This is a segment of the 0xResearch newsletter. To read the complete edition, Subscribe.

Crypto centralized exchanges are driving business rapidly these days.

And to get there, they’re all using their biggest trump card: distribution.

Case study number one.

Bybit announced Byreal on Sunday. This is a Solana Dex, scheduled to be released later this year. Along with Dex, there are also Ildo Cults (Revive Vault) and Token Launchpad.

Byreal routes liquidity from CEX via Hybrid RFQ (Quotation Request) + CLMM (Concentated Liquidity Market Maker) model. Therefore, Onchain users can exchange Onchain at CEX’s liquidity depth.

My guess is that BYBit users can also access Byreal from the main CEX app.

Case Study No. 2.

A few days later, Coinbase announced its direct integration into the Base DEXS exchange business, which is scheduled to be rolled out this week. The dexes from other chains are also eventually integrated.

This opens gas-free trading access to thousands of altcoins for millions of Coinbase users (although the usual CEX trading fees are still paid).

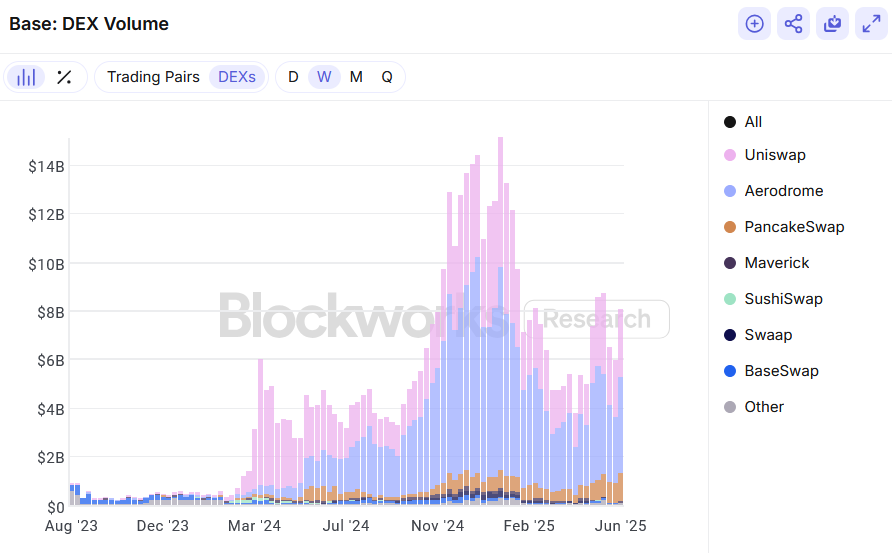

That’s an important tailwind for the base dex. In other words, it’s aerodrome, the biggest one. Aero tokens, which generate revenue from DEX trading fees, have put a price of 52% since its announcement.

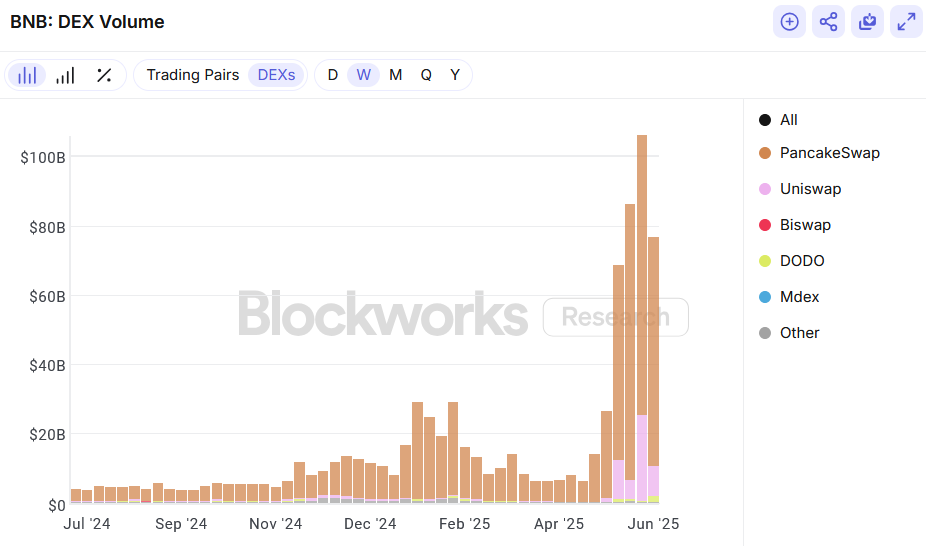

Source: BlockWorks Research

Source: BlockWorks Research

This is not the first attempt by Coinbase to push Onchain out with the advantages of its distribution. CBBTC, its wrapped Bitcoin products, was bootstrapped using Coinbase as the main distribution rail.

By integrating Base’s lending market under the hood, Coinbase CBBTC holders can easily borrow USDC against Bitcoin collateral without leaving the Coinbase app.

Loading Tweets…

Case Study No. 3.

Binance and its extremely complicated alpha campaign have been running since May.

Within Alpha there are dozens of “trading competitions” that reward users with “Alpha Points” to trade selected assets, which give you the right to airdrop. But calling it a competition is misleading. Most of these points are distributed based on trading volume, not P&L standards.

It’s puzzling until you realize there’s a double-lined strategy here.

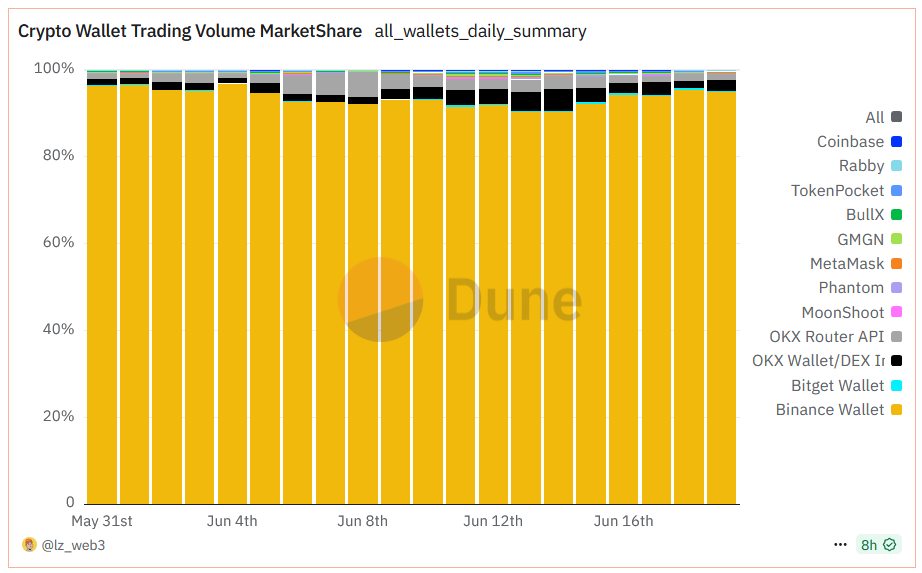

The first prong is to encourage adoption of a benance wallet. Alpha Points are only eligible if you trade using a keyless binance wallet. This allowed Binance to absolutely control the “wallet market share” of crypto as shown below.

Source: Dune

Source: Dune

There are two things to note here. For one thing, the activities are not organic.

Secondly, these are simply “Binance CEX” users, and therefore are not “Binance Wallet” users.

As traders still pay Binance CEX trading fees, revenue capture is different from the revenue of MetaMask users who pay for using the in-app trading feature. Calling it “wallet market share” is probably misleading.

Still, Binance encourages the adoption of wallets, allowing users to potentially funnel users with fragments of their infrastructure, which can be monetized later.

The second prong of the strategy behind Binance Alpha is to strengthen its own on-chain ecosystem with the BNB chain.

What drives these alpha token trades under the hood is the pancake swap that has exploded in volume since the alpha kicked off in May.