According to data, the US Ethereum Spot ETF has just seen its biggest influx date, driven primarily by BlackRock and fidelity demand.

Demand for Ethereum SpotETF is rising sharply

July 16 was a big day for the US Ethereum Spot ETF, according to data from Farside Investors. Spot Exchange Trading Funds (ETFs) refer to investment instruments that allow investors to be exposed to assets without directly owning them. In the case of cryptocurrency, this means that ETF holders do not need to manage their digital asset wallets or navigate exchanges. For traditional investors, this fact can make Spot ETFs a convenient way to explore the market.

The Ethereum Spot ETF received approval in the US almost a year ago. Demand has been varied since then, but recent assets have fallen into a positive trend inflows, with the latest figures only increasing momentum.

Below is a table showing how Netflow has seen it over the past few weeks related to various Ethereum Spot ETFs.

Looks like BackRock's ETF has consistently led in terms of inflows | Source: Farside Investors

As visible as it is, the US Ethereum Spot ETFs have already had a notable daily influx of over $200 million over the past week, indicating strong demand from institutional organizations, but on the latest record-breaking day things are clearly pushing into even higher gear.

BlackRock’s ETHA saw its biggest inflow on July 16th at almost $500 million. Fidelity’s Feth was the distant second, buying around $133 million in cryptocurrency on behalf of its users. Capital saw a breakout of over $3,000, earning $3,400 for the first time since January.

Following the rally, institutional investors are not only paying attention to ETH as data from analytics firm Santiment shows a surge in retail profits.

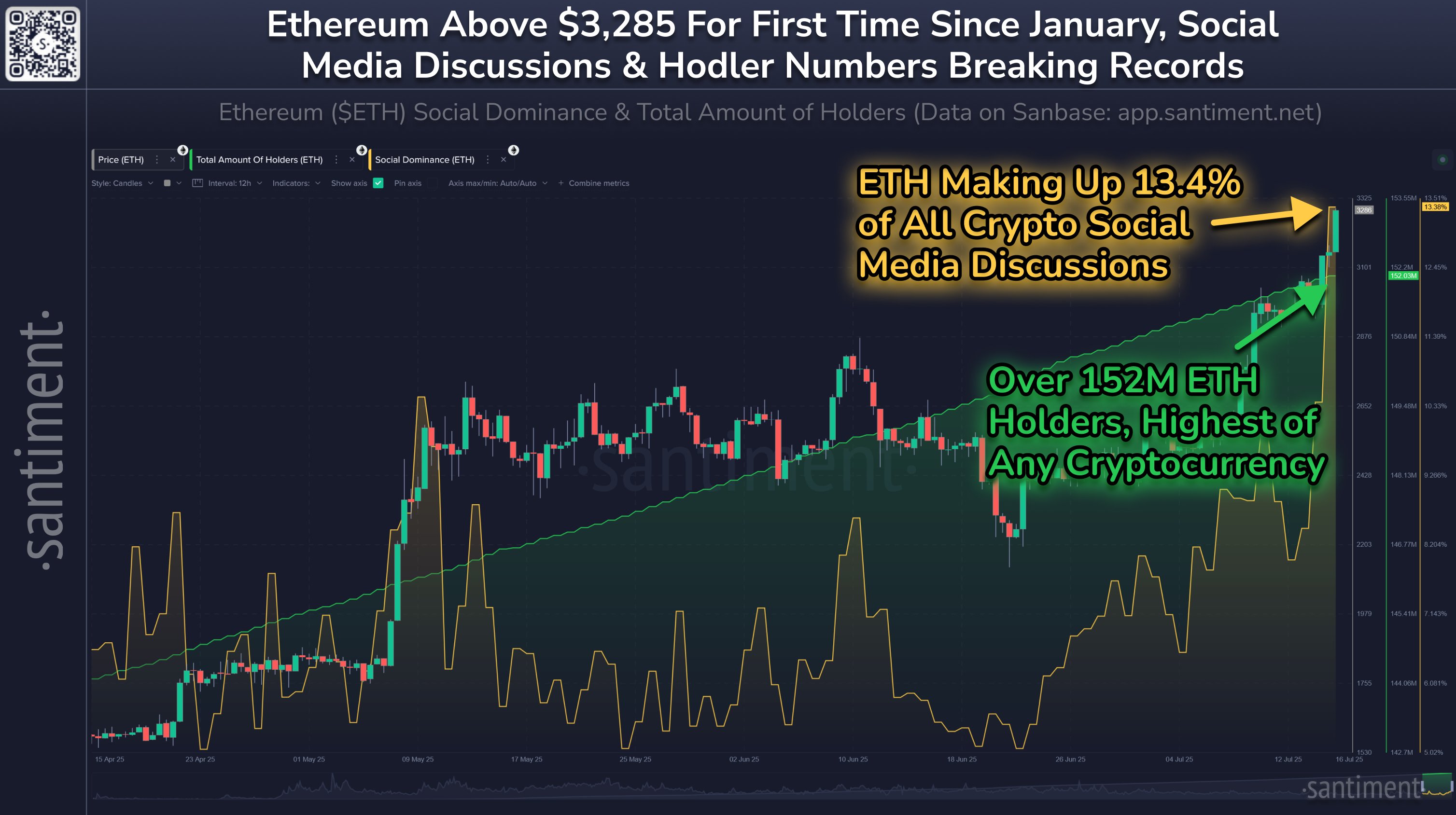

The trend in the Social Dominance and Total Amount Of Holders for ETH over the last few months | Source: Santiment on X

In the chart, Santiment attaches data on social domination. This is an indicator that tells us about the discussion share Ethereum occupies on major social media platforms compared to other cryptocurrencies.

This metric reflects small hand behavior as retail investors far outperform larger holders in terms of numbers. From the graph, it is clear that ETH’s social domination saw a huge surge along with price surges, with 13.4% of all digital assets debates on social media that coins are currently involved.

Obviously, retailers are now paying attention to assets, but this trend can be kept an eye on as historically exaggeration among crowds tends to not end well with cryptocurrencies.

ETH Price

At the time of writing, Ethereum traded around $3,400, up over 23% last week.

The price of the coin appears to have sharply been going up | Source: ETHUSDT on TradingView

Featured images from charts on Dall-E, santiment.net, and tradingview.com

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.