Ethereum is facing strong downward pressure after losing its bullish grip near the $2,900 mark earlier this month. Combined with a wider market slump, increased liquidation activity and weaker technological structure, ETH has fallen below critical levels.

Both price action and on-chain metrics suggest a cautious outlook in the short term, and the next few sessions could determine whether the ETH will stabilize or be headed for a deeper correction.

By Shayan

Daily Charts

The daily chart shows clear bearish breakdowns from the upward channel, which had been developing since early May.

The pattern was played with high accuracy and within a few days it sent ETH from nearly $2,900 to just over $2,200. Prices were tapped into a large fair value gap (FVG) zone between $1,900 and $2,200, with some buyers intervening.

The 100-day moving average, around $2,200, also serves as support. But a 200-day MA rejection around the $2,600 mark reinforces the idea that sellers are in control.

Additionally, the RSI is currently around 35 years old and has not yet been sold oversold, but is hovering near key areas. If the mentioned FVG is not retained, the next major support zone is $1,500, the level that previously served as the basis for the April rally. Therefore, buyers should check the 200-day moving average recovery to consider meaningful bullish continuation.

4-hour chart

Zooming into the four-hour timeframe, ETH has been on a steady downtrend since losing its rising channel support earlier this month. After the breakdown, the price retested the lower limit of the channel, unable to regain it, dropping quickly towards the $2,100 area. This level provided temporary relief, but the bounce appears weak and corrected.

There is a visible bearish structure formed at lower highs and lower lows. The RSI for this time frame is approximately 34, reflecting the bearish momentum and lack of strength in bullish attempts. Unless Ethereum recovers above $2,300 and can retain that level as new support, current sales pressure could lead to another leg towards the $2,000 level. If selloffs intensify, the next important demand zone is close to $1,800.

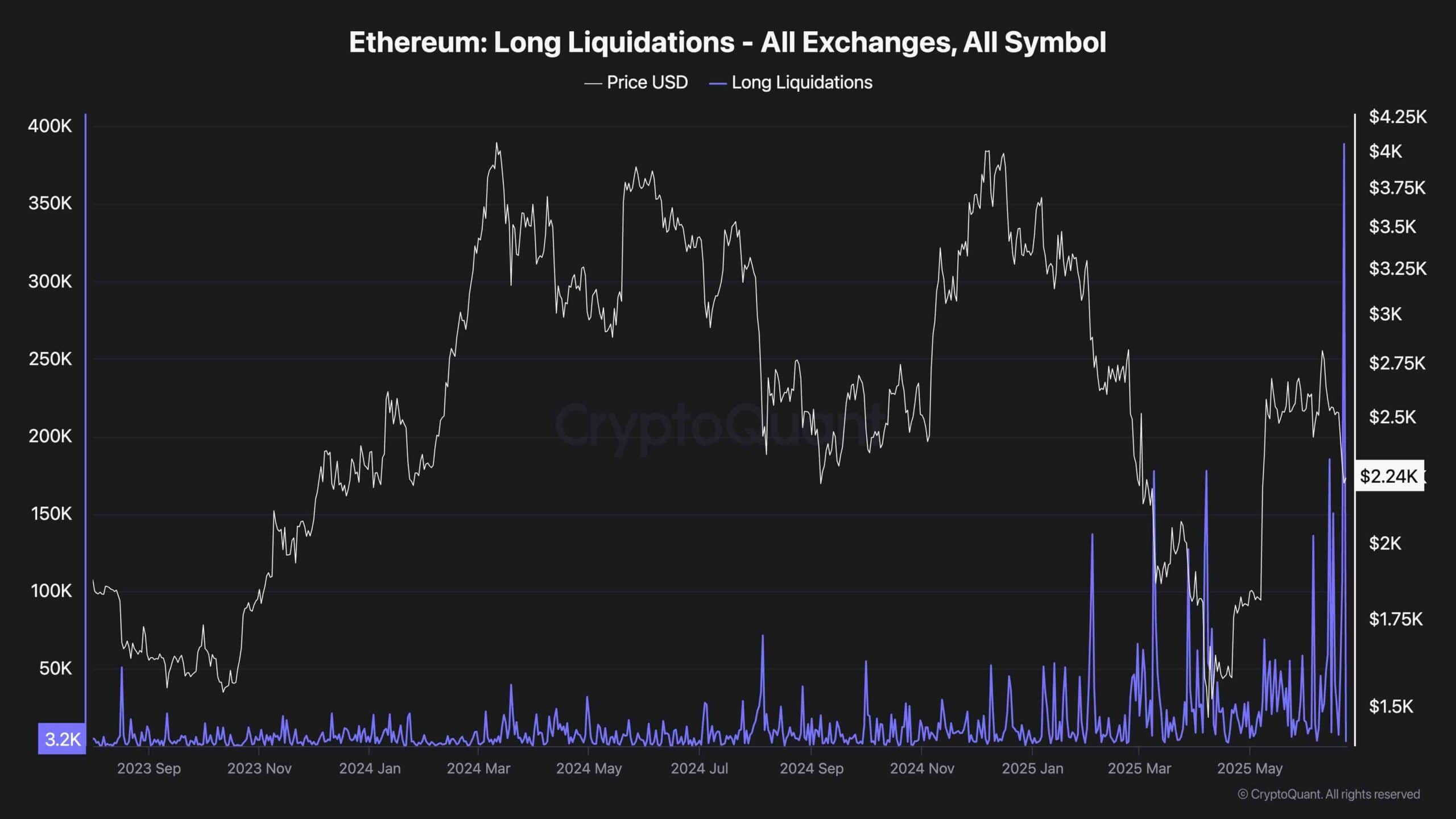

Ethereum’s long liquidation

The liquidation chart reveals a massive spike in long liquidation over the past few days, bringing Ethereum’s aggressive move to $2,200. This uptick shows that many slow long positions have been wiped out during this drop, entering levels between $2,600 and $2,800 at around $2,600 to $2,800.

These liquidation could temporarily exaggerate the movement of shortcomings, especially in highly utilized environments, and it appears that this is happening here.

The total clearing reached levels not seen in months, indicating how busy the bullish trade has become.

This could reduce the pressure of sold out in the short term as it clears the most vulnerable positions, but it also reflects the emotional shift from bull to defense. With confidence shaking and many traders underwater, rebound attempts can be met with sales pressure from participants trying to shorten exits and low highs.