BlackRock, the world’s largest asset manager, made an even bigger move by purchasing $240 million worth of Bitcoin. This strategic acquisition marks an impressive recovery with BTC prices bounced back from 85.3K to current level of 94.3K. Many traders and analysts believe they are gaining momentum Bitcoin price forecast If the trend continues, $10,000,000, could soon become a reality.

BlackRock doubles with Bitcoin

In one of the most impressive Bitcoin news this week, BlackRock confirmed its $240 million new Bitcoin purchases. The move strengthens our long-term conviction in BTC as a key asset in our diversified portfolio, particularly after the successful launch of the Bitcoin ETF earlier this year.

Institutional confidence led by BlackRock and other financial giants continues to serve as a solid backbone for Bitcoin’s ongoing rally. Each major purchase indicates to the broader market that assets are no longer fringed investments, but mainstream financial instruments.

BTC prices will be rebound strongly

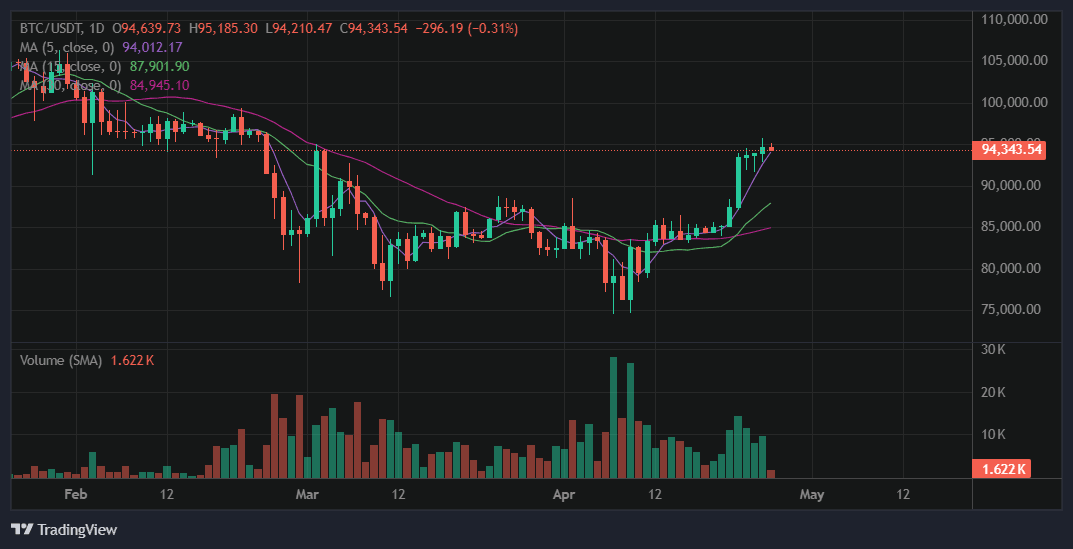

After immersing in $85.3k during a period of market uncertainty, Bitcoin showed responsive resilience. The price of the BTC returned to 94.3k within days, spurring both the institution’s purchases and updated retail profits.

The current trajectory suggests that bullish momentum is not only intact, but also reinforced. Historical trends show that new all-time highs often follow when Bitcoin rebounds from major dips with strong volume and institutional support.

BTC/USDT 1 day chart, TradingView Above BitGet

Is $100,000 Bitcoin right there?

Given the current setup, the $100,000 Bitcoin price prediction is no longer a distant dream. Momentum metrics and trend patterns suggest that BTC could quickly break through the six-man figure, especially if buying pressure continues at the current pace.

Several factors could accelerate the move to $10,000:

- Institutional accumulation: Continuous purchases by giants like BlackRock add a steady demand.

- ETF Flow: Bitcoin ETFs are seeing an increasing influx and are offering additional support.

- Positive emotions: Market sentiment remains bullish and traders are hoping for a breakout.

- Macro Conditions: Inflation concerns and global uncertainty continue to direct investors towards Bitcoin as a hedge.

If BTC prices remain on an upward trajectory, the psychological $100k barrier could act not as a resistance but as a magnet that raises the price.

Bitcoin Price Prediction: Bitcoin Next Move

As BlackRock adds another $240 million worth of Bitcoin to its holdings, confidence in BTC’s long-term value proposition continues to be strengthened. The current rebound is 85.3K to 94.3K$94.3K, highlighting the market’s resilience and setting the stage for the expected push to $10,000.

Short-term volatility is always possible, but the broader trend remains bullish. For now, the path to bitcoin to six numbers is not only possible, but it is inevitable if momentum applies.