On-chain data shows that the Ethereum Daily Active Addresses Metric was recently fired. This is what cryptocurrency means.

Ethereum Daily Active Address is close to the highest level in two years

According to data from the Institutional Defi Solutions Provider Sentora, Ethereum Blockchain has been getting brighter in activity recently. “Daily Active Address” is a chain-on-chain indicator that tracks the total number of ETH addresses participating in certain forwarding activities each day.

If this metric increases, it means that more users are moving on the network. This trend means that profits from transactions with cryptocurrency may be on the rise.

Meanwhile, metrics observing drops suggest that investor activity is declining on the blockchain. This type of trend can be a potential indication that attention is shifting away from the assets.

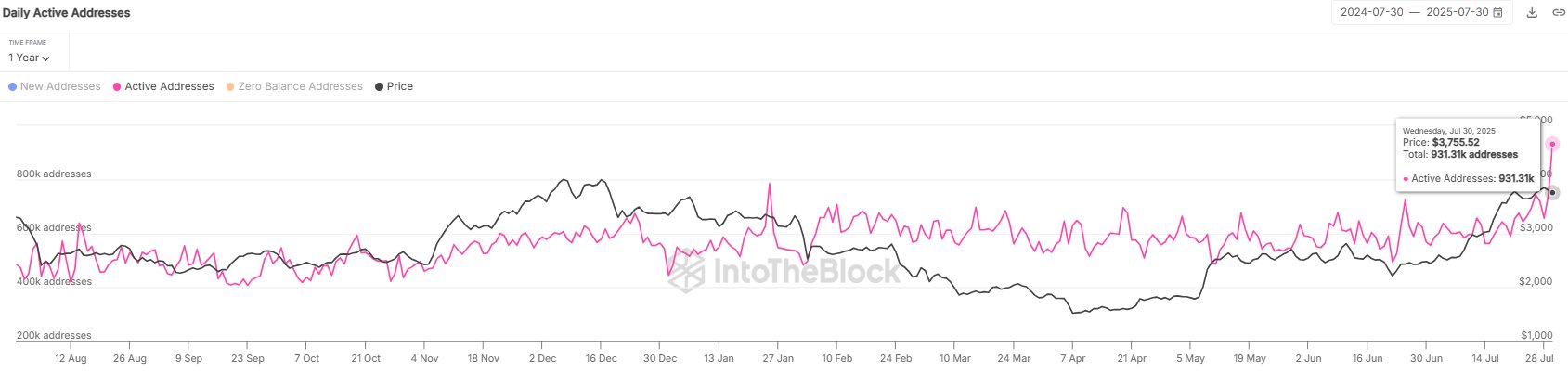

Now, here’s a chart showing the trends in Ethereum daily active addresses over the past year.

The value of the metric appears to have shot up in recent days | Source: Sentora on X

As shown in the graph above, Ethereum’s daily active address exceeds the recent integration level in recent rally above the 600,000 deviation, meaning that the price measures have brought interest in the assets.

Interestingly, this trend has accelerated over the last few days, with the indicators registering sharp spikes. This rapid increase has brought its value to 931,310. This is the highest everyday level in almost two years.

Historically, high transactional activity from users has often been a precursor to volatility. In theory, the price actions that appear in a transaction can take either direction. Daily active addresses do not contain information about whether or not the purchase or sale is dominant, so investors are just moving.

As cryptocurrency prices have plummeted since the advent of the arrival of the market, it seems like Ethereum’s daily active address spikes may have led to volatility again.

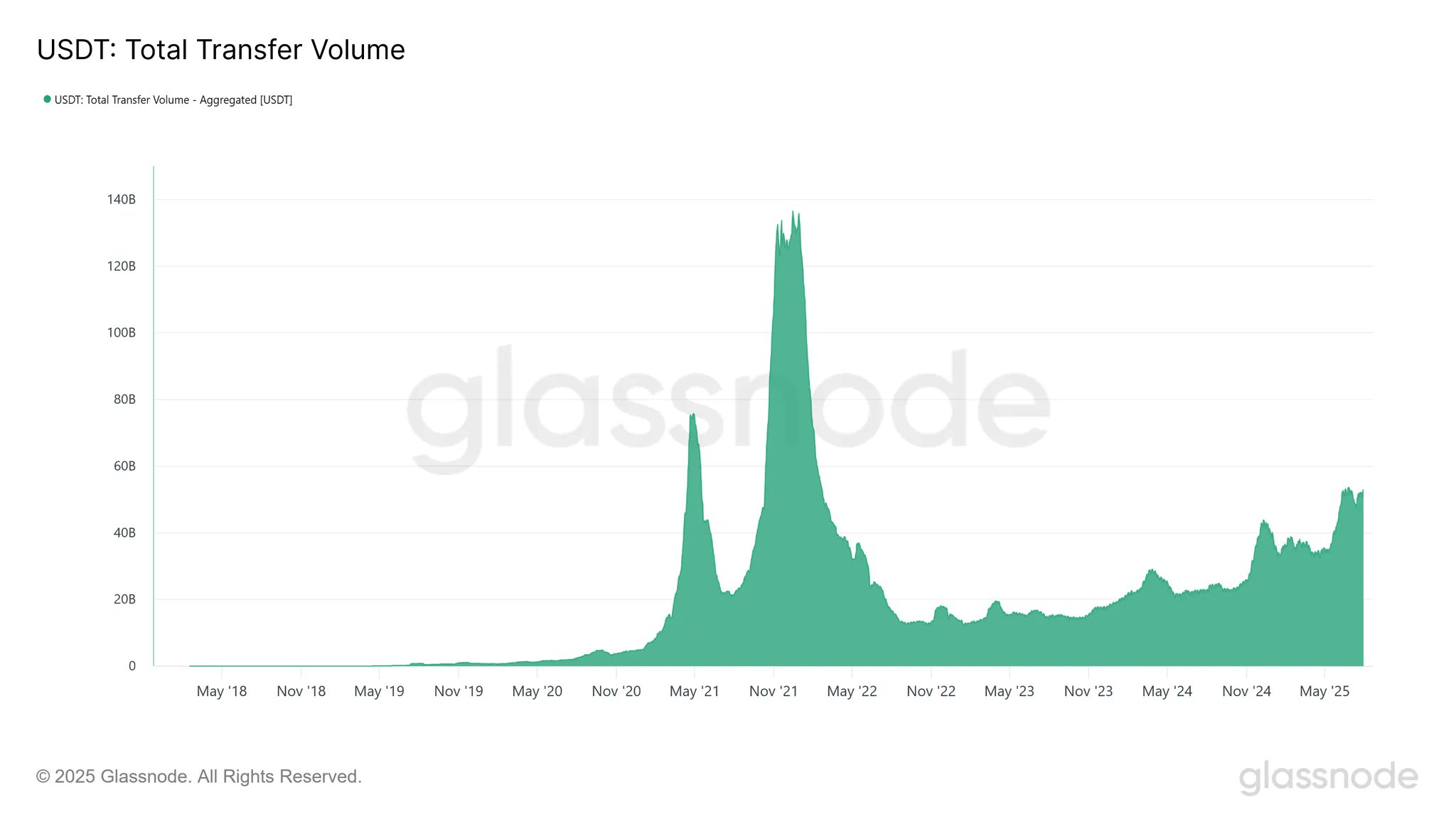

In other news, Stablecoin USDT has discovered that its 30-day moving average (MA) transfers have recently recovered to $52.9 billion, as explained in the X-Post.

The trend in the USDT transfer volume over the last few years | Source: Glassnode on X

As shown in the graph above, USDT transfer volume has steadily recovered since the 2022 crash. “This progressive climb reflects a steady speed and a slow and consistent recovery in market activity,” GlassNode said.

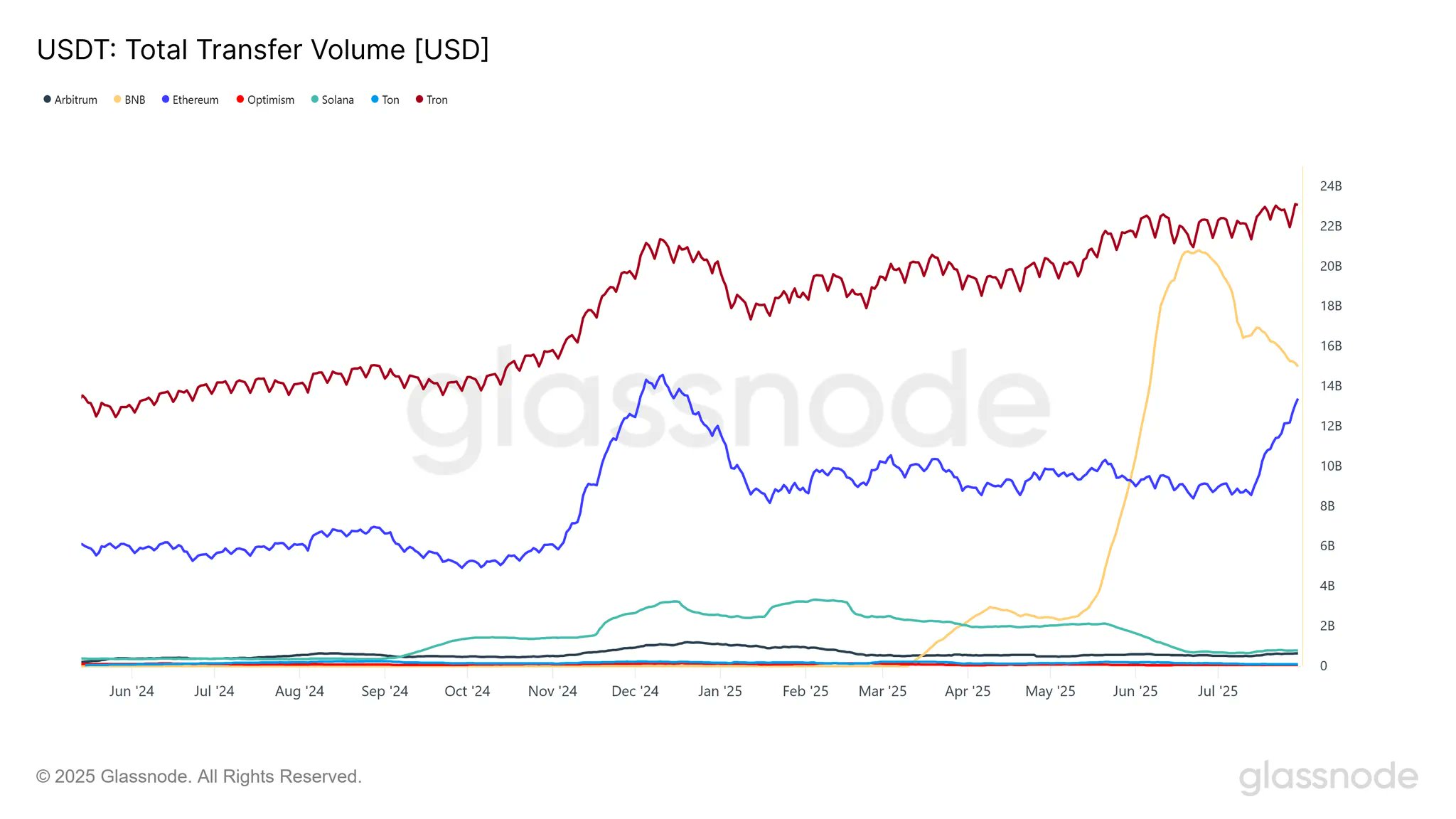

Interestingly, Ethereum was not even one of the top two networks with the largest share of stable volumes.

The data of the USDT Transfer Volume across major networks | Source: Glassnode on X

Tron and BNB are two networks leading USDT volumes, with metrics sitting at $23 billion and $14.9 billion respectively.

ETH Price

At the time of writing, Ethereum has fallen about 3.5% in the last 24 hours, trading around $3,650.

Looks like ETH has just taken a hit | Source: ETHUSDT on TradingView

Featured images from charts on Dall-E, Glassnode.com, IntotheBlock.com and cradingView.com

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.