Etha, BlackRock’s Ethereum ETF, faced intense sales pressure this week, coinciding with a period of increasing asset volatility.

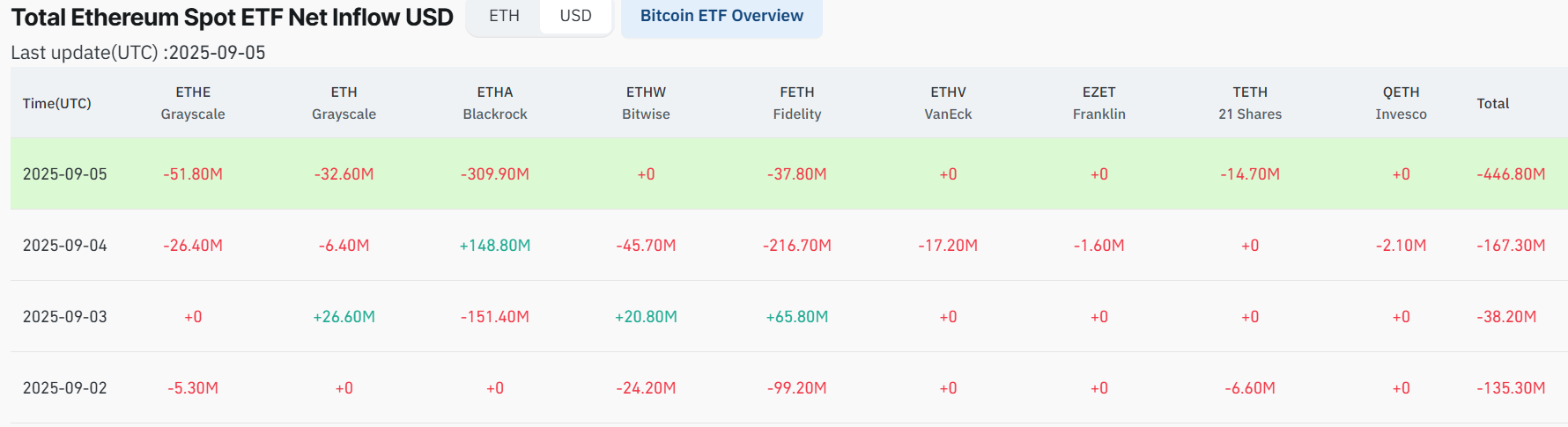

Data shows that the ETF recorded a net outflow of $312.5 million. The only positive session took place on September 4th, when $148.8 million was poured into the fund.

This profit was immediately offset by third consecutive redemption dates, including $151.4 million on September 3, $339.9 million on September 5, and small drawdowns on other days, resulting in a highly negative week.

The spill is now under widespread pressure due to the spot on Ethereum ETFS, which saw a strong inflow in August. In contrast, Bitcoin ETFs, including BlackRock’s IBIT, recorded net inflows and suggest that institutions are spinning towards more established assets.

Large redemptions from Spot ETFS send signals to curb institutional demand, but retail and offshore buyers help ETH cushion against steep losses. Still, the second largest cryptocurrency is testing support of $4,000.

ETH Price Analysis

At press time, Ethereum (ETH) traded at $4,281, an increase of 0.11% over the past 24 hours, but fell 4% a week.

Technically, Ali Martinez’s analysis highlighted that ETH is approaching a critical level of nearly $4,260. This has repeatedly served as a key pivot in recent sessions. Failure to hold this threshold could lead to a sharper reduction towards the $4,000 psychological mark.

In particular, ETH has struggled to build momentum beyond its $4,380 and $4,500 resistance zone, with repeated denials underscoring sustained sales pressure. On the downside, $4,260 remains an important barrier between relative stability and deeper retracement.

With volatility rising and future macro events set to affect risk assets, Ethereum’s response to the $4,260 level could determine the next major directional movement.

Featured Images via ShutterStock