After weeks of intense sales pressure and persistent negative emotions, Ethereum finally shows signs of life. The bull is trying to regain important price levels and reverse the bearish trends that have defined the past few months. Despite the renewed momentum, ETH remains below the key $2,000 mark. This is the level that must be violated to see meaningful changes in the market structure and set a stage of sustained recovery.

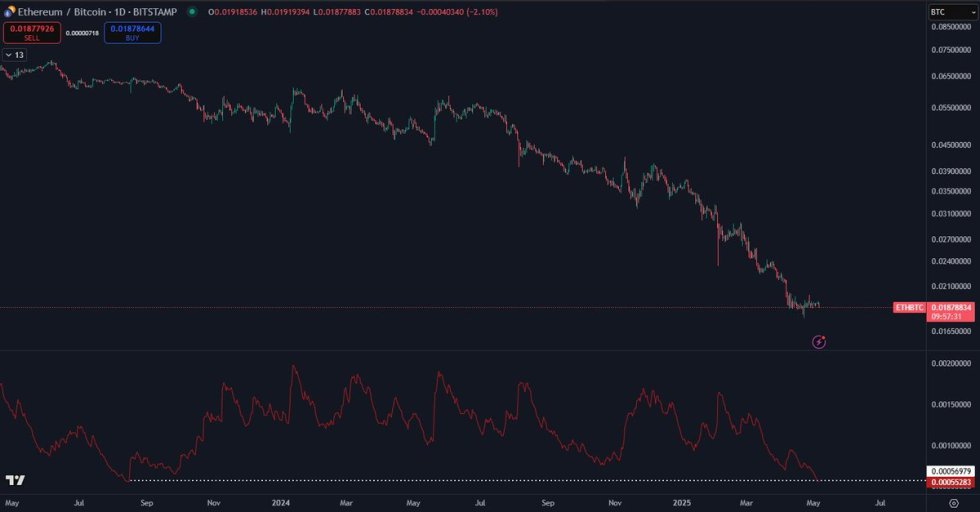

As traders evaluate Ethereum’s outlook, attention is also being paid to the ETH/BTC ratio, which has reached its lowest volatility level in more than two years. The metric has been on a long-term downtrend, but has now stagnated for more than a month, according to top analyst Dern. Historically, these low volatile periods often precede sharp movements as markets put pressure on them and prepare for breakouts and breakdowns.

Although Ethereum’s prices remain technically vulnerable, the combination of reduced volatility, long-term support for the ETH/BTC pair, and a new bullish momentum on the USD chart creates a carefully optimistic setup. As a resistance to ETH testing, the upcoming days are extremely important. A confirmed breakout of over $2,000 could be a signal that Ethereum’s next leg is getting higher.

Ethereum is below $1,900 due to risk and uncertainty dominating

Ethereum faces new pressure as it didn’t break beyond the $1,874 high set on May 1, leaving the bull with the urgent challenge of regaining momentum before volatility takes over. Assets currently trade close to critical support, but as the global market remains vulnerable, it is not possible to establish a clear direction. As Ethereum is still down more than 55% from its December high, the bearish price structure remains intact, and any further weakness could cause a deeper downside.

Market volatility is especially driven by macroeconomic uncertainty, as the US and China continue to engage in high-stakes trade negotiations. Investors are cautious, and the inability of Ethereum to show strength amid the broader crypto recovery has sparked concerns about its upcoming outlook.

In addition to complexity, Daan emphasizes that the ETH/BTC ratio is at the lowest volatility level in over two years. The ratio is on a long-term downtrend, but has been stagnant for the past month, suggesting a breakout (or breakdown) may be approaching.

Historically, such periods of compression often precede sharp movements. However, Daan points out that the trend in the low time window has not yet turned bullish, and until that happens, any assembly must be treated with caution. For now, Ethereum remains at Limbo.

Price Action Details: ETH Test

Ethereum is trading at $1,831 and shows modest strength after bounces from recent support of nearly $1,780. On the four-hour chart, ETH is trying to establish a higher and lower, recovered bullish momentum, but faces stiffer resistance than $1,874, which is $1,874 high, from May 1st. Prices combine $1,787 and 200-period SMA just above the 200-period EMA at two levels that served as a dynamic support and resistance zone throughout the recent trading sessions, with $1,699.

This landscape action emphasizes indecisiveness as ETH struggles to be released from its range, volatility compressed and volume remains muted. A clean breakout of over $1,874 could mark the start of a bullish leg targeting the psychological $2,000 mark. However, if you do not exceed $1,780-$1,750 and beyond $1,780-$1,750, the structure can be disabled and the door can be further downsided.

Technical indicators suggest that momentum has been built but has not yet been confirmed. The broader bearish trend remains in play until Ethereum regains its $1,900-$2,000 range. For now, ETH is in a critical zone where both bulls and bears are sued, and the next few sessions will be crucial in determining whether Ethereum will continue to recover or resume the downtrend.

Dall-E special images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.