- Ethereum Price rebounds and maintains the chance to reach $4,000 after retesting daily support at $3,730.

- On-chain data shows that ETH whale wallets continue to accumulate ETH tokens, but exchange reserves have reached their lowest level in nine years.

- Ether Machine announced that its subsidiary had purchased around 15,000 ETH for Ethereum’s 10th birthday.

Ethereum (ETH) celebrated its 10th anniversary this week with signs of bullish momentum growing, trading above $3,800 at the time of writing, then bouncing back key support levels the day before.

Data on the chain shows a steady accumulation of ETH tokens from whale wallets during July, but replacement items fell to their lowest in nine years. This supply crunch, coupled with growing institutional and corporate profits, could set the breakout stage at $4,000.

Ether Machine adds 15,000 ETH

Ether Generation Company Ether Machine announced on Wednesday that its subsidiary Ether Reserve LLC had purchased around 15,000 ETH for the 10th anniversary of Ethereum on Wednesday, with an average price of $3,809.9, totaling $56 million.

This purchase is part of the long-term accumulation strategy for ether machines, bringing the total to 334,757 ETH. The company said it still has up to $447 million available for additional ETH purchases.

“We couldn’t imagine a better way to celebrate Ethereum’s 10th birthday,” Andrew Keys, chairman and co-founder of Ethereum, said in a press release.

“We’re just starting out. Our mission is to accumulate, complicated and support ETH over the long term, not just as a financial asset, but as the backbone of the new internet economy,” he added.

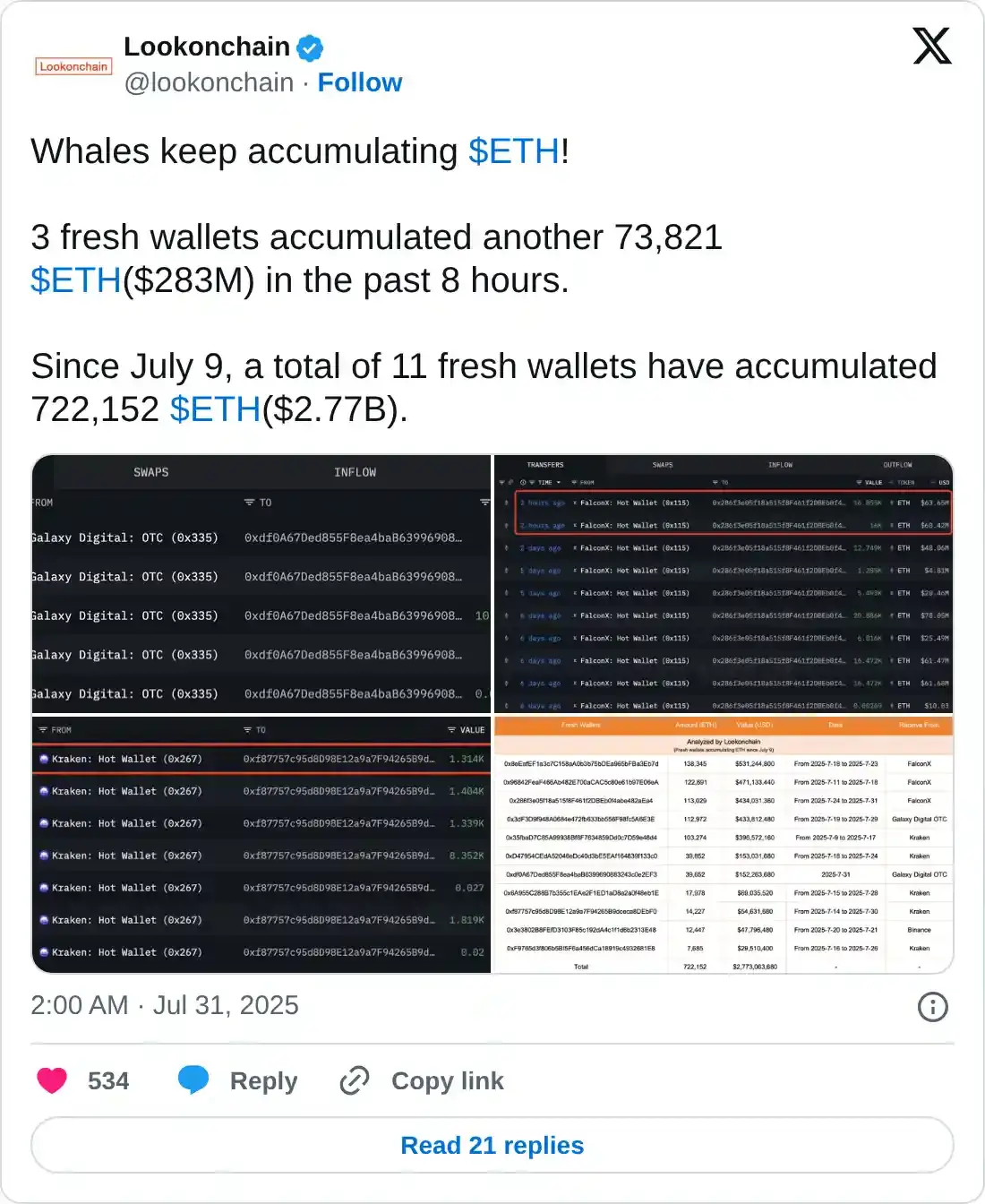

Whales accumulate ETH tokens

LookOnchain data shows that whale wallets accumulate ETH tokens. Data shows that three fresh wallets added another 73,821 ETH, worth $283 million in the last eight hours. Since July 9, a total of 11 new wallets have accumulated 722,152 ETH, worth $2.77 billion.

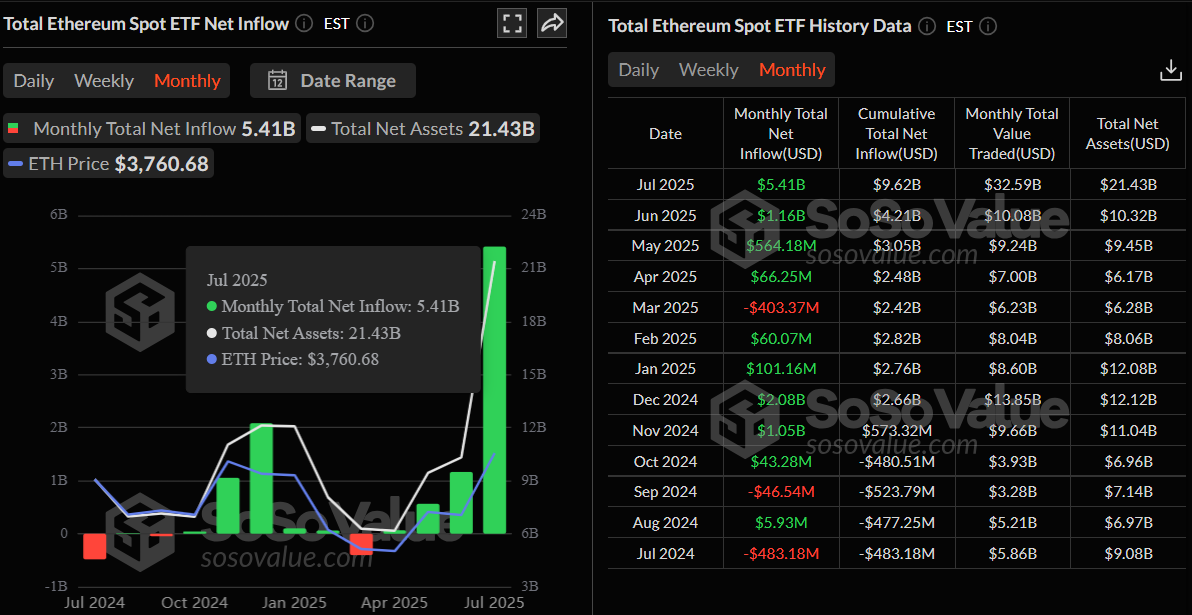

Although it is less than in the beginning of July, demand for the system is also increasing. According to SOSOVALUE data, the US Spot Ethereum Exchanged Traded Funds (ETFS) recorded a mild flow of $5.79 million on Wednesday, continuing its positive trend streak since July 3rd.

Daily chart of total Ethereum spot ETF net inflow. Source: SosoValue

Monthly chart for total Ethereum spot ETF net inflow. Source: SosoValue

Ethereum Exchange Reserve falls to the first drop in nine years

Encrypted data shows that the decline seen since early July 2024 has been extended, and the decline since 2016 has been extended, reaching lowest levels from investors, indicating a decline in sales pressure from investors and a decline in the supply available for trading, has been reduced to 18.7 million people.

The reserve drop indicates an increase in the rarity of the coin. This is an outbreak that is usually associated with bullish market movements.

Ethereum Exchange Reserve – All exchange charts. Source: Cryptoquant

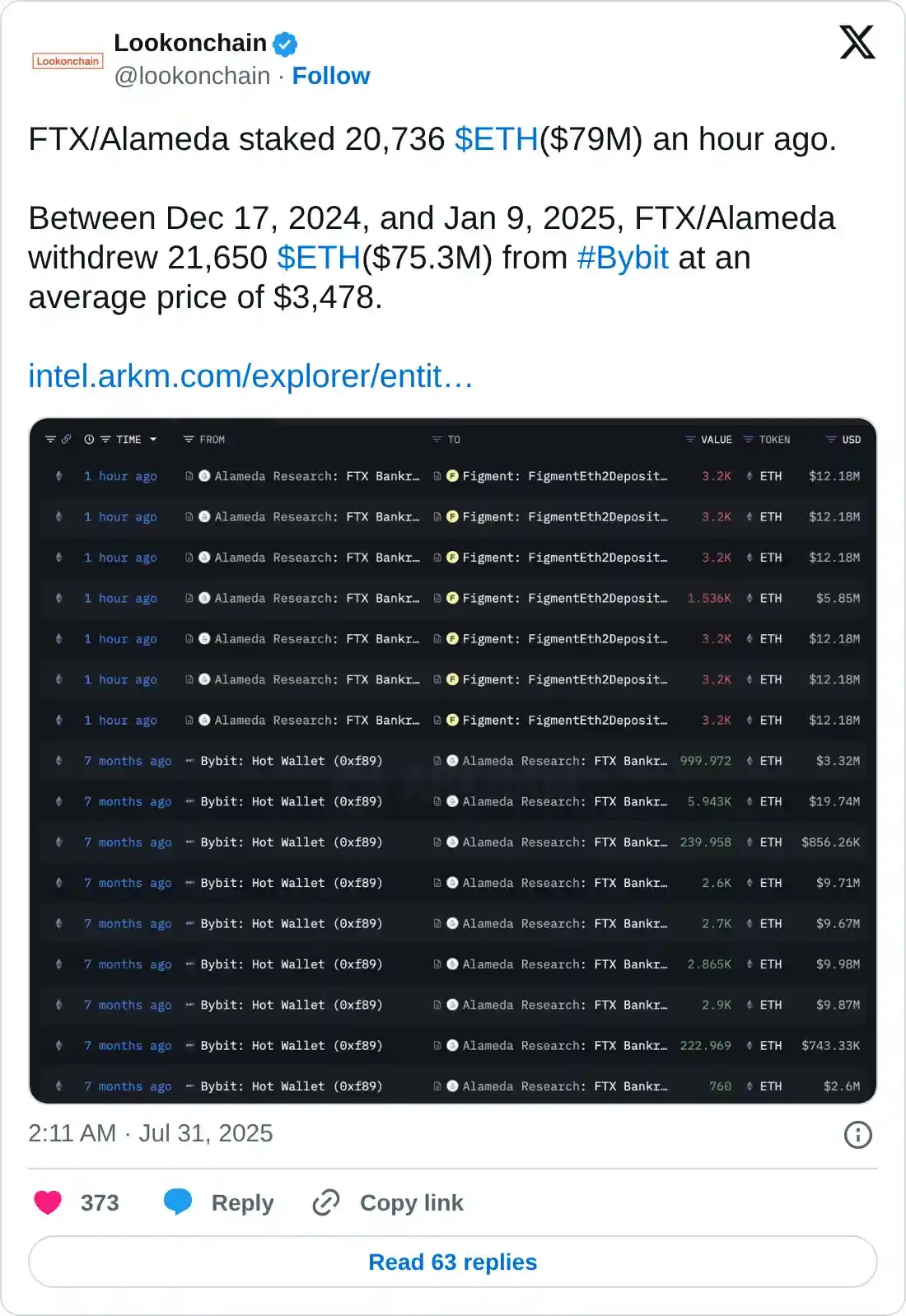

Apart from Falling Exchange Resmere, LookonChain data shows FTX/Alameda bet 20,736 ETH, worth $79 million on Thursday. From mid-December to early January, FTX/Alameda withdraws 21,650 ETH from the Bibit exchange, thereby reducing sales pressure and increasing the rarity of the coin.

Ethereum Price Prediction: ETH Bulls aiming for a level above $4,000

Ethereum prices faced a denial below the $4,000 psychological level on Monday, and fell slightly to find support at a daily level at $3,730 the following day. On Wednesday, ETH recovered after retesting this support level. As of Thursday’s writing, it continues to recover and is trading above $3,800.

If daily support is held at $3,730, ETH can continue its upward momentum targeting a major psychological level of $4,000. Above this level could potentially expand additional profits towards a high of $4,488 on December 9, 2021.

The Relative Strength Index (RSI) indicator on the daily chart reads 77, exceeding its excess level of level 70. Traders have shown a bearish crossover on Wednesday when the divergence of moving average convergence (MACD) showed bearish crossover, suggesting early signs of bearish momentum and potential downward trends.

ETH/USDT Daily Chart

If ETH faces fixes and falls below daily support at $3,730, the decline at $3,500 could be extended to next support.