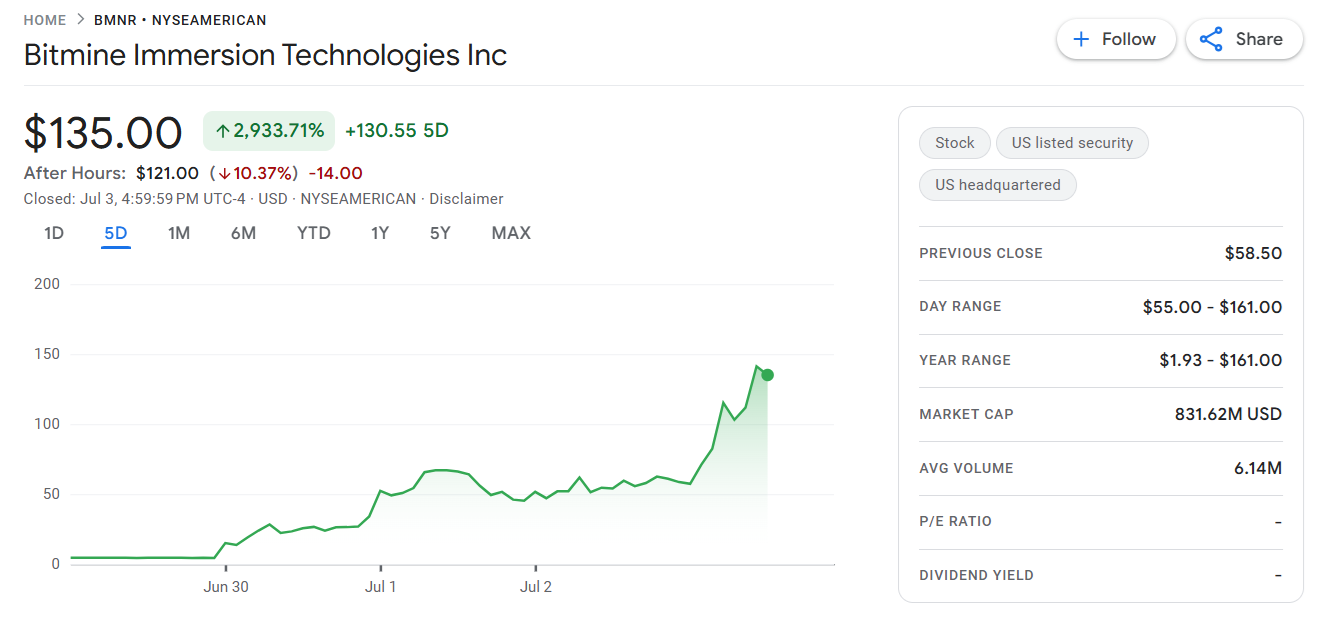

Bitmine Immersion Technologies Inc. has peaked its price for four years, doubling its price in the last two days. The company unlocked the 3,000% rally after it announced a $250 million facility to build the ETH Treasury Department.

Bitmine was one of the latest finance companies to unlock stock gatherings. In the last two days alone, Bitmine has grown by more than 100%, reaching the price of $135 for the first time since April 2021.

The latest stock gathering launched after Bitmine’s announcement $250 million Privately owned placement with the goal of earning and retaining ETH. Prices jumped even further after the private placement ended on July 3rd.

Bitmine gathered in the past days after the $250 million private placement agreement ended with the goal of building the ETH Treasury. |Source: Google Finance

Bitmine began at an all-time low, rising from $1$ mining stock to more than $135 over a week. Bitmine continues to meet as leader of Ethereum Ministry of Finance Stockhas joined the Bitcoin trend in the past few weeks.

The growth trend also saw Sharplink Gaming shares rise, further up from $9.50 to over $12.60. SBET’s stock price is still falling from its peak, but the recent recovery shows ETH’s financial enthusiasm. Bitdigital, Inc. also rose to a monthly high of $2.94.

ETH Treasury also allows businesses to wager tokens for additional passive income. Sharplink Gaming has already bet 95% of its ETH, which is over $450 million.

Bitmine Planning Dual BTC-ETH Strategy

Bitmine already owns 154.2 BTC and has been acquired since June 16th at a price of over $106,000. The company is also hiding hashrates that will generate additional BTC influx over the next six months.

Bitmine aims to use privately owned revenues along with BTC to acquire more ETH and build a Ministry of Finance. The company aims to obtain cryptocurrencies for long term holdings from a mix of BTC mining operations or raising additional capital.

Bitmine has direct mining operations, contracts in the synthetic market, and hashrates as a financial instrument. Bitmine also serves as a mining consultant and owns a data center in a low-cost location in Texas.

Can Bitmine wake up ETH?

Demand for ETH is increasing based on the purchase of ETFs. The recent announcement from the Corporate Treasury Department has yet to be depressed in the market. ETH remains a speculatively traded asset, with intentional trading on long positions, with market price trading dropping within the approximately $2,500 range.

ETH traded for $2,557.21, far from the vibrant treasury of the treasury company’s stock. The token stalled at just under $2,700, causing sales pressure.

For bullish traders, ETH was supposed to be raised to $3,000, but for now the rally has been shortened. Ethereum has seen an increase in staking and chain activity due to increased demand for obstacles. The network is gradually regaining its activity, primarily based on the use of Stablecoin. USDT and USDC drive traffic on Ethereum as part of both centralized and decentralized activities.

The Ministry of Finance has not yet purchased on a strategic scale recently, and has already affected the BTC market. However, the emergence of a new wave of Altcoin finance companies could extend the 2025 crypto rallies. While companies have already announced SOL and BNB finances, ETH may be the leading candidate for preparing to guarantee guaranteed compensation.