- The dormant ETH whales will move $20 million after eight years, causing market speculation.

- ETH prices fall 3.5% despite a surge in volume and whale activity.

- The exchange data shows a bearish slope, but top traders remain bullish about ETH.

Eight years later, the long-term Ethereum wallet was back, launching two major relocations that attracted attention from blockchain analysts and market watchers. Whale wallets, which previously dormant since 2017, have run a total of $20 million worth of ETH within the last 24 hours.

Blockchain data shows that wallet address 0x2178602E5A25E5ECA759939C7D56… transferred 10,856 ETH, valued at about $19.53 million, to the newly created address, 0x23F435DD0D25718A80EA10563… Prior to this, the same wallet deposited 247.93 ETH ($443,960) on the Coinbase address, resulting in a smaller 0.0015 ETH transfer.

After eight years of dormant, the whale deposited $248 ETH ($444K) in #Coinbase today, and transferred the remaining $10,856 ETH ($19.5 million) into a new wallet.

The whale bought a $11,104 ETH ($2.5 million costing $2.5 million) in 2017 for $226 and is currently sitting at $17.5 million profit: //t.co/i4fjf3eqfl pic.twitter.com/PWTPF1QCKKV.

– lookonchain (@lookonchain) April 6, 2025

The move sparked speculation about the possibility of liquidation and wallet restructuring. Records of historical transactions show that this wallet accumulated ETH holdings eight years ago through a large influx from central exchanges, including Kraken and Gemini.

One of the recorded influx totaled 7,467 ETH, while the other records changed in hundreds. At the time, ETH was trading nearly $226, with the original investment of around $2.5 million. The shares currently represent profits of more than $17 million.

Prices will fall as Ethereum faces market pressure

Whale activity often coincides with market changes, but Ethereum prices have fallen 3.51% in the past 24 hours to $1,722.77. The decline followed a brief rally early on that day, April 6th, where asset transactions were seen at close to $1,800. After peaking near that mark, prices began to slide downwards accelerated after 4pm.

Source: CoinMarketCap

Source: CoinMarketCapThe adjustment was made during a massive 10.44% expansion of average trading volume, but now represents a BLN of $8.78. It points to strengthening the activities of the parties involved. Ethereum’s market capitalization is currently at $2078.9 billion, but distribution supply has not changed since September, and is currently at 120.67 million.

Exchange data reflects mixed signals in the market

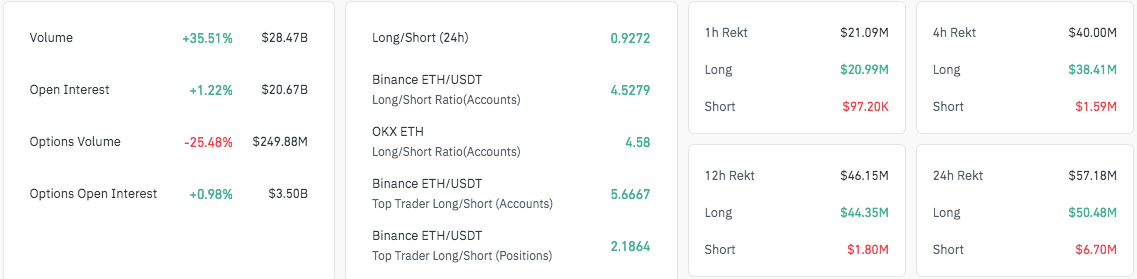

Ethereum’s trading volume rose above 35% to $28.47 billion, while open interest also rose 1.22% to $20.67 billion. In contrast, options trading volume fell 25.48% to $24,988 million, suggesting a decrease in involvement in ETH derivatives.

The current long/short ratio is 0.9272, indicating a slightly bearish bias. Nevertheless, the top accounts of Binance and OKX show stronger, longer emotions. The ETH/USDT Binance ratio is 4.5279 for typical accounts and 5.6667 for top traders. OKX reports a similar ratio of 4.58.

Source: Coinglass

Source: CoinglassOver the past day, there was a $57.18 million liquidation from both short and long positions, belonging to the former. Most of these happened in the last day. This means that there may be current changes in perception within the population.

Analysis of on-chain data pointed out that there was an average negative net flow from Ethereum since November 2023. Part of the outflows exceeded $200 million, especially in December and March. On the other hand, inflows were inflows, which were volatile at significantly lower amounts.

Source: Coinglass

Source: Coinglass