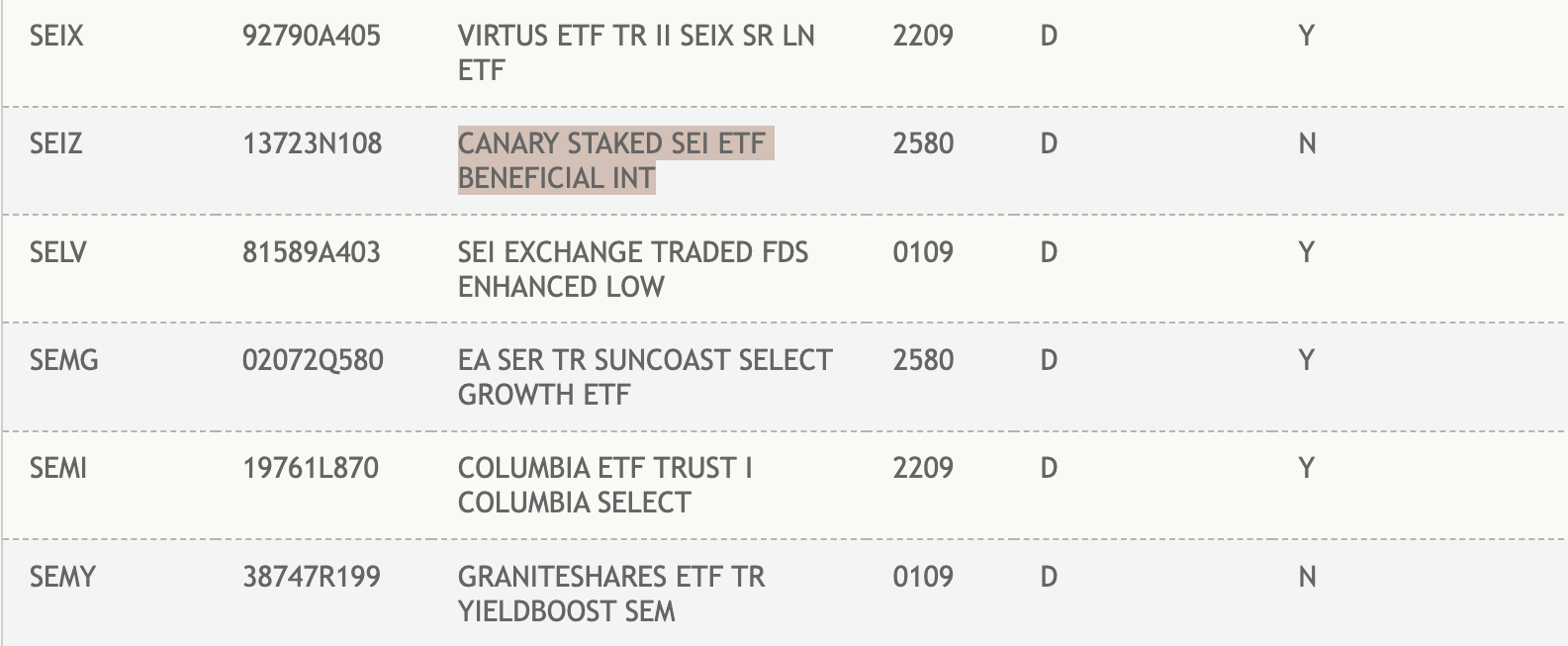

The Canary Staked SEI Exchange Traded Fund ETF has been officially registered on the Depository Trust & Clearing Corporation (DTCC) platform.

This listing does not imply approval by the U.S. Securities and Exchange Commission (SEC). Nevertheless, this is an important operational milestone and is often seen as a positive sign.

Canary’s staked SEI ETF joins DTCC list

According to DTCC records, this product is currently classified in the “Active and Pre-Launch” category. This classification indicates that the ETF is technically set up for future electronic trading and clearing, pending SEC approval.

Canary’s staking SEI ETF has been added to the DTCC list. Source: DTCC Active and Pre-Launch ETF List

Importantly, ETFs cannot yet be created or redeemed, meaning they remain non-operational despite being included in DTCC’s system. However, listing is a standard step in the ETF introduction process and is often interpreted by market participants as a sign of confidence on the part of the issuer.

“DTCC handles the clearing and settlement of most US stocks and ETFs behind the scenes. This means that the SEI ETF will be injected into the regular pipeline before appearing on securities platforms. Once market sentiment improves, SEI will be a big runner,” the analyst noted.

Canary Capital filed an S-1 earlier this year to introduce a staked SEI ETF. At the time, the SEC remained cautious about staking mechanisms within exchange-traded products. The regulatory landscape is currently changing.

BeInCrypto reported that the U.S. Treasury Department and Internal Revenue Service have issued Revenue Procedure 2025-31, establishing a clear safe harbor framework for crypto ETFs and trusts that wish to participate in staking and distribute rewards to investors.

This step mandates strict conditions, including holding only one type of digital asset and cash, using a qualified custodian for key management, maintaining an SEC-approved liquidity policy, and limiting activity to asset holding, staking, and redemption without discretionary trading.

Additionally, these guidelines resolve previous tax ambiguities. This could pave the way for SEC approval for products that include staking, such as Canary’s SEI ETF.

In addition to Canary, Rex Ospreay has also filed for an SEI ETF in which he owns shares. Finally, 21Shares is seeking SEC approval for an SEI-focused ETF. This reflects widespread institutional interest in exposure to SEI networks.

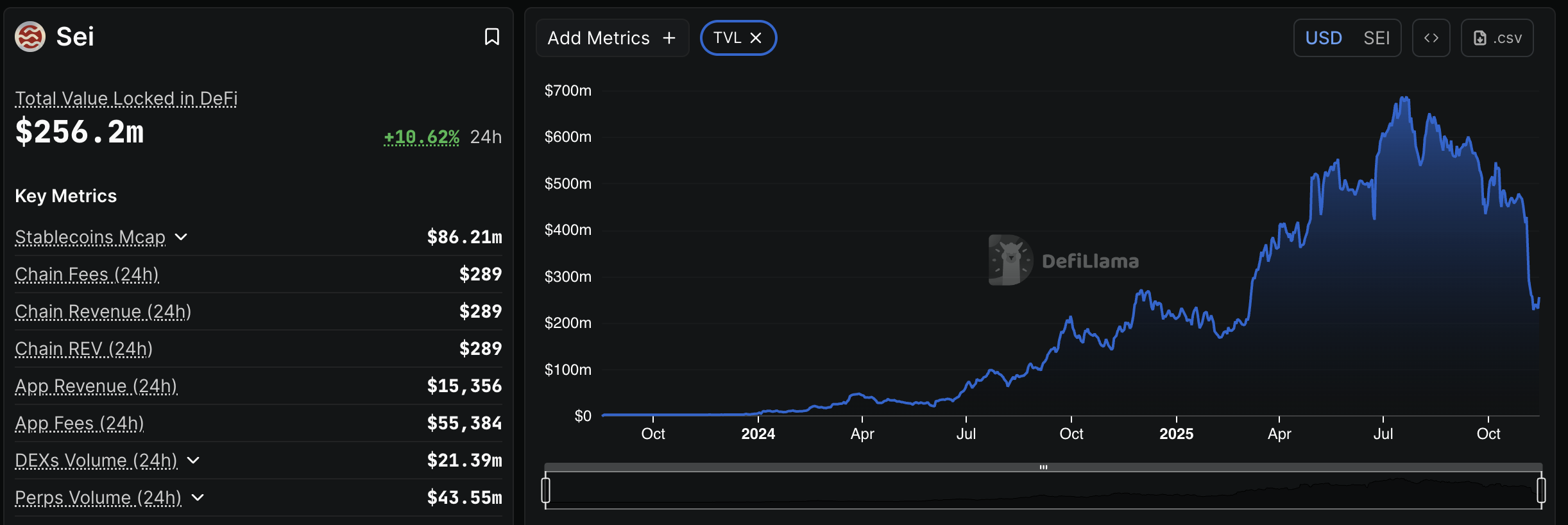

While TVL struggles, SEI rises due to net flow

On the other hand, this comes at a time when Sei is experiencing intense capital movements. According to Artemis Analytics, the network currently ranks second in net flows over the past 24 hours, with inflows accounting for the majority. This trend suggests that investors are shifting towards SEI despite broad volatility in the market.

Analysts are also increasingly optimistic about SEI’s price potential. ZAYK Charts noted that the altcoin is once again completing a falling wedge cycle and claimed that a breakout could trigger a 100-150% rally.

$SEI maintains this major support level.

We can expect a strong reaction here! pic.twitter.com/6Uqg0woJAN

— Mister Crypto (@misterrcrypto) November 13, 2025

However, on-chain data paints a more complex picture. Statistics from DefiLlama show that the network’s total value of lock (TVL) contracted significantly in November, the largest decline in almost two years.

Approximately 1 billion SEI tokens have been unstaken, reflecting the acceleration of user exit from the ecosystem.

For now, therefore, this list serves as a meaningful, albeit procedural, signal that the path to institutional SEI exposure is beginning to take shape, both against the backdrop of a recovery in inflows and remaining challenges within the network.

The post DTCC Lists Canary’s Stake SEI ETF as SEC Market Oversight Decision appeared first on BeInCrypto.