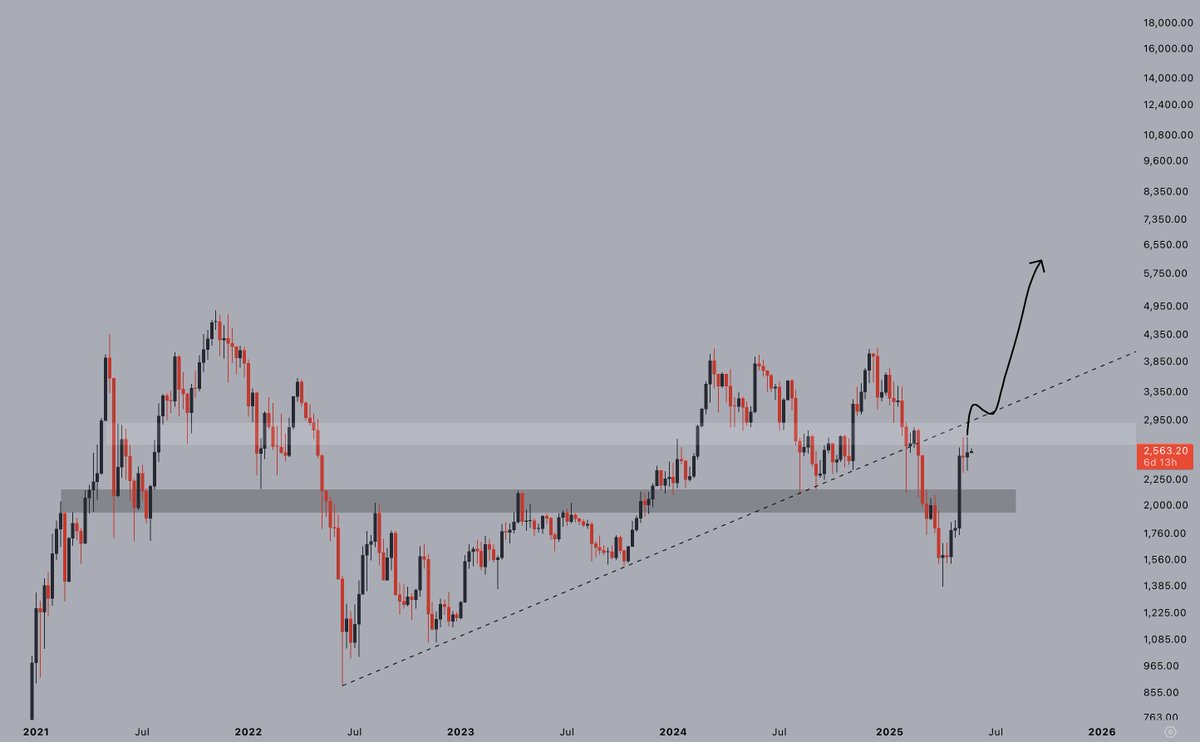

Ethereum is trading above $2,600 after a volatile stretch that regained momentum and pushed prices into a major resistance zone. Recent rebounds have brought new optimism to the market. Still, progress remains uncertain as analysts warn of possible retrace before a massive breakout takes shape.

Over the past few days, ETH has shown strength, bounced back local support and regained a short-term moving average. This move shifted emotions, but it wasn’t enough to completely escape the risk of short-term pullbacks. Some market watchers argue that a healthy setback from current levels will become normal before sustainable gatherings beyond resistance.

Top Analyst Gel has added to the conversation to simple but persuasive insights. “If ETH exceeds $3,000, real fun begins.” The $3,000 level serves as a psychological and technical barrier throughout this cycle, and by recapturing it, it could ignite the momentum of the wider market.

Ethereum leads the altcoin as $3,000 becomes a vital battlefield

Ethereum has shown significant strength among Altcoins, leading the market with new momentum as the Bulls continue to push for a new bullish stage. After regaining the $2,600 level, ETH has steadily built support and gained traction, setting the stage for what many analysts believe will mark the beginning of a wider Altcoin revival.

However, for a true AltSeason to come to fruition, Ethereum must first collect and retain it above the $3,000 level. This threshold is more than just a psychological milestone, and has historically served as a pivot for powerful gatherings across the market. Many experts agree that ETH needs to break through this resistance, confirm leadership and spark trust across the Altcoin sector.

Hope remains high, especially among analysts looking at Ethereum following the Bitcoin lead. Some believe that as BTC continues to test its all-time highs, capital will spin into ETH and other large altcoins as the current bullish impulse cools down. This turnover could serve as an ignition point for market-wide gatherings.

Jelle supports this view, saying that once Ethereum recovers $3,000, there will be a bullish impulse. According to his analysis, a confirmed breakout above this level marks the start of a strong continuity phase and will likely send ETH quickly to more than $3,400.

Until then, Ethereum remains in a critical position and is sturdy enough to lead, but still faces critical resistance. If the Bulls maintain momentum and get back $3,000 after being convicted, the stage will be set for the full-scale alter season of the entire market, not just Ethereum’s next leg. The next few days could prove decisive.

ETH integrates SMAs for less than 200 days

Ethereum (ETH) is currently trading at $2,634 on its daily charts, with 200-day SMA consolidating just under its main resistance zone of $2,699.60. After a sharp rise in early May, the ETH entered a lateral structure, with the Bulls defending the $2,500-2,600 zone and attempting to surpass the $2,700 level. Price actions often indicate tightening ranges, which are precursors of breakouts or failure.

ETH is held above the 34-day EMA ($2,513) and all short-term moving averages (50- and 100-day SMA), indicating that bullish momentum remains intact in the short-to-medium term. The fact that Ethereum is consolidating beyond key support levels rather than sharply correcting is a constructive indication of the bull.

At this stage, the volume remains relatively stable, suggesting that neither buyers nor sellers are yet to be fully committed. Clean daily closures beyond the 200-day SMA with volume can trigger the next bullish impulse, targeting psychological $3,000 levels.

However, if you don’t break the resistance, you could end up with a temporary pullback towards a support area of $2,450-$2,500. Ethereum has been bullish for now, but it needs confirmation to maintain its ongoing continuity. Future days will be important in defining the next directional movement of ETH.

Dall-E special images, TradingView chart