Bitcoin is guarding key support amid short-term volatility, with analysts pointing out that the recent decline is a result of temporary risk aversion.

Bitcoin ($BTC) is currently trading just above $89,000 and has experienced a notable decline of 5% in the past 24 hours. The daily chart shows significant volatility. $BTC During the day, the price ranged from $87,901 to $92,258.

The recent decline has been driven by geopolitical risks and a decline in bond markets, in part due to investors’ wariness about various asset classes, including cryptocurrencies. As a result, $BTC is facing some downside pressure and despite a brief recovery from its lows, remains below the psychological mark of $90,000.

Bitcoin has fallen 6.6% over the past seven days, showing continued challenges in the market despite strong fundamentals. However, the Firstborn cryptocurrency has remained resilient over the long term, gaining 0.7% over the past 30 days.

Traders are keeping an eye on whether Bitcoin can regain momentum as there are signs of support in the $89,000 to $90,000 range. What’s next for Bitcoin?

what’s next for $BTC?

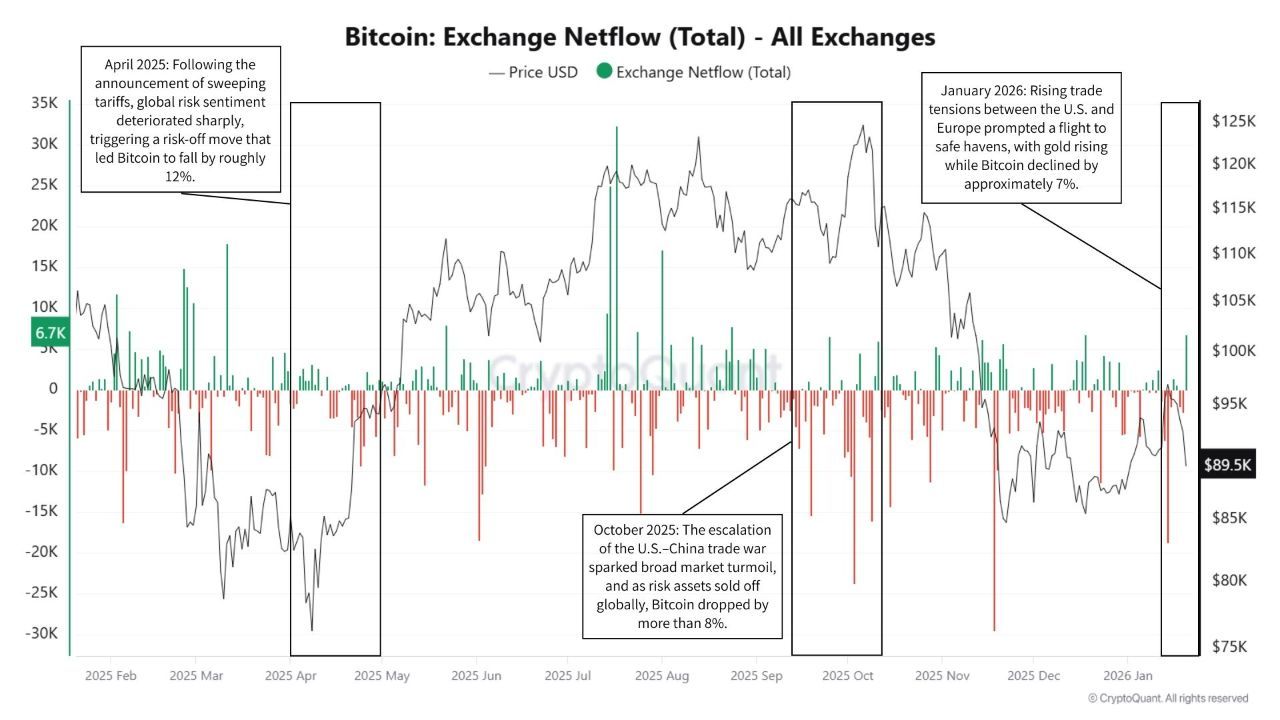

In particular, X analyst CryptosRus recently said: analyzed He emphasized that Bitcoin will decline from 2025 to 2026, and that these price declines are consistent with macro-level shocks related to tariffs and trade tensions. Key examples cited by CryptosRus include the drop in April 2025, when sweeping tariffs caused Bitcoin prices to drop by 12%.

Bitcoin exchange net flow

Similarly, in October 2025, the escalation of US-China trade tensions led to another significant decline, with Bitcoin depreciating by approximately 8%. Finally, the January 2026 decline occurred amid heightened trade risks between the US and Europe, leading to a 7% decline in Bitcoin prices.

These events highlight Bitcoin’s sensitivity to broader economic policy. They position it as a macro-sensitive risk asset that is affected by changes in growth expectations, interest rates, and liquidity.

But despite these price fluctuations, CryptosRus points out an important detail. This means that the exchange’s net flows have not shown sustained dumping during these declines. Although there was a temporary spike in inflows during the market decline, it was short-lived, indicating that the market quickly absorbed the selling pressure.

CryptosRus suggests that this action reflects temporary risk aversion by market participants rather than a structural collapse in Bitcoin demand. If foreign exchange inflows remain consistently high, this would indicate a larger change in market sentiment. So far, this volatility appears to be driven by macro-level policy shocks rather than marking the end of the Bitcoin cycle.

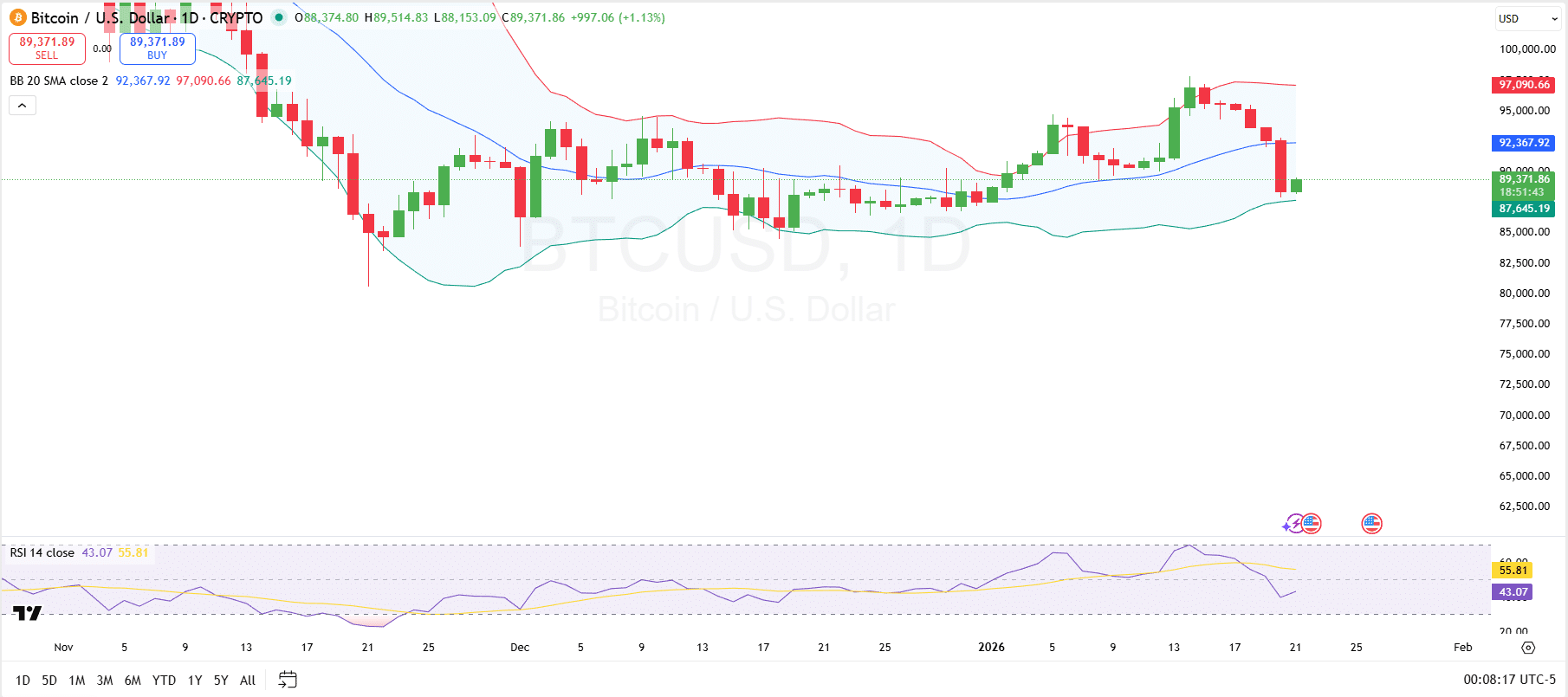

Bitcoin technical analysis

Looking at TradingView, the price trend is testing the Bollinger Bands, with the price recently approaching the lower band near $87,645 and then rebounding before touching the Bollinger Bands. The relative strength index is currently 43.07, indicating that: Bitcoin is moving now To the neutral zone.

Bitcoin daily chart

If the price manages to break above the support at $87,800 and break out of the middle band around $92,367, it could signal fresh buying pressure. Conversely, if Bitcoin fails to sustain support at these levels, downside risk remains and could test levels below $87,645.

If the price moves above the middle band, it would indicate increasing buying momentum and could push the price towards the upper Bollinger Band around $97,081.