Global risk appetite has been hit hard as geopolitical tensions between Iran and Israel escalate once again. These conflicts often inject short-term volatility into traditional and crypto markets. Ethereum is no exception.

ETH has been relatively stable at $2,500 in recent weeks, but the growing fear in the macro market is beginning to emerge in price structure and emotional changes.

This is a sensitive moment for traders. The ETH sits at the edge of the important range.

Technical Analysis

Shayan Market

Daily Charts

Ethereum’s daily chart shows a clear rejection from the $2,800 resistance area. This also coincides with the 200-day moving average and bearish order block. After a strong relief rally from the $1,500 region at the beginning of the quarter, ETH was integrated into an upward channel pattern, but could now fall below that channel’s lower trendline.

This structure usually shows bullish momentum when the market is unable to push despite a particularly favorable short-term setup. The RSI has returned below the 50 mark, reflecting its bearish momentum.

Prices are currently re-entered into the midrange zone between $2,800 and $2,150. If Ethereum is unable to regain $2,800 immediately, the door will open for a move that could return to a support level of $2,150, which coincides with the 100-day moving average and the top of the last major accumulation range. The bouncing off of it is important to maintain the broader bullish bias in recent months.

4-hour chart

On the 4H chart, the assets are broken down from the upward channel, which has been respected for several weeks. The rejection from the $2,800 order block left an imbalance (FVG) near the $2,600 zone, creating a sudden drop that is currently acting as a short-term resistance. This structure is similar to the potential distribution stage, especially when the price breaks under the channel without fresh purchasing pressure.

Furthermore, the RSI remains weak, hovering at just below 50, showing no signs of bullish divergence. Also, recent bounces have lacked a notable amount, suggesting that demand has become dry as macro uncertainty looms. If a channel breakdown occurs, ETH could retreat towards a $2,300 demand zone. Losing that area can lead to a deeper correction to $2,100, so it’s important to keep it.

Emotional analysis

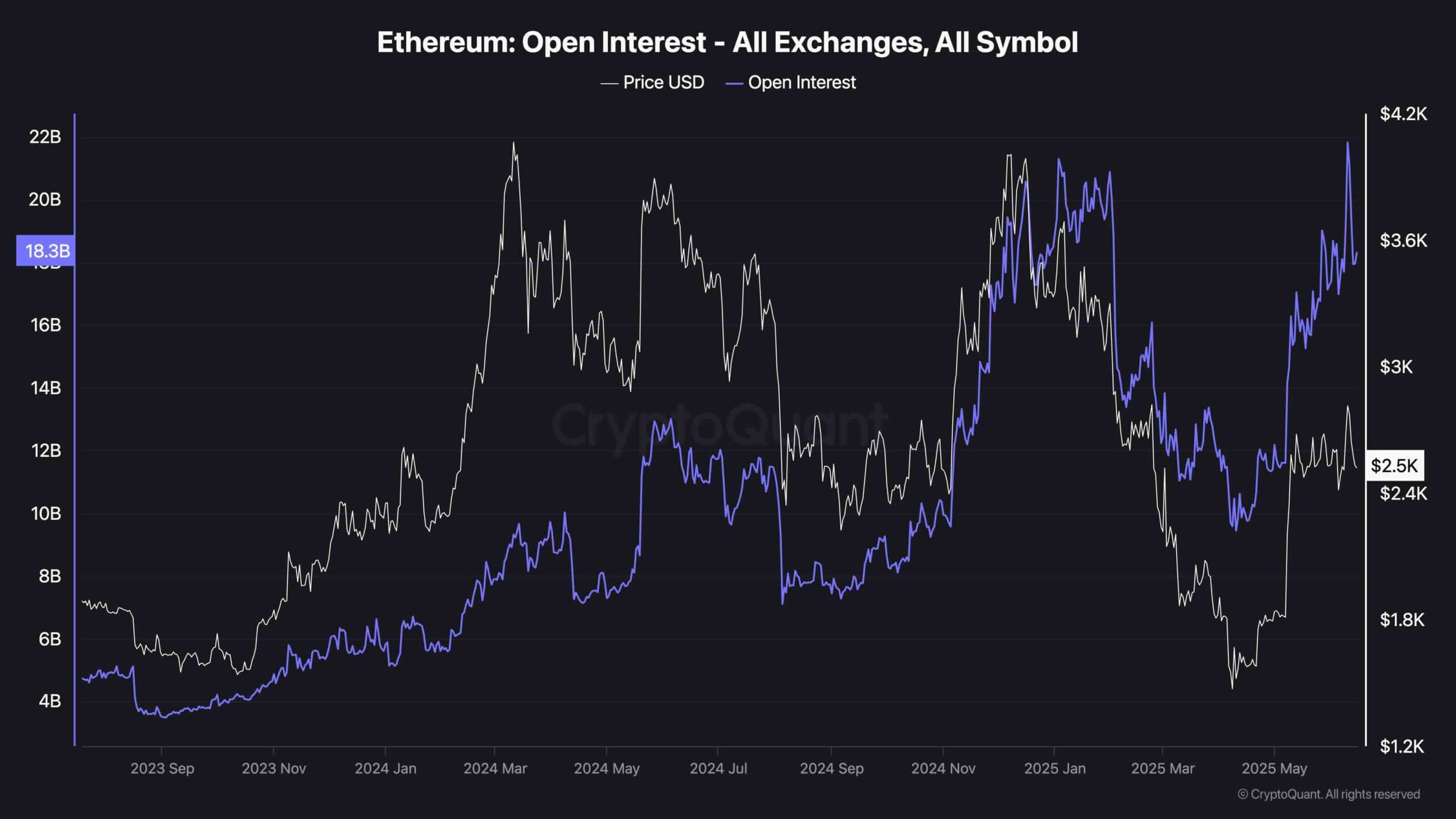

Ethereum Derivatives’ open profits (OI) reached its highest point over the past few years, exceeding $21 billion before experiencing marginal drops due to liquidity caused by Middle Eastern tensions. What makes this development even more interesting is the fact that this surge in OI has occurred while ETH is trading significantly lower than when it rose.

This divergence usually indicates that the accumulation of leveraged locations that are not flushed from the system is long and short.

Historically, such divergence of oi-prices often precede large-scale liquidation events. If the market is unable to produce a clean breakout right away, volatility spikes can occur caused by rewinding stacked positions. This coincides with increasing geopolitical risk, and could catalyze a rapid re-rick as global investors move to risk-off assets. In other words, the derivative is flashing a warning. Even if prices remain calm, the undercurrent is not stable.