- Investors in BlackRock and Fidelity Ethereum ETFs are currently down more than 21% as ETH is far below entry prices.

- Since May 16th, ETF has recorded an inflow of $435.6 million for nine consecutive days despite losses.

- Ethereum has not yet been integrated beyond $3,000, but institutional demand is much higher.

Ethereum ($ETH) is struggling at under $2,650, but most ETF holders are still deeper into red. GlassNode recorded an average cost base for BlackRock and Fidelity Ether ETFs of $3,300 and $3,500, respectively. ETH is currently trading at $2,621 and has acquired a total unrealized loss due to over 20% due to price adjustments.

The average eat ETF investor is suffering from heavy losses.

According to GlassNode, the average cost bases for ETF investors are 3.3K and $3.5,000 for BlackRock and Fidelity, respectively.

Do they have a chance for this cycle? pic.twitter.com/svqvamsfrc

– Coin Bureau (@coinbureau) May 30, 2025

However, my feelings have changed over the past two weeks. Geopolitical tensions and US tariffs have encouraged long-term sales from ether, but cryptocurrencies rose 44% from their annual low of $1,472 in April.

The nine consecutive ether ETFs that began on May 16th also attracted attention for $435.6 million. The influx followed a US federal court decision to block most of Trump’s import duties on extreme macro pressure on the crypto market.

But nonetheless, GlassNode analysts pointed out that ETFs rarely affect spot prices. At the time of release, the product accounted for only 1.5% of the trade volume, and in November 2024 it was reduced to 2.5% before fading.

However, institutional investors don’t jump in a hurry. This slimy response is suggested, especially to track previous breakaways in August 2024 and the first quarter of 2025. Since its launch, the cumulative intrusion of the Ethereum ETF has reached $2.94 billion, giving the institution’s appetite a true taste.

Market structure shows potential

According to Crypto Caesar, Ethereum escaped from a long-term downtrend in early May after seeing changes in market structure (MSS). After the breakout, ETH cleared many resistance zones and reached new support for $2,485.52. Currently, analysts are looking for continuity patterns set with higher bass surrounding key levels.

Technical indicators further support bullish bias. Sustainable demand pushes RSI near growth in nearly 66 acquired territories. With a potential bounce from the $2,487 support, we can see market test levels around $2,880, followed by $3,200.

Source: Trading View

Ethereum’s further success in regaining the $3,000 mark will encourage updated ETF purchases that could help institutional investors wipe out paper losses. If current support is not retained, you could collapse below $2,300.

On-chain metrics highlight tough supply

According to Cryptoquant Exchange Reserve data, the exchange’s Ethereum balance is still deleted. As of May 30th, the number of ETHs held on the centralized platform is 19.5 million, after surpassing 30 million earlier this year. This long-term drawdown shows that there is less sell-side pressure as most investors grow with confidence in their independence.

Source: Cryptoquant

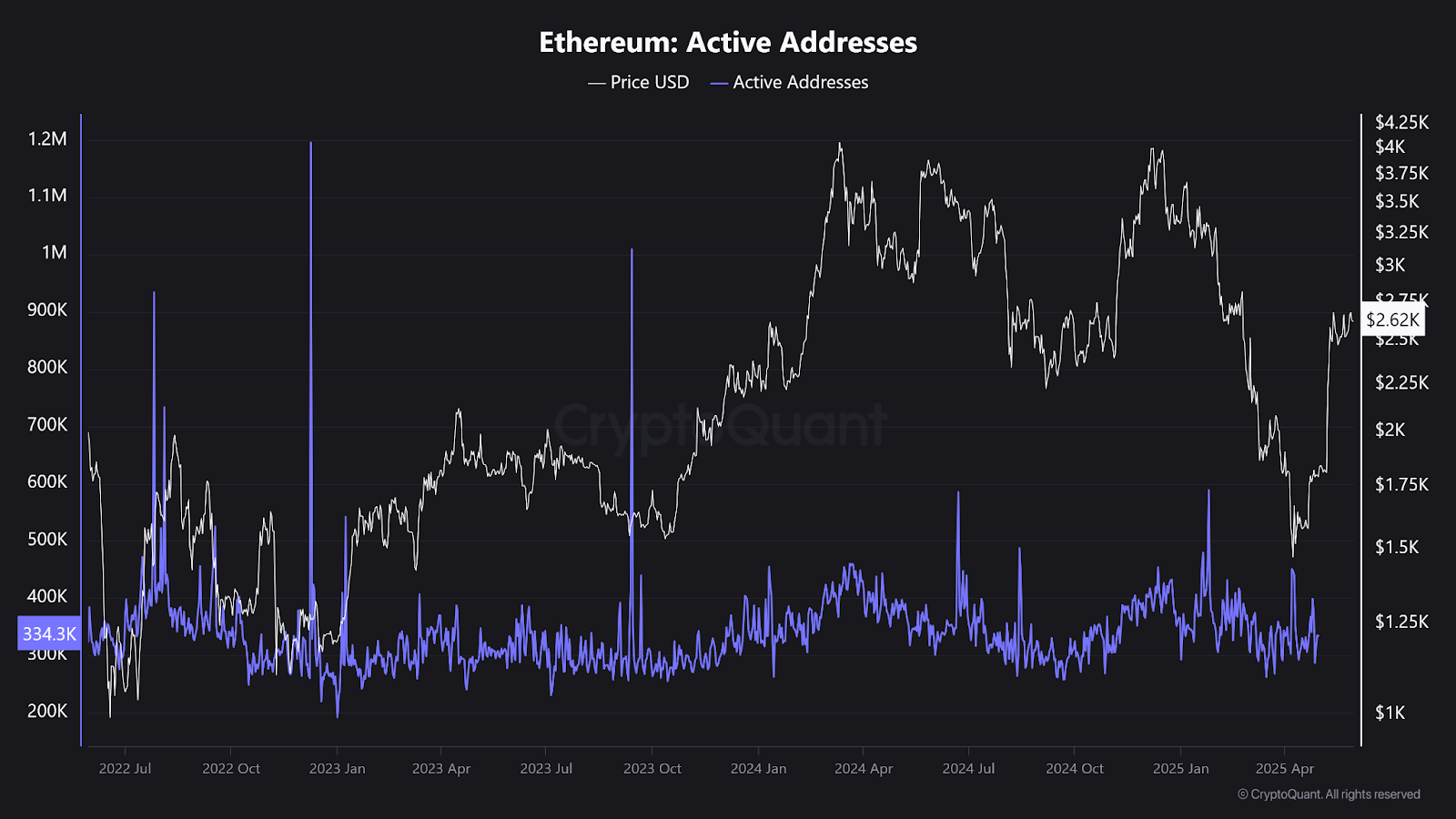

Meanwhile, the active address count has dropped to 334,000. This is a level that has not been seen since early 2023. This DIP may indicate a lull in retail activity, but it follows the current market structure where ETFs dominate when institutions buy in large quantities and have few addresses.

Source: Cryptoquant

Open interest on Ethereum Derivatives rose to $35 billion, up 8.8% last week. Coinglass said the positive funding rate indicates that most traders have taken long positions. According to options data, retailers are hoping to push prices this month to $3,000, while institutional players hope to take it to $3,500 by June.