Ethereum has entered the consolidation phase after strong gatherings in the past few months. Prices range between the main support and resistance zones, with multiple failed attempts to go beyond the $2,700-$2,800 region.

Despite the lack of immediate trends, chain fundamentals such as Exchange Reserves suggest important structural changes. This is the setting for potential volatility as the market is ready for the next direction.

Technical Analysis

Shayan Market

Daily Charts

In the daily time frame, ETH remains within the rising channel, finding consistent support around the $2,400 area and struggling to exceed $2,800.

This channel cap is combined with the 200-day moving average and key order block formed in February, and serves as a heavy resistance element. Each test at this level has led to rejection, but so far the structure has not been broken, indicating that the Bulls are still in control for now.

However, the momentum is weakening. The RSI floats around the midline of the 51, reflecting indecisiveness and lack of drive of strong direction. If ETH can regain its top range and flip to support an area between $2,700 and $2,800, you can start a new leg higher than $3,000. On the back, a breakdown below $2,400 changes bias and exposes a $2,150 support zone.

4-hour chart

Although it zooms in on the 4H chart, ETH is still crushing within the same ascending channel. After a recent drop to $2,430 from $2,875, the price was pulled back to the 0.5-0.618 Fibonacci zone, but was rejected on the downside and is now integrated. The area has repeatedly acted as a supply zone between $2,600 and $2,700, refusing bullish attempts multiple times. For short-term traders, this remains a critical level of flips.

ETH may continue to operate in a range-bound state until this resistance collapses. The RSI has recovered slightly from being oversold, but is now sitting at nearly 52. This suggests that momentum is rising slightly, but there are no clear indications of bullish domination yet. If the Bulls don’t break above this key FIB zone anytime soon, another drop could be made towards the lower limit of the channel, close to $2,400.

Emotional analysis

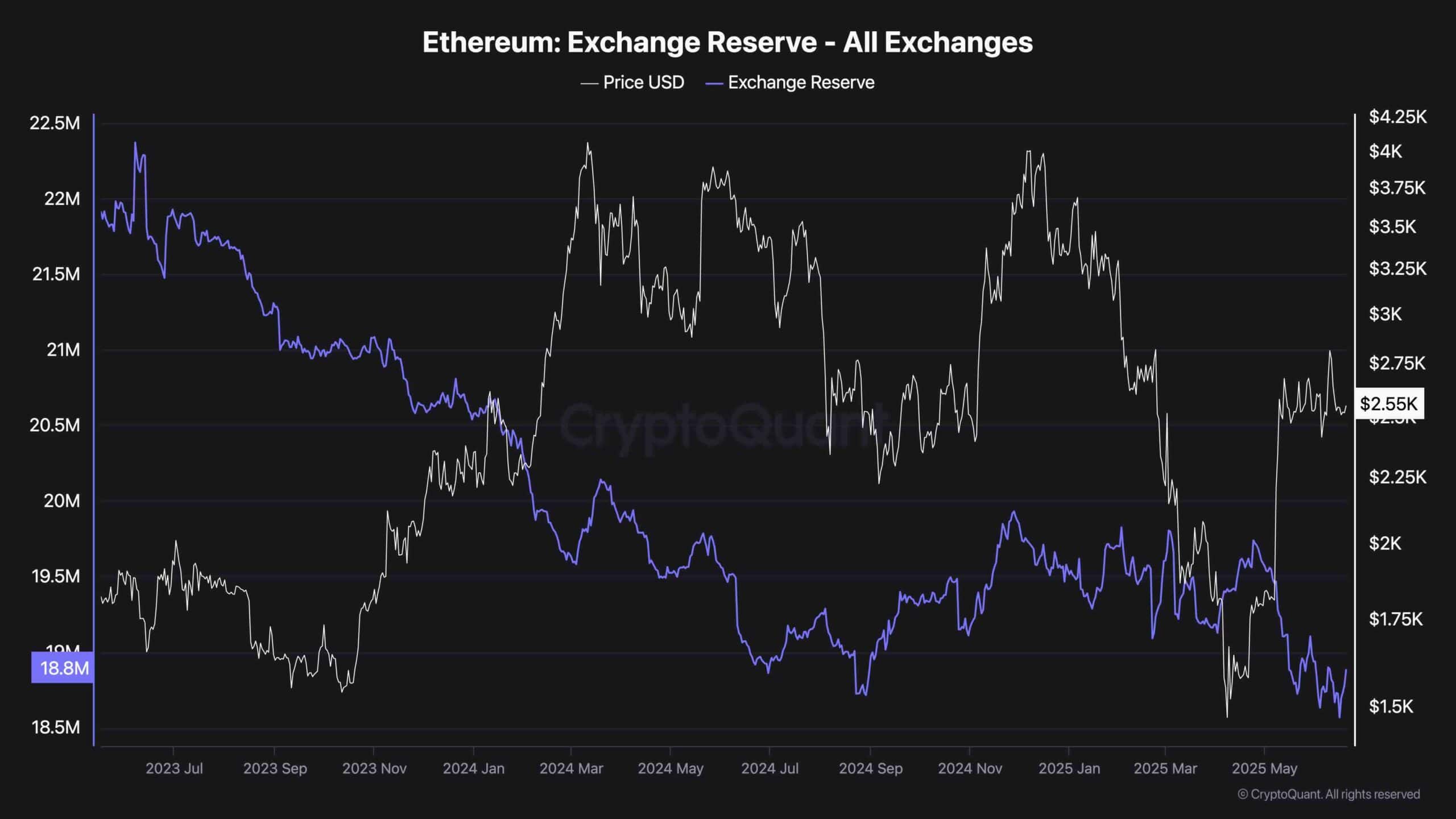

One of Ethereum’s most important long-term signals remains a consistent downtrend in exchange reserves. Currently, they sit at 18.8 million ETH, one of the lowest levels in recent history. Exchange Reserve data shows the amount of ETH that an ETH is held on a centralized trading platform. This means a decline signal that the coin is being withdrawn into independence, staking, or cold wallet.

Historically, the continuous drops of the exchange suggest that the supply squeezes the story building beneath the surface. Less exchange tokens can lead to lower available sales pressures and explosive upside down when demand rises.

Despite ETH’s technically struggling to escape, this quiet accumulation stage shows trust among long-term holders. If this trend continues, it could serve as a powerful tailwind if technical resistance levels are ultimately compromised.