Today, Ethereum prices hold a company that holds nearly $2,640 and continue to fight against a critical supply barrier between $2,660 and $2,745. This level serves as a historic zone of rejection, and despite multiple breakout attempts, buyers still struggle to close persuasively on top of it. On June 4th, ETH managed mild daytime profits of around 1.5%, and signaling showed continued interest, while momentum indicators suggest a more cautious tone than on June 5th.

Ethusd Price Dynamics (Source: TradingView)

From a broader perspective, weekly candles remain constructive, with Ethereum price action well above the 38.2% Fibonacci retracement level at $2,424. However, ETH has not yet recovered a 50% retracement of nearly $2,745, so a full medium recovery is confirmed. Until then, the market remains technically biased towards integration under this zone.

What will be the price of Ethereum?

Ethusd Price Dynamics (Source: TradingView)

Looking at the daily and four-hour charts, the volatility of Ethereum prices is compressed into a symmetrical triangle, with prices vibrating between $2,590 and $2,660. This narrow range is adjacent by increased support from early May and downward resistance from mid-May highs. ETH is currently hovering at the top of this structure, indicating possible breakout attempts in the next 24 hours.

Ethereum’s price update highlights how much the Bulls defended their near $2,589 short-term support. This coincides with 20 and 50 EMAs on the 4-hour chart. The base has consistently absorbed sales pressure and is increasing its importance towards June 5th.

Ethusd Price Dynamics (Source: TradingView)

Meanwhile, the Bollinger band in the 4H time frame is tightened. This is usually a setup that precedes an expansion of direction. Given the recent price spikes of ETH from similar structures, traders should monitor clean breakouts above $2,660 or breakdowns below $2,590 as a confirmation of the direction of the short-term trend.

Why are Ethereum prices rising today?

Ethusd Price Dynamics (Source: TradingView)

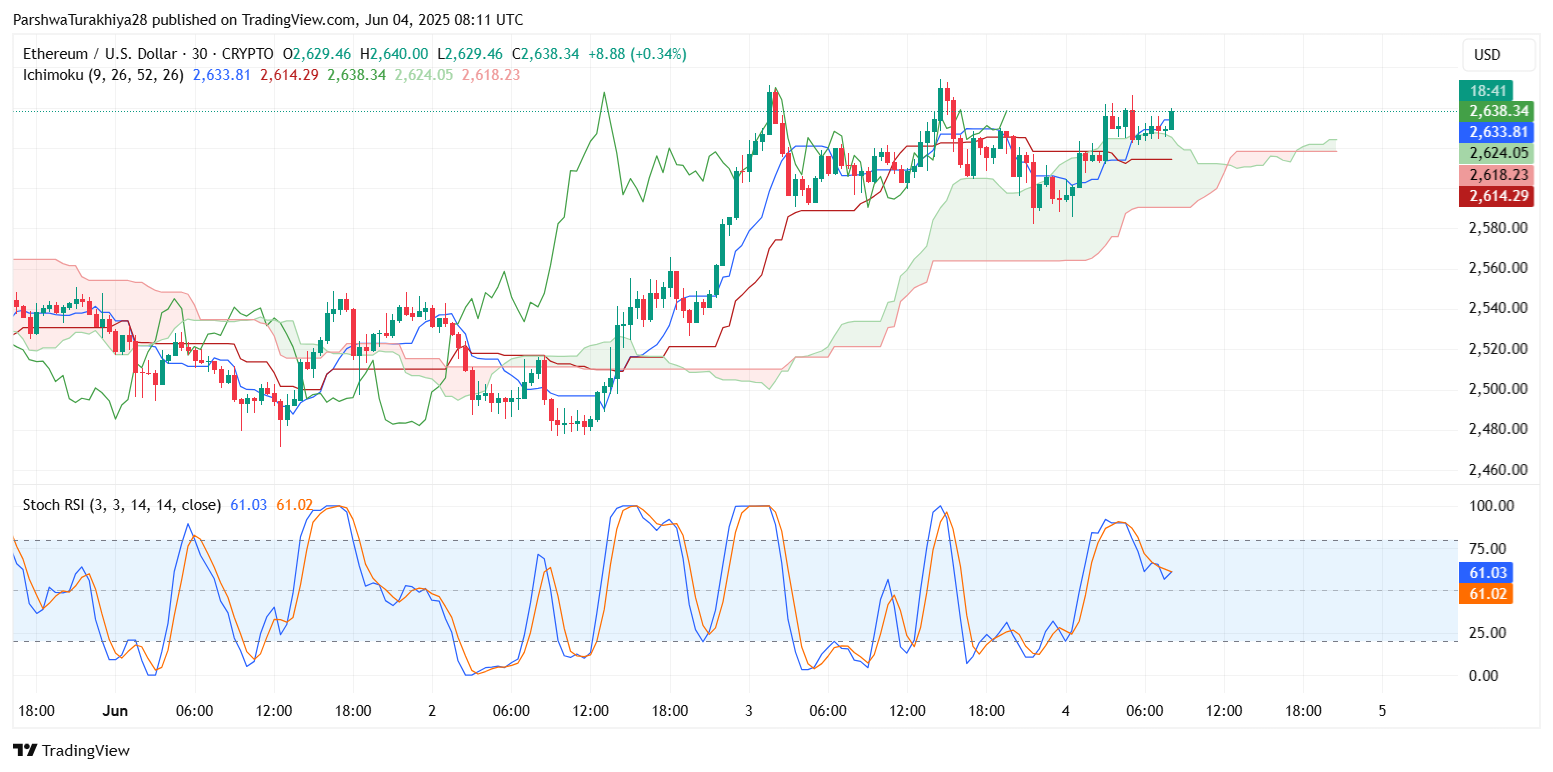

The answer to why Ethereum prices are rising today is the boost in daytime momentum. On the 30-minute chart, RSI is above 60, and the MACD line shows fresh bullish crossovers, indicating growth in upward bias. At the same time, the Stoch RSI readings have risen again, supporting recent movements.

Ethusd Price Dynamics (Source: TradingView)

The 30-minute chart signal is currently trading firmly on the cloud, suggesting equilibrium before breakout with flat Tenkan and Kijun lines. This coincides with price integration near the triangular resistance. If ETH can clear this resistance zone with volume, it could cause the next leg to $2,745.

However, if it doesn’t break above this ceiling, it could cause new sales pressure, especially as areas between $2,660 and $2,745 are still actively protected.

Short-term Ethereum price forecast before June 5th

Ethusd Price Dynamics (Source: TradingView)

Heading towards June 5th, the short-term trend remains neutral. The presence of symmetrical triangles, supported by a strong horizontal demand of nearly $2,590, keeps the bull’s structure constructive. However, the lack of follow-through of previous upside attempts means that traders should stay cautious.

If Ethereum prices exceed $2,660 on confirmed volumes, the next target will be at the midpoint of Fibonacci at $2,745. Beyond that, it cannot rule out a move from $2,850 to $2,880, especially when macro conditions or wider crypto momentum is preferred.

On the back, a refusal of nearly $2,660 allows us to return to $2,480 and $2,408. 200 EMA on the 4-hour chart provides dynamic support. Failures below this range can negate bullish patterns and open the door for a deeper retreat.

ETH Technology Forecast Table: June 5th

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.