Bitcoin mining company CleanSpark (CLSK) maintained high production levels in November, showing signs of increased revenue despite a challenging environment for crypto miners and the broader digital asset market.

The company reported Wednesday that it mined 587 Bitcoins (BTC) during the month, an 11% increase from October.

CleanSpark also expanded its contracted power capacity by approximately 11% to more than 1.4 gigawatts. This is an important measure of the power the company has secured to support future mining operations. The high power consumption allows companies to deploy more mining equipment and expand production over time.

CEO Matt Schultz also reiterated the company’s $1.15 billion zero-coupon convertible debt offering, which provides long-term interest-free financing. The proceeds are intended to strengthen CleanSpark, Inc.’s balance sheet, fund infrastructure expansion, and support its stock repurchase program.

The mining update follows CleanSpark’s 2025 financial results release, where revenue more than doubled year over year to $766.3 million.

sauce: block space

Related: CleanSpark secures second BTC-backed credit line this week with no equity dilution

The economy of Bitcoin miners will be burdened.

CleanSpark is expanding its production capacity amid increasing financial stress across the Bitcoin mining industry. November was particularly tough, as Bitcoin’s price fell more than 36% from its all-time high in mid-October, eroding miners’ revenues and margins.

As reported by Cointelegraph, the industry entered one of its deepest recessions in November due to collapsing revenues and rising price volatility.

Data from The Miner Mag shows that the performance gap between the average miner and the most efficient operators is widening, highlighting that scale and cost efficiency will become increasingly important to survive in a prolonged downturn.

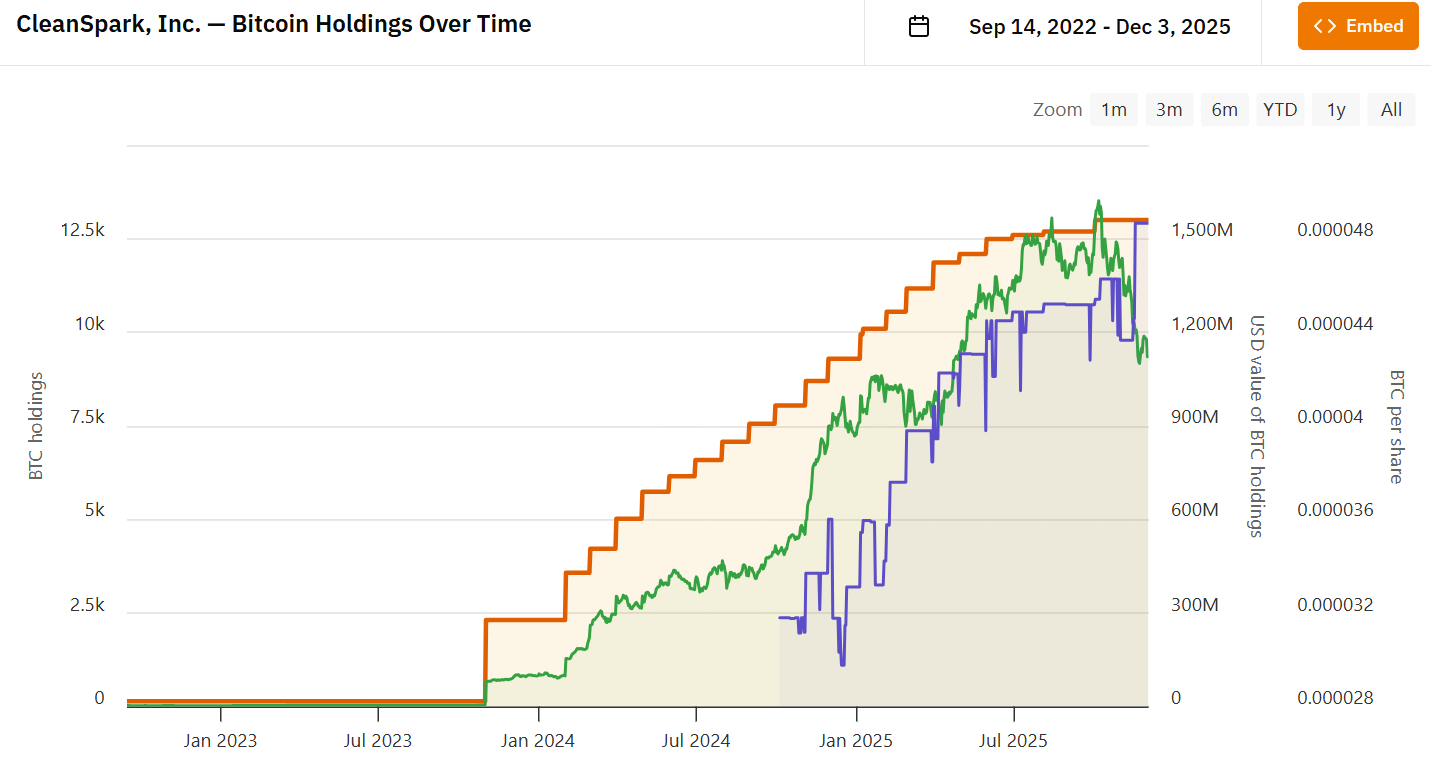

CleanSpark has accumulated over 13,000 BTC on its balance sheet. sauce: BitcoinTreasuries.NET

As a result, mining stocks plummeted. Shares of MARA Holdings, Riot Platforms, and HIVE Digital Technologies are all under significant pressure.

CleanSpark has continued to operate through the recession, but its stock price has also fallen more than 30% since mid-October.

magazine: 7 reasons why Bitcoin mining is a terrible business idea