Ethereum is currently trading above the $3,000 level, providing some surface-level stability after weeks of volatility. However, under this price resilience, market sentiment remains decisively bearish. Many analysts are openly calling for lower levels in the coming months, citing weak momentum, macro uncertainty and sustained selling pressure across risk assets. Extreme fear dominates positioning, with investors showing little confidence that the recent recovery can develop into a sustained uptrend.

This pessimistic background highlights recent institutional-related activity. Amid widespread alarm, data suggests that Fundstrat co-founder Tom Lee and affiliated entity Bitmine is increasing its exposure to Ethereum.

Bitmine is a digital asset mining and investment vehicle focused on long-term participation in blockchain infrastructure, combining mining operations with strategic accumulation of leading crypto assets. Rather than trading on short-term price movements, companies like Bitmine typically operate with a multi-year horizon, focusing on network fundamentals and asymmetric upside.

The contrast is striking. While retail and short-term investors remain on the defensive, long-term capital appears to be willing to intervene in times of fear. Historically, this disconnect between sentiment and positioning has often appeared near transitions in market cycles.

Bitmine expands exposure to Ethereum amid market fears

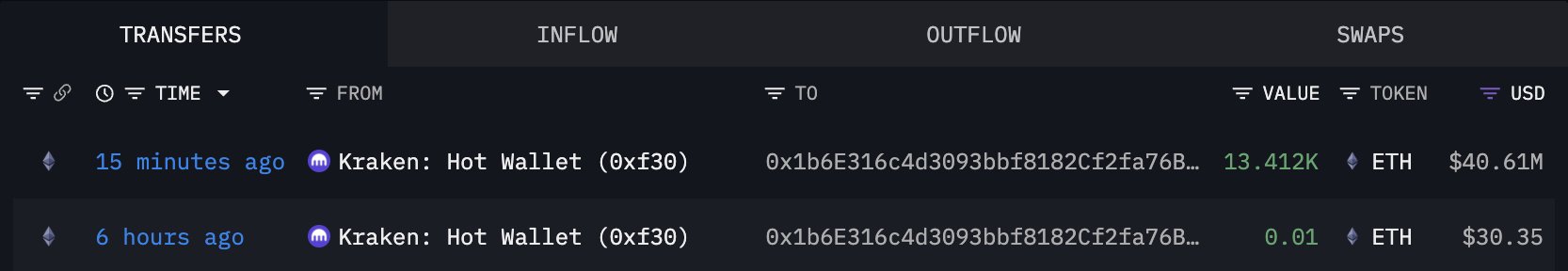

Arcam’s on-chain data confirms that Bitmine has added an additional 13,412 ETH to its holdings, an acquisition worth approximately $40.61 million at current market prices. This purchase comes at a time when Ethereum sentiment remains extremely bearish, reinforcing the contrast between short-term market uncertainty and long-term capital positioning.

Following this latest accumulation, Bitmine’s total Ethereum holdings now stand at approximately 3.769 million ETH, with an estimated market value of approximately $11.45 billion. This places Bitmine as one of the largest holders of Ethereum known globally and highlights the scale and belief behind its strategy.

Such a position is not consistent with short-term speculation. Instead, this reflects an intentional approach centered around long-term exposure to Ethereum’s network value and future role within the digital asset ecosystem.

Bitmine’s accumulation behavior suggests confidence in Ethereum’s long-term fundamentals despite short-term volatility and widespread pessimism. Historically, large purchases made during times of extreme fear have often resulted in prices trading below their perceived intrinsic value.

While this move does not eliminate the risk of further decline in the coming months, it does signal that structurally patient capital continues to be deployed. The growing divergence between bearish sentiment and aggressive accumulation highlights a market environment where positioning may provide clearer insight into long-term expectations than headlines.

Some investors are using the current pessimism as an opportunity to increase exposure, reinforcing the idea that even a fear-driven environment can attract structurally patient buyers.

Ethereum price struggles to rebuild bullish structure

Ethereum is currently trading just above the $3,000 level and is looking to stabilize after an extended period of correction. This chart shows that ETH is still below the key medium-term moving averages, with the 50-day moving average and 100-day moving average still acting as dynamic resistance overhead. All recent attempts to raise prices have been met with selling pressure, underscoring the market’s difficulty in regaining bullish momentum.

Structurally, the price movement since the October peak reflects a clear sequence of falling highs and falling lows, confirming that ETH is still operating within a bearish trend on the daily time frame. While the recent bounce from the $2,800-$2,900 zone suggests demand exists, volumes remain subdued compared to earlier expansion stages, indicating a lack of buyer confidence. This supports the view that the current movement is a correction rather than the beginning of a new impulsive rally.

From a support perspective, the $2,900 area is important right now. If losses at this level continue, ETH will be exposed to a deeper retracement towards the $2,600-$2,700 area where the previous consolidation occurred. On the upside, the bulls will need a decisive daily close above the descending moving average around $3,300 to invalidate the bearish structure.

Overall, the chart shows consolidation below resistance rather than a trend reversal. Until ETH expands in volume and regains key moving averages, price action suggests continued distribution and increased risk of further downside.

Featured image from ChatGPT, chart from TradingView.com

editing process for is focused on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is carefully reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance, and value of your content to your readers.