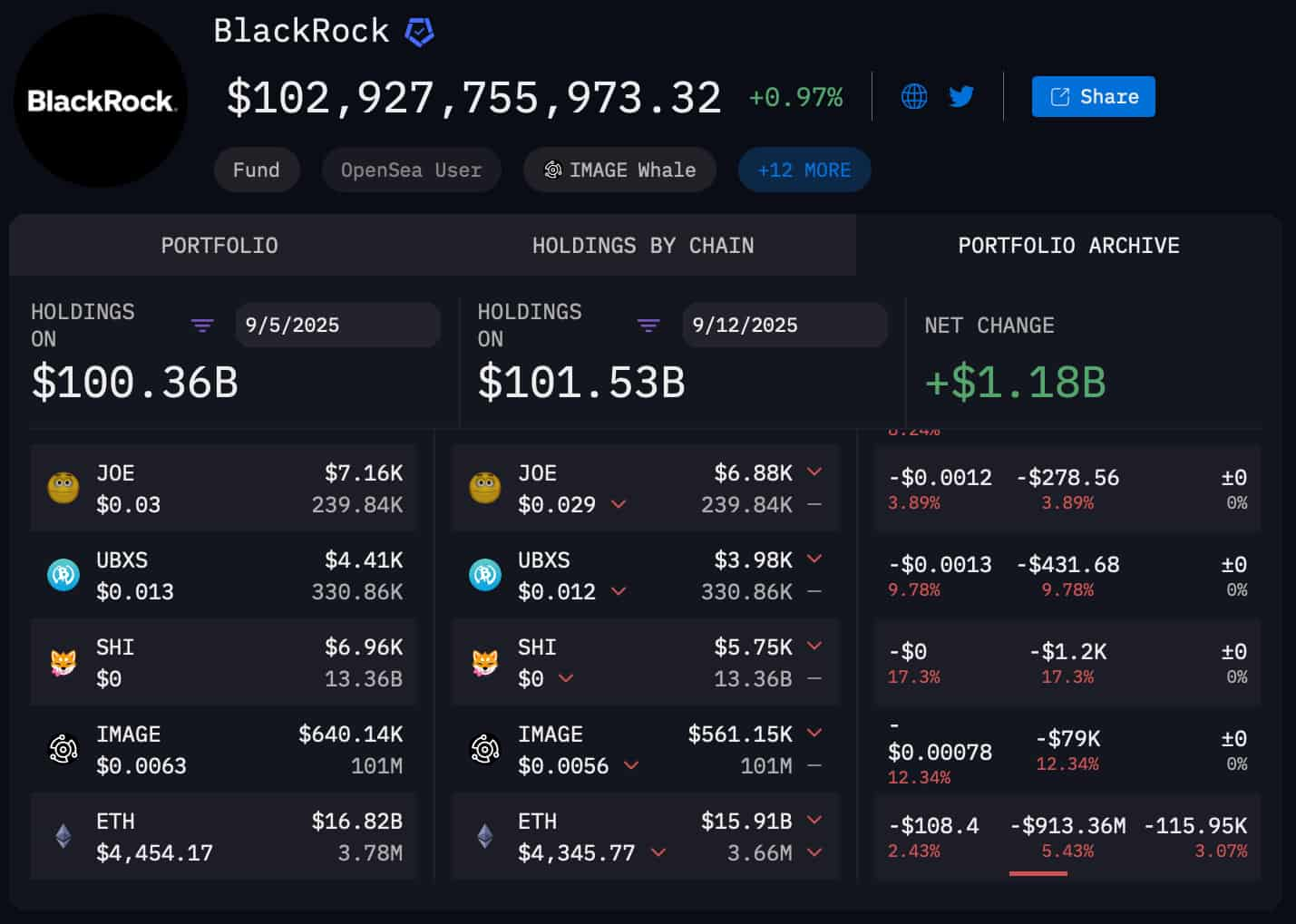

BlackRock’s Crypto portfolio has shifted significantly over the past week, with blockchain data rapidly declining in Ethereum holdings with new accumulation of Bitcoin.

BlackRock’s Ethereum Position fell from $168.2 billion ETH on September 5 from $168.2 billion ETH on September 12, which amounted to $159.1 billion, according to data obtained by Finbold from $3.66 million.

Ethereum’s BlackRock crypto exposure share fell from 16.7% to 15.7%, away from cryptocurrency, the second largest by market capitalization.

BlackRock supports BTC holdings

In contrast, BlackRock was added to the Bitcoin location. Holdings rose from 747,470 BTC ($83.53 billion) to 751,400 BTC ($8.562 billion) over the same period. The rise in 3,930 BTC, worth more than $2.09 billion, has increased Bitcoin control within the fund’s crypto portfolio from 83.2% to 84.4%.

The portfolio movement saw BlackRock’s overall crypto assets climb over $100 billion, reaching $101.5 billion on September 12th.

Meanwhile, Ethereum faced headwinds, lowering its price of 2.43% to $4,345, causing unrealized losses of over $900 million across BlackRock’s s allocation. Despite this trim, Ethereum remains BlackRock’s second-largest crypto-holder, far ahead of other assets in the portfolio, such as Images ($561,000) and Joe ($6,880).