Bitcoin has maintained a bullish structure in defending its major support zone following its recent all-time high. As long as this level applies, there is still a possibility that a continuation to higher price discovery.

summary

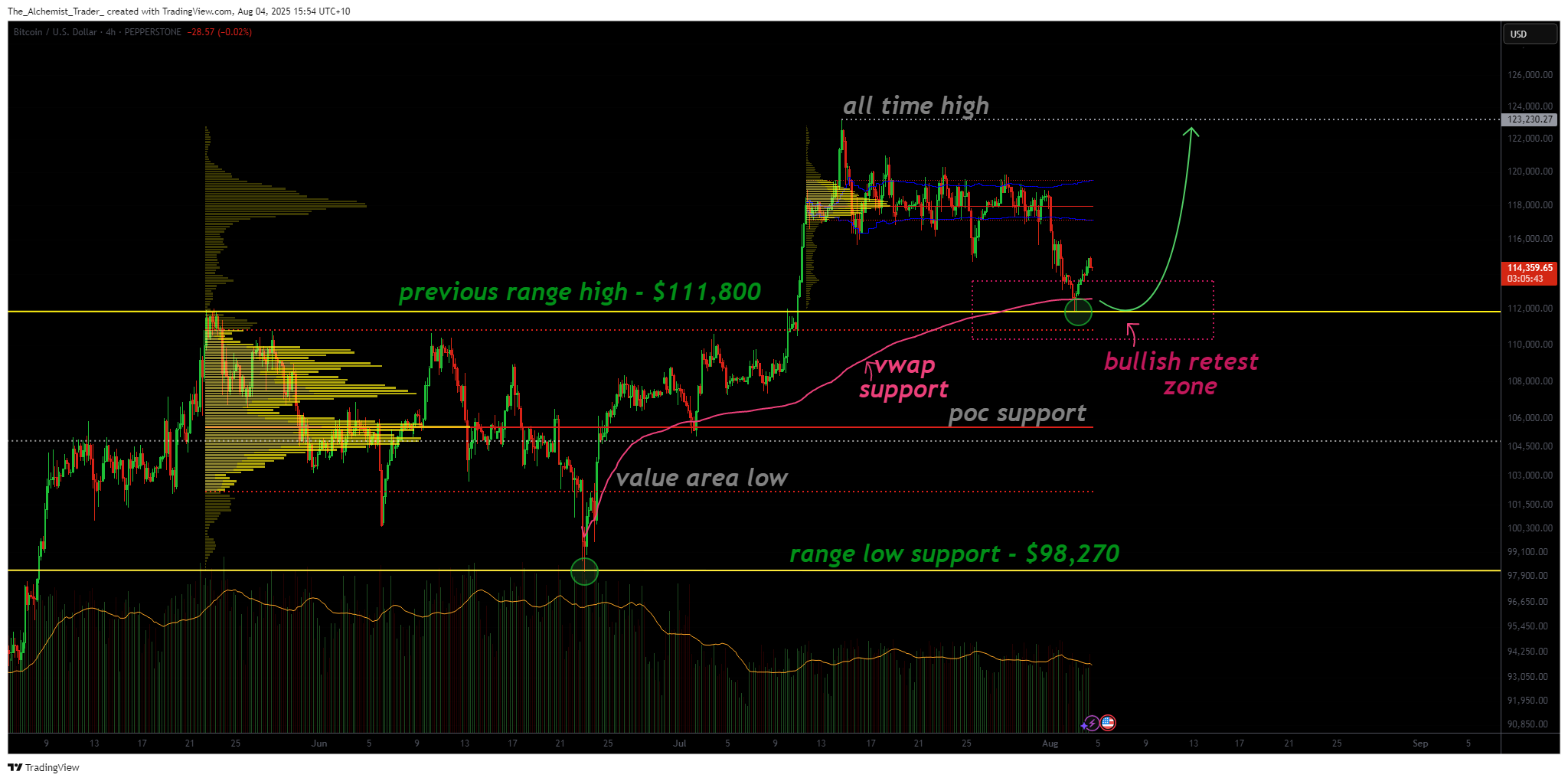

- Bitcoin holds key confluence support at $111,800 after post-ATS fix

- Volume and structure support the possibility of bullish continuation to $123,230

- This level of loss disables bullish papers and targets range support of $98,200

After setting a new all-time high at $123,230, Bitcoin (BTC) received a healthy fix and is currently trading just above the key support zone, around $111,800. This level previously served as a high-range resistor and is now confirmed as a support. It is consistent with multiple technical confluences, making the price a key zone for bases before another potential leg gets high.

Important technical points

- Important support for $111,800: Resistant resistance in the previous range currently serving as a support at a strong technical confluence point.

- Confluence Zone: Support tailored to Point of Control, Value Area High, VWAP, and 0.618 Fibonacci Retracement.

- Volume check: An increase in volumes beyond support suggests that aggressive demand and potential reversals are ongoing.

BTCUSDT(4) Chart, Source: TradingView

From a structural standpoint, Bitcoin remains a clear upward trend, and while this latest corrective movement has been tested, it has not broken the bullish formation. Prices are currently being pulled back to the High Enhanced Zone for continuance supported by points of control, Value Area High, VWAP, and 0.618 Fibonacci retracements. This gives you a strong reliability of 111,800 levels as a base for higher next waves.

Price action closely respects this support and shows that demand exists with clean responses and bounces off levels. This sets up scenarios where higher and lower values have been confirmed, and strengthens cases of even more bullish continuation towards recent history highs.

You might like it too: Here’s why Keeta Price rebounded over 13% today

Volume profiles are also beginning to see bullish cases. Prices are hovered over support, so there is a visible increase in volume, suggesting that shopping is coming back. If this volume is maintained, it will validate demand and increase the chances of an upward breakout.

The next target remains at an all-time high of $123,230. If it breaks, the price could soon move to a new price discovery. Based on Fibonacci’s expansion and historic pivot, resistance levels range between $130,000 and $135,000. However, once the $111,800 level fails and prices are accepted back to previous ranges, the structure shifts and $98,200 becomes the next important support target.

What to expect from future price action

Bitcoin’s bullish structure remains as long as it’s a $111,800 pending. Continuation above this level could lead to rallying to new all-time highs, particularly with volume growth. If not kept, setup will be disabled and bias will shift to a deeper retracement.

read more: Bitcoin Swift is turning early adopters into code tycoons