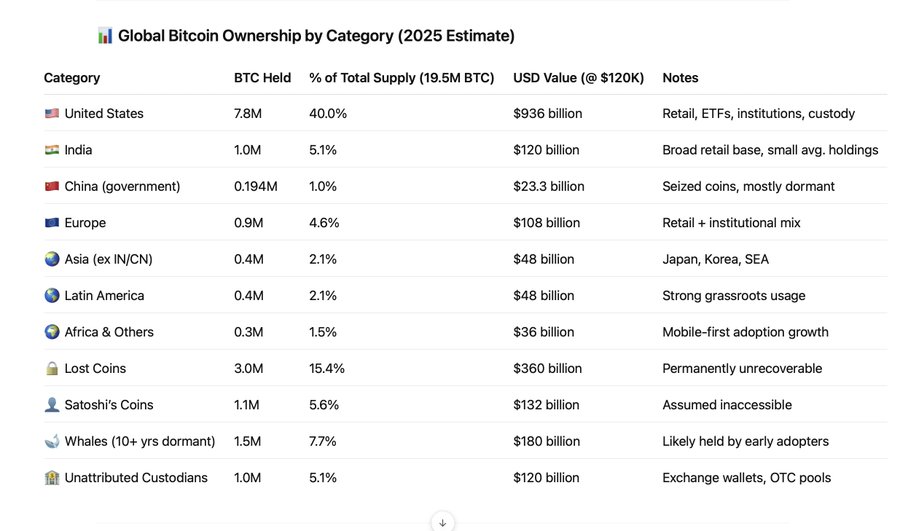

The US manages the largest share of Bitcoin Circulation supply, while India holds the second largest share, while Europe is closely behind.

According to the 2025 estimate Share According to Fred Kruger, US Bitcoin holdings are worth an estimated 7.8 million BTC out of 19.5 million circulation. This represents 40% of the circulation supply. A combination of retail investors, institutional funds, ETFs and custody services promotes control of the country.

Bitcoin ownership by category

At $120,000 per valuation of BTC, its US holdings are valued at around $936 billion. Bitcoin is trading lower than this rating, but this figure reflects an increase in adoption through regulated products such as Bitcoin ETFs. Due to the context, there was a net inflow in US Bitcoin ETFs $6.02 billion in Julyit was the third best month of February and November 2024.

Bitcoin Holdings in India ranks second in retail-driven growth

India holds 1 million BTC, accounting for 5.1% of its total supply. The country’s regulatory environment remains uncertain, but its user base continues to expand rapidly.

Most Indian holders are retail investors with a low average balance. Still, the country’s volume is ahead of Europe, China and other global regions. India’s Bitcoin holdings are valued at $120 billion based on the same price assumption.

Europe, China, Latin America and Asia trails are behind Bitcoin control

In particular, Europe holds an estimated 900,000 BTC (4.6% of supply), worth $108 billion. The region shows a mix of retail and institutional ownership, but remains behind India in total. Fred opinion Continents are not significantly involved compared to the US

Meanwhile, the Chinese government holds around 194,000 BTC, or 1% of the total. These coins have been seized and most are dormant. The value of these holdings is estimated at $23.3 billion.

Latin America and Asia (excluding India and China) each hold about 400,000 BTC (2.1%). Their holdings, worth $48 billion each, are largely attributed to strong grassroots use. Meanwhile, aFRICA and other regions combine 300,000 BTC, accounting for 1.5% of the total.

Doormant and Lost Bitcoin reduces active supply

A significant portion of Bitcoin is no longer an active cycle. An estimated 3 million BTC (15.4%) is thought to be permanently lost. This could be due to the incorrect placement of private keys or inactive wallets.

Meanwhile, Nakamoto’s known wallet contained 1.1 million btc (5.6%), which did not move. These coins are assumed to be inaccessible.

Additionally, 1.5 million BTC (7.7%) has remained dormant for over 10 years, presumably held by early adopters. Together, these three categories account for around 28.7% of the total supply, severely limiting available liquidity.

An additional 1 million BTC (5.1%) is held by contactless custodians, including exchange wallets and over-the-counter (OTC) pools. Third parties control these coins and do not directly result from individual users.