Ki Young Ju, CEO of Blockchain Analytics Platform Cryptoquant, has declared that Bitcoin Bull Cycle has ended. In particular, the best cryptocurrencies have struggled to establish a sustained uptrend since reaching a new all-time high of around $109,000 in January, raising questions about the viability of the current Bull Run.

Bitcoin’s unresponsive price range begins the market

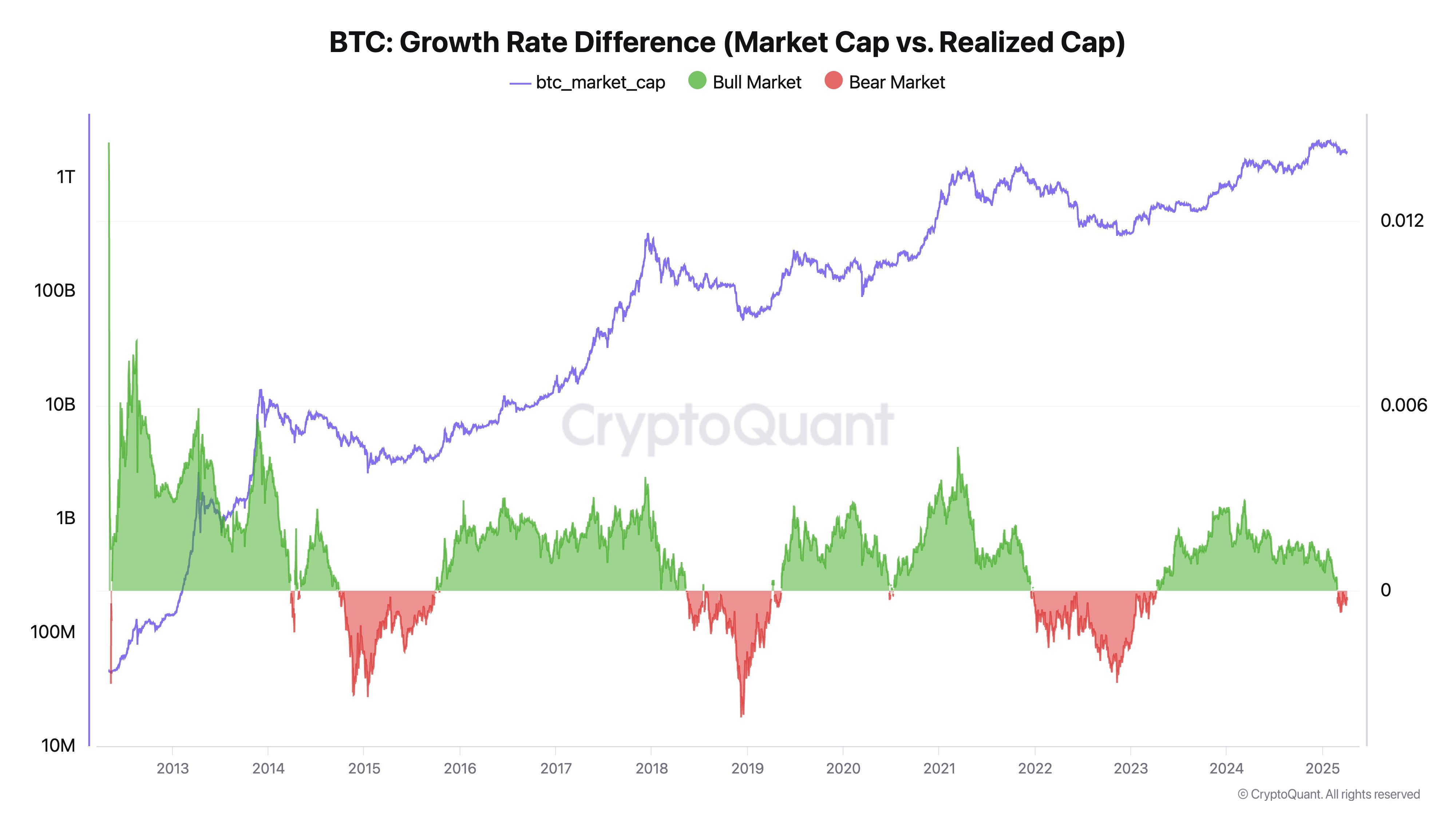

In an X post on April 5th, Ki Young Ju shared an interesting theory about why Bitcoin concluded the current Bull Run. The well-known cryptographic diagrams are based on this assumption and on the chain’s concept of data on realised caps and market capitalization.

Young Ju describes the cap realized as the total capital flowing into the BTC market, as revealed by actual on-chain activities. The realized cap reveals a more accurate measurement of the BTC network by summing the price each coin last moved.

Market capital, meanwhile, provides a valuation of the BTC network based on the latest exchange transaction prices. Cryptoquant CEO explains that market capitalization/price will not rise or decrease proportionally with the size of the transaction, based on general misconceptions, depending on the balance of trading pressure.

Young Ju said small buying could lead to rising prices and market capitalization amidst low selling pressure. Meanwhile, the market is made up of a large number of sellers, so massive bitcoin purchases may not result in a positive price response during high selling pressures.

Looking at both concepts, it is understood that the realized cap measures capital inflows into the BTC market, and market capitalization indicates a price response to these inflows. Thus, the encrypted boss explains that the increased caps achieved presents a classic bearish signal as the market cap does not fall or change, while the price cannot respond positively despite new investments.

Alternatively, stagnant realisation caps with increased market caps are bullish signals reflecting low-level sellers. Therefore, a small amount of new capital can cause significant price increases.

Ki Young Ju says that the previous situation is currently unfolding in the Bitcoin market, with prices failing to rise in flows, as shown by on-chain data in exchanges, ETF markets and custody wallet activities. This development suggests the existence of a bear market. The younger JU says current sales pressures could wander at any time, but historical data supports a reversal period of at least six months.

Bitcoin price overview

At the time of pressing, Bitcoin was trading at $83,700, reflecting a 0.94% decline over the past day.

TheStreet featured images, TradingView charts

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.