Over $155 billion, Tether’s USDT has been leading almost synonyms for the Stablecoin market for nearly a decade.

Last year, many people doubted that Stablecoin could compete, thanks to the asset manager joining Donald Trump’s presidential minister, earning the most transactional volume of any crypto assets, including BTC itself.

But for the first time in history, the world’s largest stubcoin issuer is considering serious competition in the form of circles.

Circle has been significantly pushing USDC this year, with Protos compiling data on three metrics that have gained the foundation for Tether.

For the first time in history, the world’s largest Stablecoin publisher is considering serious competition.

Tether is still a market leader and holds a dominant share of outstanding tokens, but retains search queries and trading volumes, but the circle’s growth rate highlights some areas in which it has acquired a position.

After all, the most important indicator that ranks Stablecoin publishers is their market capitalization share. Due to this metric, USDT is still a leader 61.5% of the $253 billion market.

USDC has a 24% share in second place.

Still, the growth of the circle is impressive.

Circle will win the ground with tether in 2025

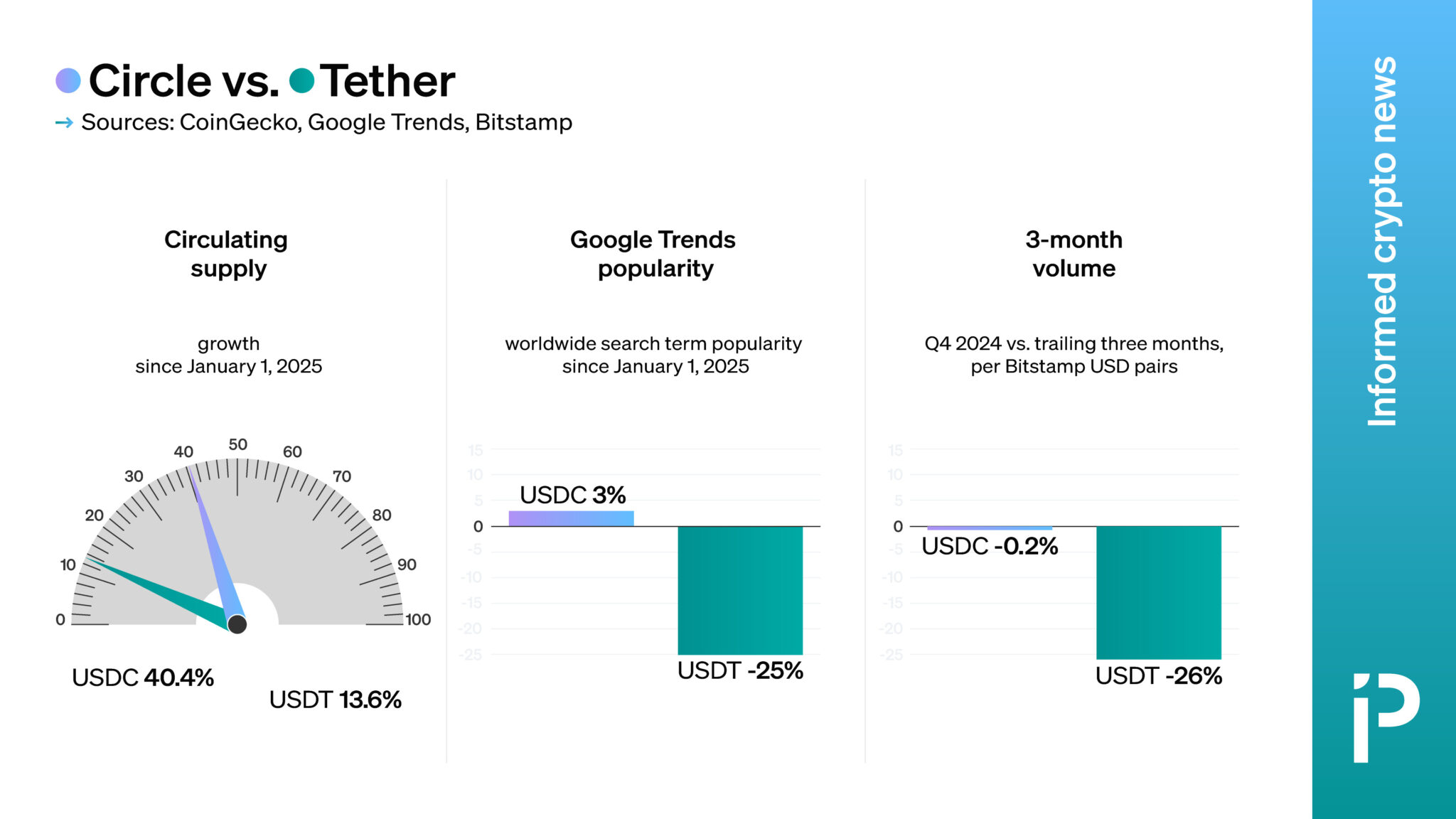

Since the beginning of the year, the circle has increased its USDC distribution supply by 40.4%. This is comparable to a 13.6% increase in USDT over the same period.

Specifically, USDC distribution supply has increased from over 43.7 billion to over 61.4 billion. USDT is excellent Growing from 137 billion to just 155.7 billion.

This is the first metric of outperformance for the circle.

Second, USDC’s global Google search queries also increased by 3% from 64 to 66 this year. USDT is an absolute popular term, with a 25% drop in popularity from Google Trends’ 82-61 rankings.

Third, USDC also outperforms USDT in FIAT trading volume growth. While USDT remains the most massively traded digital asset, USDC gained a bit of USDT’s market share in 2025.

BitStamp’s snapshot shows that the rate of USD trading volume decline since the fourth quarter of 2024 is much slower for the following three months in the case of USDC vs USDT.

Specifically, USDC volumes fell 0.2% from 107 million to 0.2% from 851 million to 628 million compared to a 26% decline in USDT.

Read more: Circle vs. Tether: What are the reserves?

Circle IPOs drive growth in media and evaluation

The Circle also attracted a disproportionate amount of media attention in 2025 compared to its major competitors. Since January, articles mentioning USDC have increased by 75% from 24,169 to 42,455 per Muckrack data.

USDT Media mentions grew from 55,473 to 78,680 to a more modest 42%.

Of course, the growth of the media is attributed to Circle’s IPO. In fact, the company’s valuation has increased tenfold this year from $4.79 billion to $48 billion. I am mainly grateful for my US stock market debut.

Read more: Analysis: Is the Circle IPO worth $31.6 billion?

Some of the circle’s growth has gained share from Tether, but Tether is increasing in value in itself.

However, private companies have not implemented funding to renew Tether’s corporate ratings from the $7 billion Trump election rating. As a result, it is impossible to compare the evaluations of both companies.