Bitcoin posted one of its worst first quarter returns in 2025. Ethereum got worse, with a drawdown of over 45% in price. Ethereum prices have been declining since the Dencun upgrade in March 2024. The downfall of Ethereum appears to be driven by Layer 2 protocols accumulating large transaction volumes and passing a percentage of revenue to the ETH chain.

Ethereum (Eth) has grown its crypto ecosystem over 2025, rooted in its role as a blockchain that underlies security infrastructure and Layer 2 protocols.

table of contents

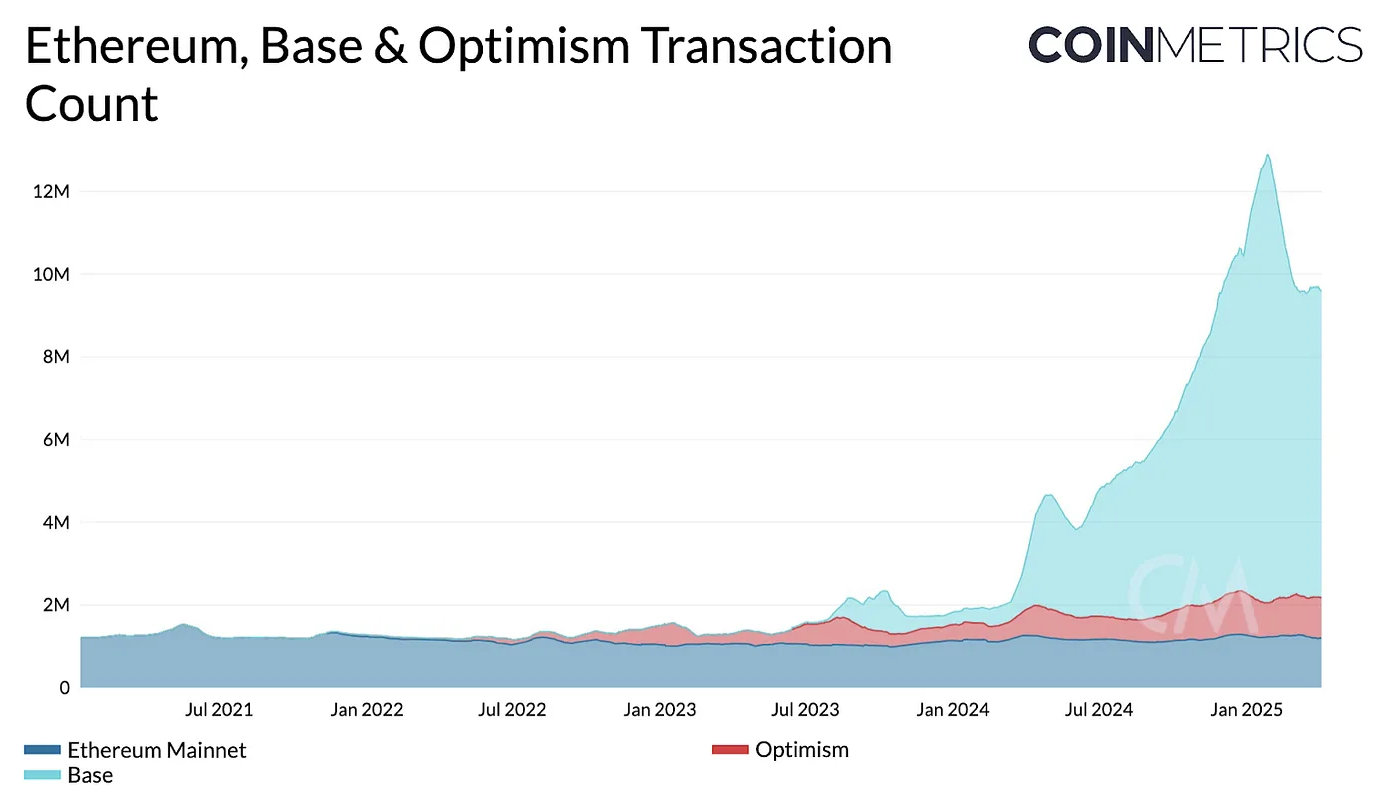

Ethereum Powers Layer 2 Scaling, Mainnet loses traction

Ethereum began with the goal of becoming a global decentralized computer, and since ICO, the chain has generated value and rose to a peak of $4,878 in November 2021. ETH has since removed 71% in four years.

The most notable shift, considered a catalyst for lowering ether prices, is the Layer-2-centered scaling model. Ethereum shifted from its main role to a chain that aggregates values and powers layer 2 scaling. The movement driven by DenCun upgrades that reduced transaction costs for the Layer 2 chain has reshaped Ethereum’s ecosystem dynamics.

Using Ethereum as a base chain has significantly reduced Layer 2 and Layer 3 projects, powering a large defi ecosystem. Base by Coinbase raised $94 million in profits and paid Ethereum a small portion of its expenses, $4.9 million.

The profitability of the Layer 2 chain has sparked debate about whether Layer 2 is either squeezing value from Ethereum, deriving security and fostering partnerships that pass revenue to the ETH blockchain.

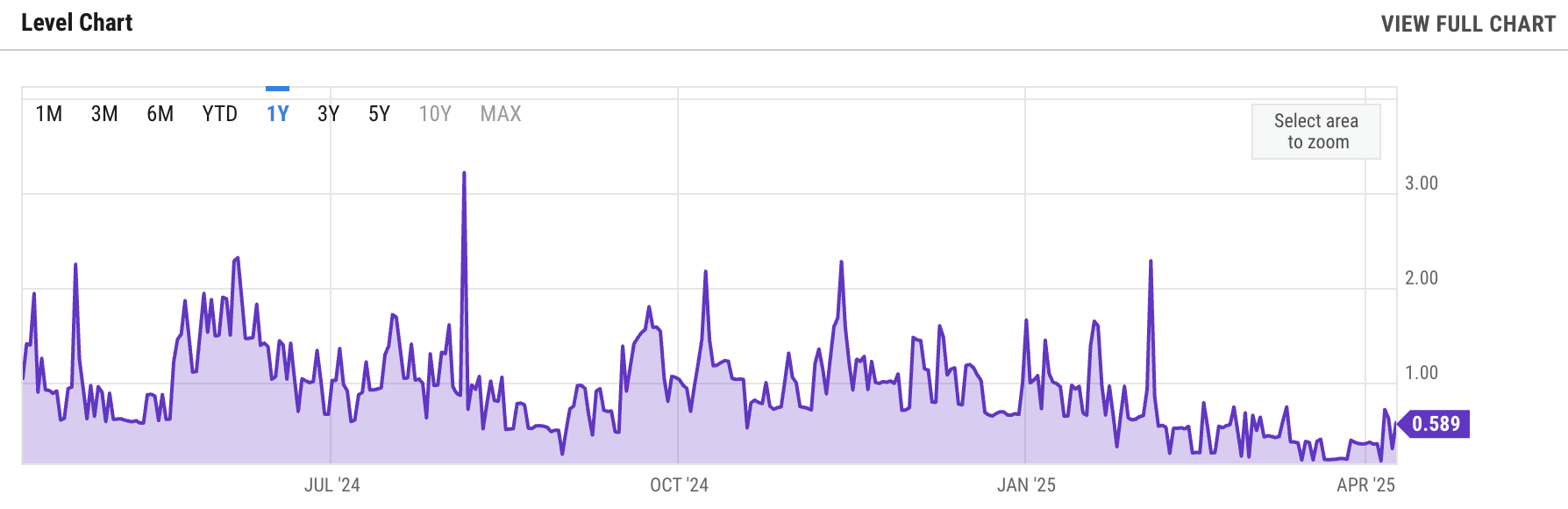

Dencun upgrade ETH value declined, trading revenue declined

With the Dencun upgrade, Layer 2 payments are now cheaper enough to lower the entry barrier for the Defi protocol. Ethereum totals over $44 billion in locked assets, and the reduction in fees collected by the network has disrupted its goal of turning Altcoin into a “Deflationary.”

Ethereum is not deflationary due to the low amount of fees collected by the chain, but according to ultrasound money trackers, supply is expected to be below an annual percentage point. X and trader crypto experts across the exchange have questioned Ethereum’s value proposition in light of a changing business model.

Pectra upgrades, the next key update of the Ethereum ecosystem, could replenish the value of the chain if it stimulates demand.

Ethereum Average Transaction Fee Chart | Source: Yahoo Finance

You might like it too: Bitcoin, Ethereum, XRP and altcoin prices rose as US inflation lurked

Ethereum returns and ETH prices are increasingly linked to fees and burns

Ethereum owners and traders have looked at metrics such as the total value of assets locked in the chain, as well as trading volume, relevance, and demand for determining ETH prices previously. Ethereum is now increasingly valued for the fees generated by the chain, token burns and fees generated by the net revenue.

The number of transactions in Ethereum shows a sharp decline due to the key metrics of devaluation and transitions to the 2-second layer two layer and the number of values and transactions.

Ethereum, Base and Optimism Transaction Count | Source: Coinmetrics

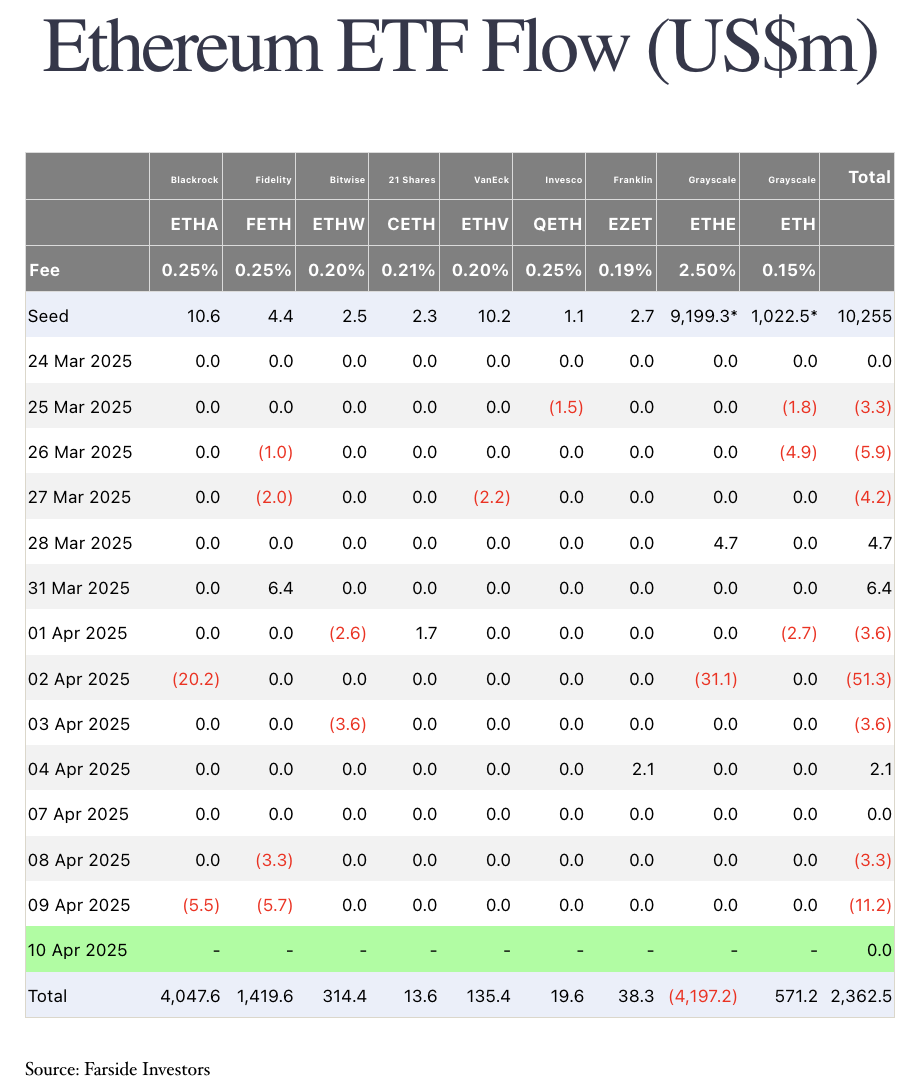

Worse, the institution has lost interest in ether, possibly due to the pivot of the chain’s business model, and the Ethereum Foundation has consistently sold ETH over the past few months, raising concerns among traders.

The US-based Ethereum ETF has been unable to attract attention from institutional investors and has been slowing down inflows throughout 2025.

Ethereum ETF Flow | Source: Farside Investors

What do you expect from a Pectra upgrade?

Pectra upgrades will affect validators and stakers in the Ethereum ecosystem. Pectra introduces Ethereum Improvement Protocol, which streamlines validator management, reduces chain congestion, improves the efficiency of the Valetter deposits, and gives higher control to stakers beyond the exit of the verification device.

The upgrade is packed with technical updates related to blockchain developers, but the changes are expected to drive higher value to Ethereum.

Pectra upgrades have a significant impact on Ethereum validators and stakers, streamline validator management, reduce network congestion, improve validator deposition efficiency, and introduce EIPs that allow for more control over the exits of the verification device.

You might like it too: Ethereum price rally stalls as economists keep the odds of the recession at 60%

Expert commentary

Graphite Network’s CTO Marko Ratkovic, enterprise-ready monitoring tools and layer 1 blockchain, told crypto.news.

“Pectra is expected to have a positive impact on the growth of L2 network users. As two new EIPs aim directly for this, EIP-7691 will increase the number of blobs per block, and EIP-7623 will increase the cost of call data.

Overall, according to Ratkovic, Pectra is a huge step forward.

The executive explains in the example EIP-7702:

“For example, use EIP-7702. You can send transactions without the need for a native token. This solves a long-standing issue that requires workarounds like gas station networks, but is now addressed natively at the protocol level.

At the same time, Ethereum upgrades remain technical in nature and do not directly address the wider gap between Tradfi and Defi. While Ethereum focuses on streamlining onboarding, overhead reductions and improving throughput, institutional players are interested in legal clarity, user verification, and preventing illegal flows. ”

Chains like graphite can solve the challenges faced by institutional investors and support the entire ecosystem.

Dr. Shawn Dawson, head of research at Derive.xyz, a decentralized on-chain option platform, told crypto.news.

“As volatility continues to skyrocket, the implicit volatility (IV) of the ETH jump is from 71.5% to 122%, reflecting the fear of market uncertainty and further disruption.

Going forward, the likelihood that ETH will fall below $1,400 by May 30 almost doubled from 18% to 33% as of April 8, indicating an increase in bearish sentiment in the market.

In short, we are taking part in bumpy rides and volatility may remain high as both traditional and digital markets continue to respond to these macroeconomic shocks. Traders and investors need to support more uncertainty in a few weeks as the market navigates these disrupted waters. ”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.