Coinbase Institutional explained that Bitcoin’s recent decline was due to structural distortions, as weakening trend signals, reduced liquidity, whale selling, and ETF outflows weighed on the market despite conditions that typically support monetary easing.

Bitcoin breaks support due to liquidity compression, increasing market volatility

Coinbase Institutional, a division of cryptocurrency exchange Coinbase (NASDAQ: COIN), explained on social media platform X on December 2nd why the price of Bitcoin is plummeting. The group noted that while easing financial conditions typically supports risk assets, recent market movements have diverged from expectations.

Coinbase says:

So why was BTC dumped?

The department outlined several structural pressures weighing on Bitcoin. The asset fell below a major bull market support band, suggesting weakening trend strength. Options trading has shifted to a bearish structure. Whales, which had been held for many years, were sold due to declining liquidity. Spot Bitcoin ETFs have seen significant outflows, reducing consistent demand on the buyer side. Digital asset trader participation has slowed, liquidity conditions have tightened, and market volatility has increased.

The company further stated:

With the end of quantitative tightening and the Fed returning to the bond market, capital outflows may end. This is usually a good thing for risk-on assets like cryptocurrencies.

read more: Coinbase turns up the heat with global expansion and prime-grade assets

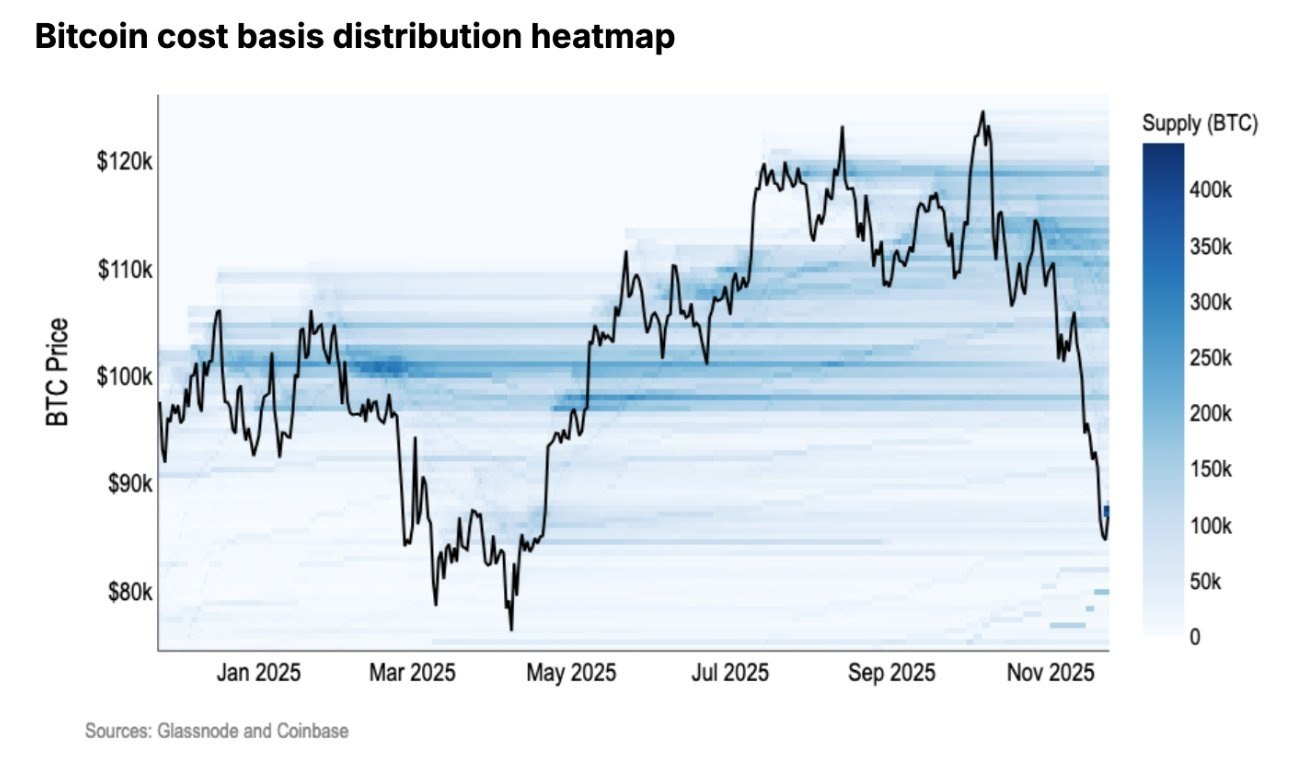

Coinbase also posted an accompanying chart showing the distribution of Bitcoin’s cost base throughout 2025. The heatmap shows concentrated pockets of holder supply in the range of approximately $95,000 to $110,000, with darker bands indicating heavier clusters of coins purchased in that range. As prices plummeted in November, the chart shows Bitcoin moving under a dense ownership tier, suggesting that many market participants are now holding unrealized losses. This visualization also reflects thinner supply zones at lower levels, which can impact volatility as price explores areas of historically strong demand.

Bitcoin cost-based distribution heatmap shared by Coinbase Institutional. Source: Coinbase

The team also emphasized its tactical view, stating:

In this environment, high-probability setups are considered more favorable for breakout trades than knife catches.

Analysts pointed to shrinking liquidity pockets, persistent clustering of implied volatilities, and selective institutional flow patterns influencing short-term behavior. Although the analysis leans toward caution, crypto advocates counter that Bitcoin’s fixed issuance, broader international adoption, and continued institutional consolidation support a constructive long-term theory. They argue that the correction phase will help de-leverage over-leverage and lay a more stable foundation for future price appreciation as macro conditions gradually normalize.

FAQ ⏰

- Why is Coinbase saying Bitcoin is falling?

Coinbase points to weakening trend signals, bearish options flow, whale selling, and ETF outflows as key pressures. - What role do Spot Bitcoin ETF outflows play?

Coinbase points out that these reduce stable buy-side demand and undermine market stability. - How does liquidity affect Bitcoin’s recent volatility?

Market volatility is amplified by slowing trader participation and tightening liquidity due to whale sales. - What does Coinbase’s cost basis chart suggest?

This indicates that Bitcoin has fallen below the dense ownership zone and many holders are experiencing unrealized losses.