- Ethereum prices are close to key trend lines and could bounce or slice $1,800 high.

- The whales have purchased 449,000 ETH, reducing the exchange balance.

- The $1,670 and $2,000 levels seem important to see if prices are bullish or fall further.

Ethereum (ETH) shows signs of significant strength despite continued bear market pressure. Recently, on-chain data shows that long-term investors still hold 449,000 ETH while they still suffer losses, indicating confidence in ETH’s further growth. In line with the trend of users moving assets off the exchange and holding them in their personal wallets, the exchange reserves fell further to an ETH of 19.1 million.

Source: Cryptoquant

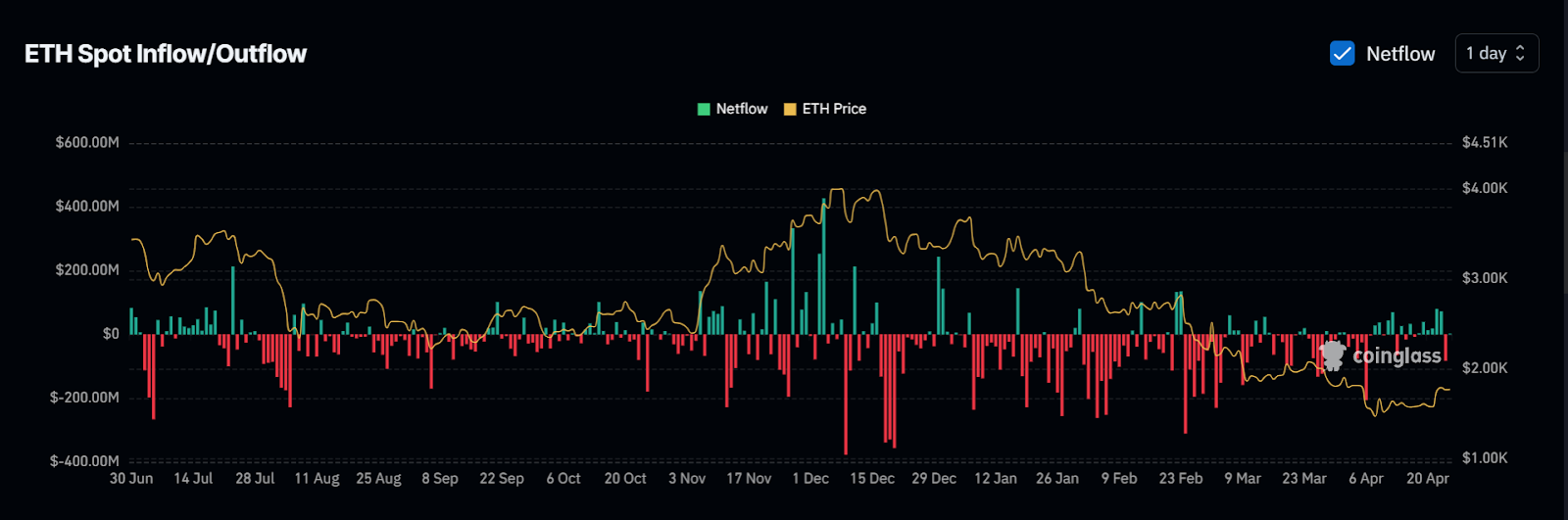

Netflows, on the other hand, remains largely negative. Data obtained from Coinglass reveals that ETH has recorded more outflows than they have since February. A sustained spill can accumulate on the buyer’s side, meaning ease of sales pressure and increase price rebounds.

Source: Coinglass

However, trading volumes have fallen by 19.18% over the past 24 hours, indicating a decline in short-term demand. At the time of writing, ETH traded at $1,775.60, an increase of 1.12% over the past day. Last week, it won 12.12%, increasing its market capitalization to $214.3 billion.

Important levels to monitor: $1,895 resistance and $1,540 support

Various technical analysis reveals a critical zone of resistance close to $1,895, with a level of extremely high $2,142 for further development that could have a bullish impact on mass Ethereum. The Bollinger Bands show that Ethereum is in the process of crossing the top of the midline, but has not yet been determined. The RSI is close to 53.7,9, so neutral momentum is required while targeting hostile breakouts past 60. This could indicate short-term continuance.

Source: TradingView

According to trader Donald, ETH should regain $2,000 in support to verify the larger turnaround. He identified $1,670 as the current short-term pivot, suggesting that he was bearish to not hold it beyond this level. If the price falls below impulse degradation at $1,540, a bearish pattern appears to disprove the current structure.

Source: x

Popular trader Crypto Caesar also noted that assets are in regions where assets may be set up to undergo bullish breakouts through long-term descending trend lines. I’ll read the tweet, “$eth is about to break out. You need a really high height…”

Source: x

On-chain activity signals show mixed emotions

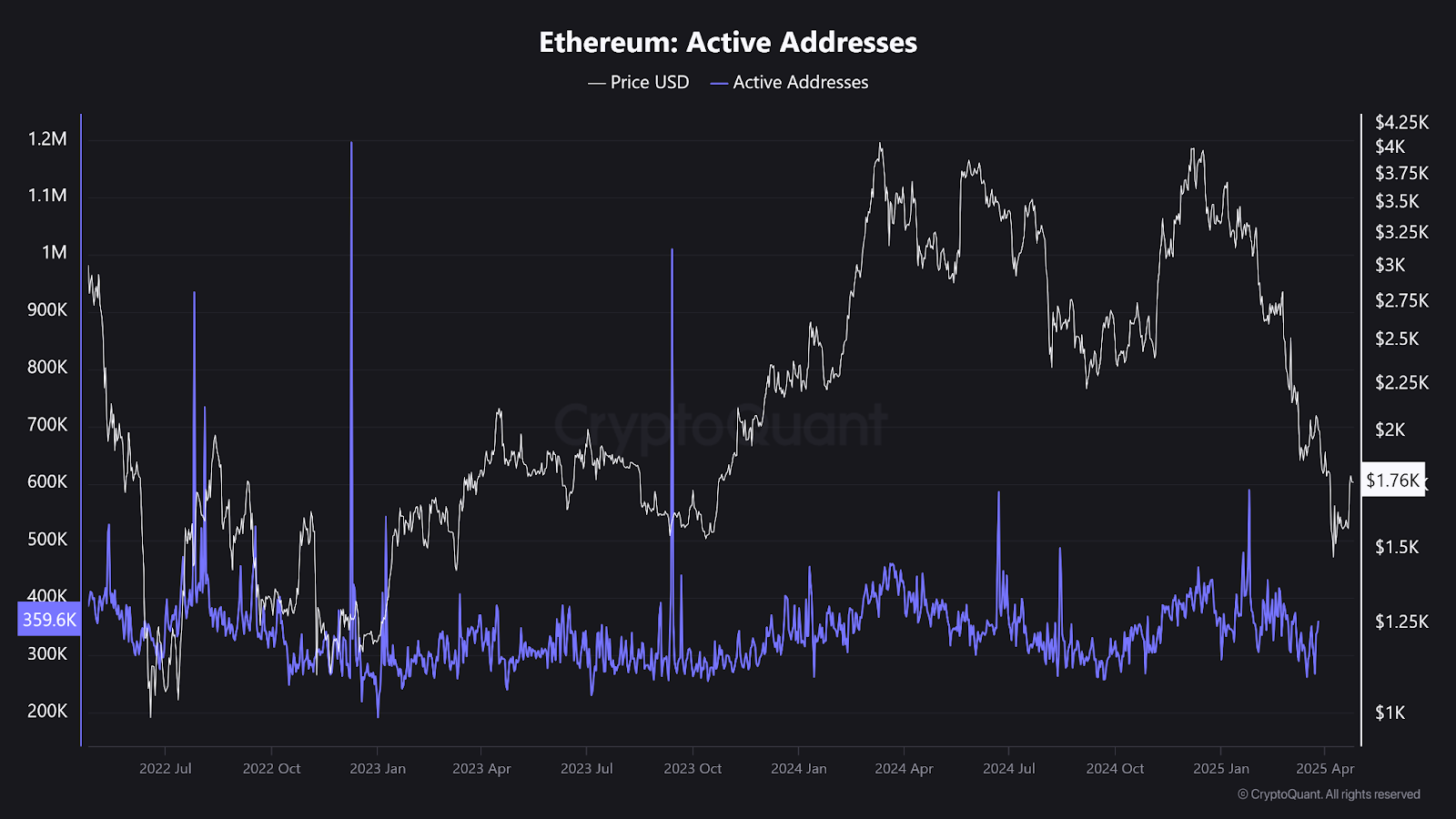

Ethereum’s active address and transaction count data tells a subtle story. The active address is about 359,600 hoverings, which still has a pattern with no increase. This means that user engagement is more or less stagnant while prices are rising.

Source: Cryptoquant

The total number of transactions is approximately 1.3 million per day. Therefore, overall Ethereum use remains continuously high even within bearish domains. It’s not at the bull market level, but it’s far above the low point at the bare market level.

The downtrend for replacement further strengthens the signal and suggests that more ether is being withdrawn from the exchange wallet, which broadly implies accumulation. These reserves have reached 30 million since 2022, and have been halved to about 19 million since 2022, a 37% decline over two years. These suggest that there is generally resistance among investors to sell securities in the market.