The BNB chain reached a record high of $332.9 billion in permanent futures trading volume in June 2025. This figure reflects a 70% increase in monthly control of the PERP protocol. Aster Dex and other Defi platforms have helped to drive the surge.

This increase marks an important milestone for Binance collateral networks, highlighting its increased advantage in decentralized derivatives.

Related: BNB Chain Daily Active Users 26.4% to 1.2 million, 58% revenue jump

The Defi protocol drives record-on-chain volumes

On-chain analyst Eljaboom shared X’s data. He thought he grew up primarily into Aster Dex. According to Eljaboom, decentralized exchanges helped increase the PARP dominance of the BNB chain by 70% through sustained user activity and innovative features.

However, Binance co-founder Changpeng Zhao also showed weight and acknowledged that multiple platforms contributed to performance.

In the reply, CZ named four people in the growth of the ecosystem, Cake and Alpha, Lista and Venus key players. He emphasized that the rising PARP volume was attributable to collective efforts across several protocols.

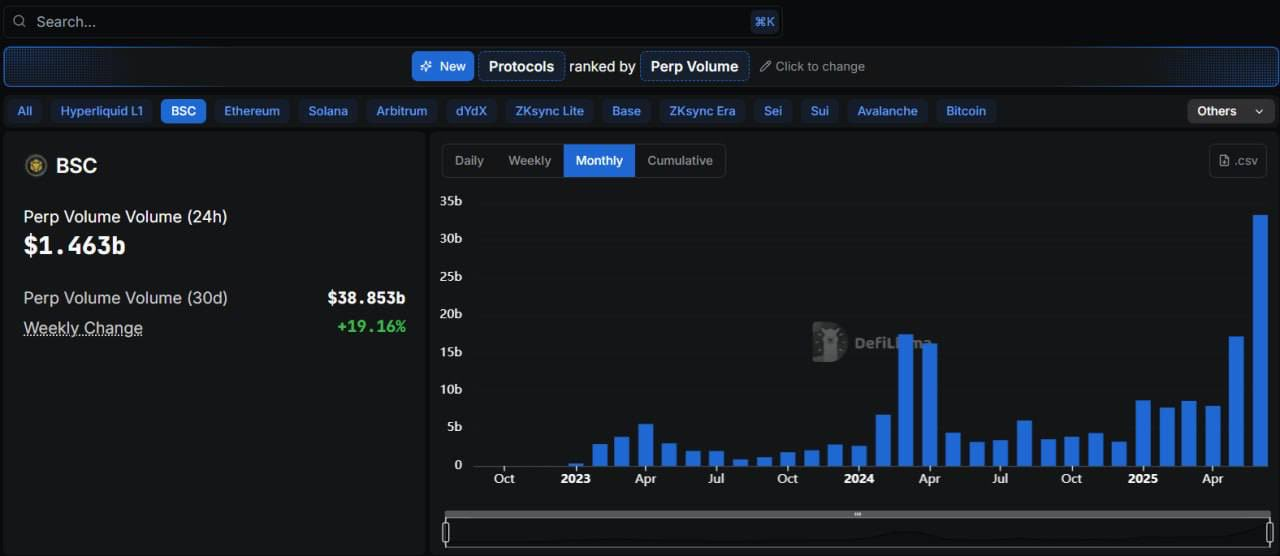

The screenshots shared in the tweet show Defillama’s data. The BNB chain’s 30-day PARP volume is listed as $38.85 billion, with daily volume of $1.463 billion, with weekly growth rates exceeding 19%. The monthly bar charts show a clear upward trend, with June 2025 significantly surpassing all of the past few months.

Futures activity is strengthened throughout exchanges

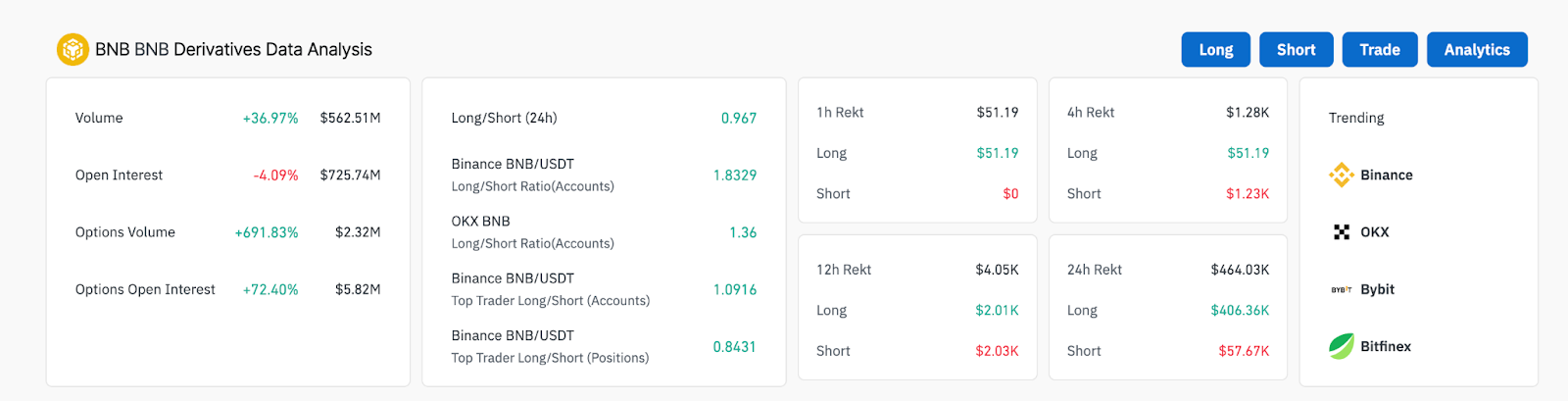

Intensive exchanges saw a significant increase in BNB derivative trading activity. BNB’s 24-hour derivative volume rose to $564.44 million, up 41.65% from the previous day, according to Coinglass data.

However, open interest fell 3.11% to $7257 million, suggesting that some traders will withdraw positions or secure profits during volatile market movements.

The amount of BNB option contracts also jumped sharply. The volume of options increased by more than 691% to $2.32 million, while the volume of options increased by 75.69% to $5.82 million. These figures indicate an increasing demand for alternative hedging tools and speculative measures.

Binance maintains market leadership

Binance led all exchanges in terms of futures performance. It posted the highest BNB futures volume for $366.06 million and earned the largest open interest at $415 million. Binance also outperformed its competitors such as OKX and Bybit, recording 707,000 BNB futures trading in 24 hours.

Binance and OKX user accounts were primarily long and had a long/short ratio of over 1.3, but sentiment was more cautious among top traders. Binance’s top trader position ratio is 0.84, indicating that it leaps towards a short position.

Related: Solana and BNB are putting pressure on a market that only has something to do with Bitcoin

At the time of pressing, the BNB price was trading at $640, down 1.8% over the past day and increased monthly losses to 6.1%.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.