The major Altcoin Ethereum has remained in range since Tuesday, offering inactive performance over the past four days.

However, institutional investors seem to be barely surprised by this price stagnation. On-chain data shows that exposure to AltCoin continues to increase.

Ethereum etf weekly inflow surge 400%

After President Trump announced the Israel-Iran ceasefire on Monday, the market rebounded after seeing some easing from last week’s sale. That day, ETH recorded an 8% daytime rallies.

However, its prices have since moved mostly sideways and have not been able to erupt clearly in either direction. Interestingly, amid this lukewarm performance, institutional investors remain resilient.

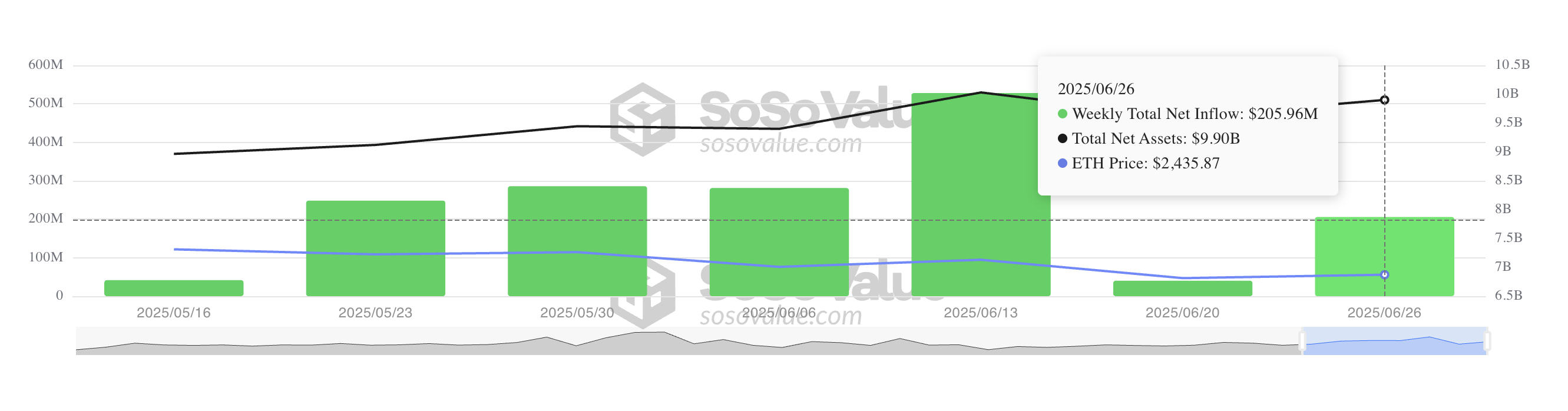

According to Sosovalue Demand for ETH exchange funds is rising rapidly this week. The weekly inflow into these funds is $206 million at the press conference.

All Ethereum spot ETF net flow. Source: SosoValue

At the time of this writing, the latest daily figures have not yet been recorded, but the cumulative net inflow for the week was over 400% higher than the total of $40.24 million last week, indicating a sharp rise in institutional appetite.

This surge in ETFs shows professional investors are positioning themselves for potential benefits, betting that ETH could recover strongly in July.

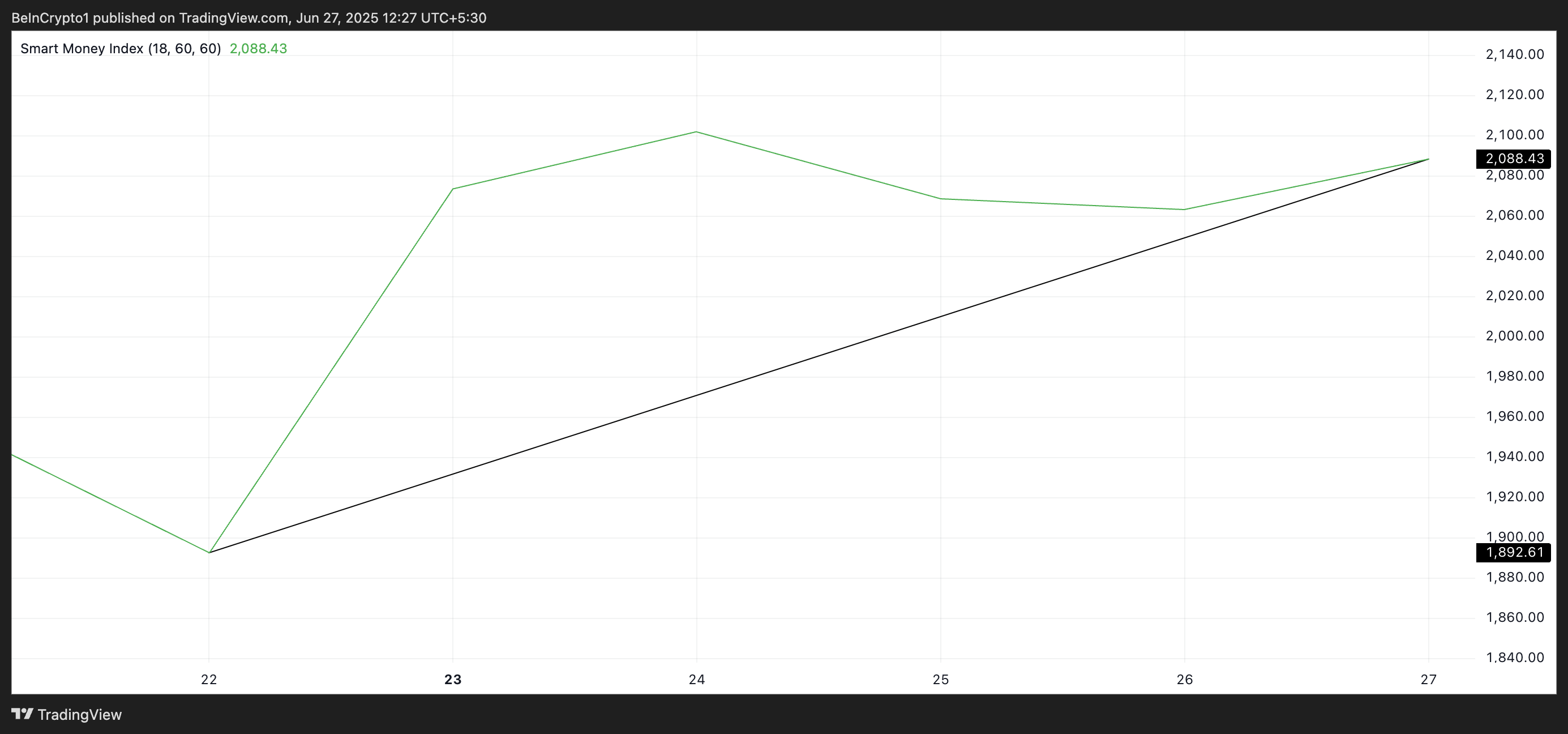

Additionally, ETH’s Smart Money Index (SMI) rose this week, confirming the growth of bullish bias against major Altcoin. At the time of press, the metric tracking trading activities of key market participants was 2,088, up 1% since Monday.

ETH SMI. Source: TradingView

The increase in SMI in ETH coincides with a surge in ETF inflows, reinforcing the growing bullish sentiment among sophisticated investors.

Ethereum’s fate depends on new demand

The combination of rising ETF inflows, smart money accumulation and a broader market recovery could help ETH escape from the current stagnation that marks July.

If Altcoin sees a resurgence in demand in the coming days, its price could rise to $2,569. This violation of resistance could send coins to $2,745.

ETH price analysis. Source: TradingView

However, once demand craters and the Bears regain control, ETH prices could be breached by the downside and drop to $2,185.