In the last 24 hours, Bitcoin (BTC) has shown a significant price rebound alongside the broader cryptocurrency market, logging a loss of $300 billion over the weekend.

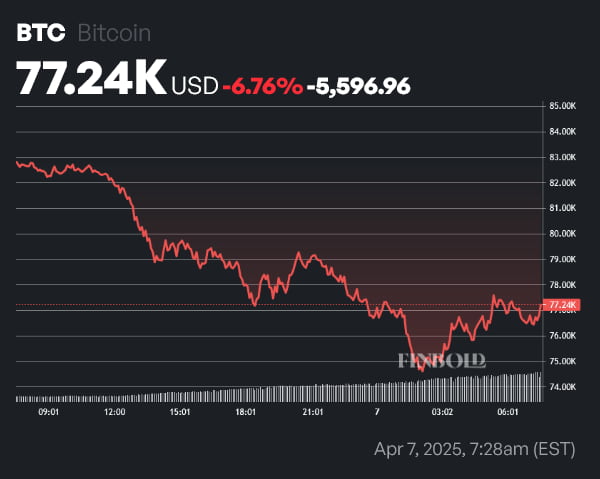

To be precise, BTC lost 6.76% on the daily chart.

In contrast to the recent crash, institutional investors appear to hold a bullish outlook.

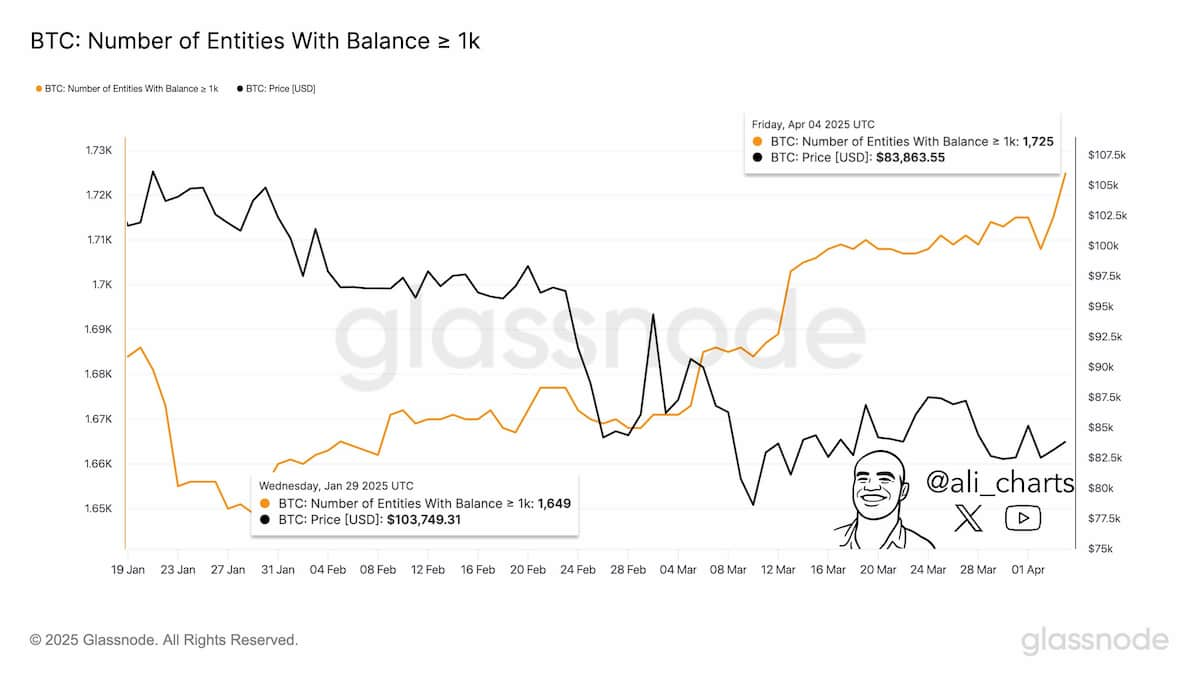

Over the past two months, 76 new entities with over 1,000 BTC have joined the network following an April 7 post from renowned cryptocurrency technology analyst Ali Martinez.

This represents a 4.6% increase in the number of accounts holding over 1,000 Bitcoin. Despite major digital assets below $80,000, institutional investors have not sold their holdings. Therefore, at least one aspect of Bitcoin’s demand is stable.

Institutional Bitcoin demand is a long-term bullish signal, but has limited effects in the short term

The technical outlook for Bitcoin remains awful and miserable as the recent discovery of a cross-chart pattern of death. And the continuous decline in prices is happening in strong quantities, indicating that assets are still far from reaching the bottom.

Ultimately, short-term price actions depend on broader macro factors. The main driver behind the current decline is President Trump’s budding trade war. Unless the US administration’s tariff approach changes significantly in the coming weeks, like BTC, the broader crypto market could potentially turn down in prices as investors shift their focus to safer, lower risk assets.

Featured Images via ShutterStock