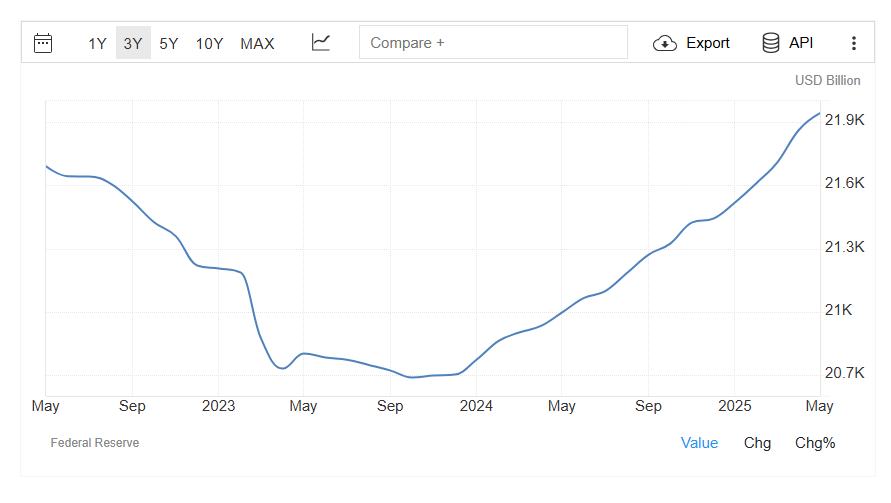

The wider US M2 money supply has moved to a new record of $21.94 trillion. Money supply rose rapidly in 2025. This is a metric that is closely monitored for its impact on the crypto market.

The US M2 Money Supply has expanded to a new record with $21.94 trillion distribution. M2 metrics are closely correlated with the performance of assets, including BTC, potentially informing you of the ongoing profits of crypto.

US money supply has hit new records and has also boosted global M2 money. |Source: Federal Reserve System

Metrics started climbing from the lowest $20.7 The 2023 trillion coincided with the awakening of the crypto after years of bear market. M2 extension matches another Debt cap The coming crisis. The Fed may need to continue to easify financially, further expand the available M2 and increase market confidence.

BTC still closely follows the M2 trend

Over time, BTC has shown a correlation with both global and US M2 supply. BTC delayed the indicator for several months, particularly responding to the squeeze of the M2 supply. A similar lag is seen in the BTC extension, delaying the growth of M2 by 3-6 months.

On a shorter time scale, the M2 Global Money Supply predicted the April BTC rally, where prices were incurred and revisited levels above $100,000. In some cases, the rise in BTC prices is only a week or two behind the shift in money supply.

BTC has occasionally skyrocketed during periods of low M2 growth, but these gatherings are now considered as signs of a bubble. As BTC prices approach M2 supply, the effect could be a more sustainable trend if the market has not yet peaked in a short-term bubble.

Global M2 Money Supply will expand more slowly

Global M2 Money Supply has gradually expanded over the past five years, based on data from four major central banks.

As of July 2025, M2 supply was $93.69 trillion, an increase of 7.45% over the past year. Recent growth in BTC has far surpassed money supply, based on additional directive liquidity from Stablecoins. But the general sense of inflation and the growing stock market vibrancy has also led to the expansion of the crypto.

Cryptocurrency is highly concentrated in the US, but China is also the source of increased liquidity. China’s M2 money supply has expanded for the past decade and has not slowed down even during the Covid-19 pandemic. As a result, China’s M2 supply exceeds $44 trillion, more than twice the liquidity of the US.

Global liquidity is being viewed more closely in relation to BTC and its potential performance in late 2025. BTC is currently delaythe M2 trend could raise prices up to $150,000 per BTC.

BTC’s recent performance raises questions about the impact of demand. M2 charts are considered potential triggers that companies and ETF purchases are too small to drive valuation. However, global M2 growth is consistent with a period of uncertainty, but it potentially affects the nominal price of all assets.