in the $70,000 to $90,000 range were marked by accumulation of large speculative pressures and leverage, but the current trend shows signs of cooling despite rising price levels. This shift could play a key role in determining Bitcoin’s trajectory in the coming weeks.

Bitcoin futures market shows signs of normalization

Shayanmarkets explained during past gatherings that the futures market showed what he called the “heating and overheating stages.” These periods usually resulted in corrections or temporary price consolidation as leveraged positions were rewinded.

However, the current data reflects a different setup. Even though Bitcoin remained near record highs, futures market activity has shifted to the neutral and cooling phases, as indicated by the grey and green bubbles on the chart.

Analysts said this cooling phase could be a sign that robbed traders of risk. In a statement on Quick Take, Shayan Market said:

This leverage shows a healthier market situation as BTC shifts to organic purchases rather than high-risk speculative bets, despite its over $100,000.

Analysts added that if speculative pressure is continued, it could provide another significant base for price increases, potentially breaching Bitcoin at its record high above $123K.

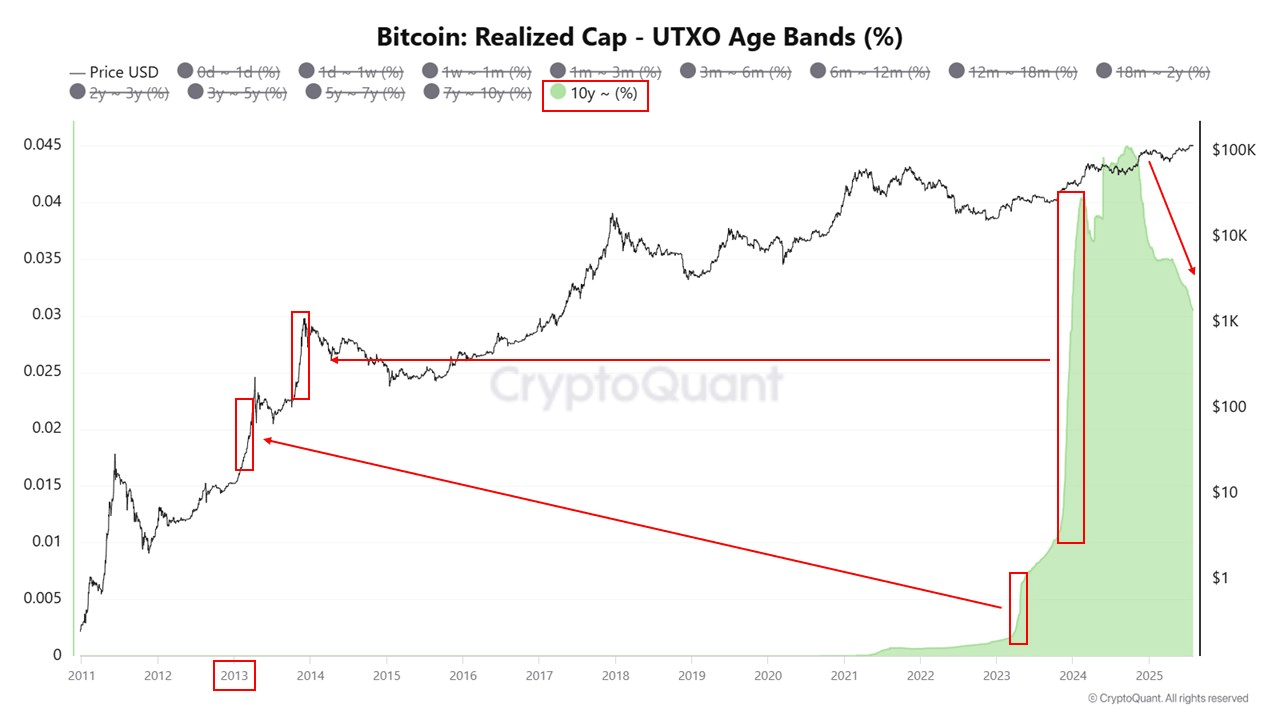

Long-term whales benefit from price stability

Meanwhile, another analysis from the coincidence of crypto-contributors revealed sales activities from long-term Bitcoin holders known as “whales,” who have maintained their position for over a decade.

By coincidence, some of these holders, including those who first accumulated Bitcoin around 2013, began liquidating some of their holdings.

This sales activity rose to about $1,000 with a historic timeline of Bitcoin’s rapid rise over that period, representing a 117,900% return for early adopters.

Such returns from early investors are not uncommon during periods of price rise and do not necessarily indicate long-term changes in market sentiment.

Historically, whale activities have influenced short-term volatility, but have also contributed to market redistribution, allowing new participants to enter the market.

Special images created with Dall-E, TradingView chart