Nearly 95% of all BTC in circulation is profitable, according to Santiment, Cryptocurrencies’ on-chain and market analytics platform. The major cryptocurrency by market capitalization leads Cardano (ADA) by 50 percentage points at 46.5%, making it the sixth spot in terms of market capitalization rankings.

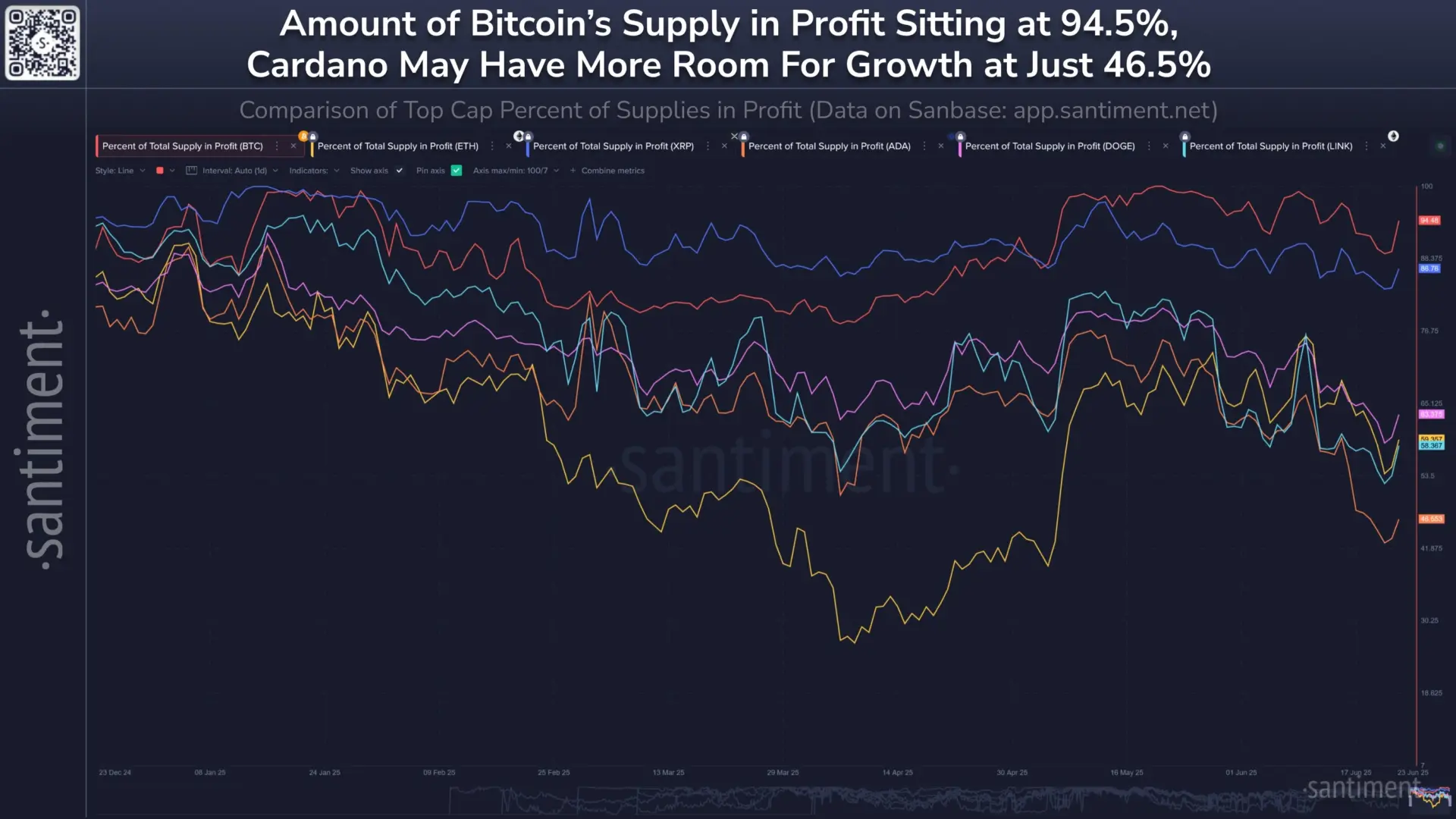

Santiment shared a chart that tracks the “total supply of profits” for six top cap cryptocurrencies over the long term.

The report pointed to a significant contrast between BTC and ADA based on the proportion of distribution supplies currently profitable, revealing how holders are doing.

While 95% of all BTC in the circulation is profitable, the ADA has a basis to compensate for it at 46.5%. Source: Santiment

BTC holders benefit most, but ADA holders struggle to maintain their faith

Santiment’s post was based on metrics that tracked the percentage of distribution supply for each asset currently held in profit. The report means that the market price is higher than the average chain acquisition price.

As of the latest data points, BTC reportedly boasts a high percentage of 94.5%, suggesting that most of its owners are profiting. In contrast, Cardano’s proportion is low (46.5%), indicating that there is a loss as the majority of holders purchased the ADA at a higher price than where it is currently located.

Despite its pessimistic performance, Santimento believes Cardano’s current position could indicate room for underestimation and growth, especially if the code witnessed another bull cycle later this year.

Other tokens that boast strong investor profits include 88.7% $ETH, 65.1% $XRP, 64.7% $doge and $Link in 59.4%.

According to Santiment, if about 19 of the 20 coins are profiting like this, then strong market trust usually follows. However, it also suggests that there is a high risk of profit and correction.

Also, coins with low profit supply rates such as ADA and Link could appeal to paradoxical or long-term investors who have not experienced strong gatherings these days.

Cardano slowly sprints towards long term recruitment

While Cardano is clearly the worst performance token of the six top cap cryptocurrencies over time, Santiment sees it for future possibilities and good reasons.

After all, Cardano’s current “bad” performance could be attributed to a combination of competitive pressures purchased at a higher price, and bearish sentiment from keen investors from the lack of immediate market catalysts.

In fact, despite its current position, Cardano boasts steady developmental advances and struggles in the current market context rather than necessarily doing anything bad in terms of its technology and community.

What’s going on with Cardano?

Check out this week’s development updates for Essential Cardano and stay ahead of all the latest developments in core technology, wallets and services, smart contracts, scaling and governance. https://t.co/8h3uomsw76 pic.twitter.com/cpkjfjwelb

– Input Output (@inputoutPuthk) June 20, 2025

Last month, Cardano released Node V.10.4.1, introducing the UTXO-HD (Unspent Transaction Output – High Density) feature, which is touted as a key technological advancement in the Cardano blockchain.

This feature enhances the extended UTXO (EUTXO) model of Cardano, the core accounting system used in blockchain. It is used to track unused transaction output, unlike traditional UTXO models such as Bitcoin, EUTXO supports smart contracts and complex transaction logic without reducing security and predictability.

This is very stupid. The project needs to maintain the 18-36 month Killlist runway with short-term Tbills, but that’s about it. Why would you want your team to buy and hold Bitcoin when someone can do it themselves? Why pay for all these coconuts?

-toly🇺🇸 (@aeyakovenko) June 16, 2025

Cardano founder Charles Hoskinson recently elicited criticism from the CEO of Solana Labs for suggesting that BTC be added to the project’s finances. This is an initiative intended to increase the profitability of the project.