A new report from Bitget Wallet shows that users in emerging markets use crypto wallets for much more payments than people in developed countries.

Emerging markets are leading the adoption of crypto in everyday trading, a new report by the Bitget Show. On Wednesday, May 28, Bitget Wallet shared a report detailing how users from around the world are involved in wallets. In particular, this report shows an increasing number of day-to-day use cases of crypto, particularly in emerging markets.

You might like it too: Dollars are no longer issued and are created by the Internet | Opinions

Bitget’s reports are based on responses from 4,599 wallet users. Survey respondents were divided into three age groups: Gen Z, Millennials, and Gen X and above, and divided into various global regions. Respondents were then asked how they would use their Bitget wallet.

Emerging markets are leading in everyday encryption

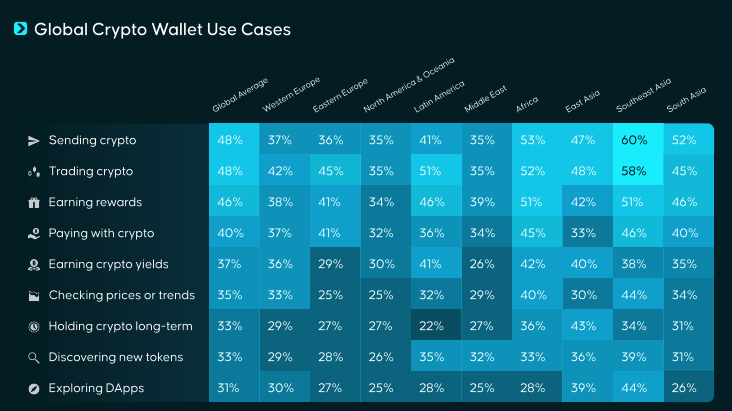

In Europe, most users are primarily engaged in trading wallets and crypto, with over 40% of respondents citing this use case. This trend was very different in emerging markets. Users in Southeast Asia, South Asia and Africa were most likely to use crypto wallets for a variety of use cases, mainly sending crypto to other users.

Answers to Bitget Survey by Region and Use Case | Source: Bitet

Emerging market users typically struggle to access trustworthy banking institutions and payment providers. For this reason, these regions tend to lead by adoption of crypto. At the same time, users in these markets are attracted to getting airdrop rewards due to their relatively low income levels.

You might like it too: The advantage of tether push dollars in emerging markets: Ardoino

According to Biget CEO Gracy Chen, this represents a fundamental change in the way users get involved in Crypto Wallets. For this reason, Bitget will adapt to this shift by making wallets more accessible to unencrypted users.

“This report captures a strong shift. Wallets are no longer an extension of the crypto ecosystem. They are emerging in a new era of financial ecosystems. At Bitget, we have seen firsthand how users’ behavior is evolving.

Interestingly, in North America and East Asia, users were divided into transactions and cryptographic transmissions. However, the level of involvement in East Asia was much higher, with 48% and 47% respectively sending crypto and transactions. At the same time, this was the region with the highest long-term holding rate, with 43%.

read more: By launching BGUSD with 5% APY, Bitget taps RWA-backed yield