The major Altcoin ETH has been bucking the broader market slump over the past 24 hours, recording a modest profit of around 1%. At press time, the coins trade for $1,842.

This comes as the main momentum metric (relative to Taker’s shopping and sales) to the highest level in 30 days.

Traders look upwards at ETH as they buy pressure and builds

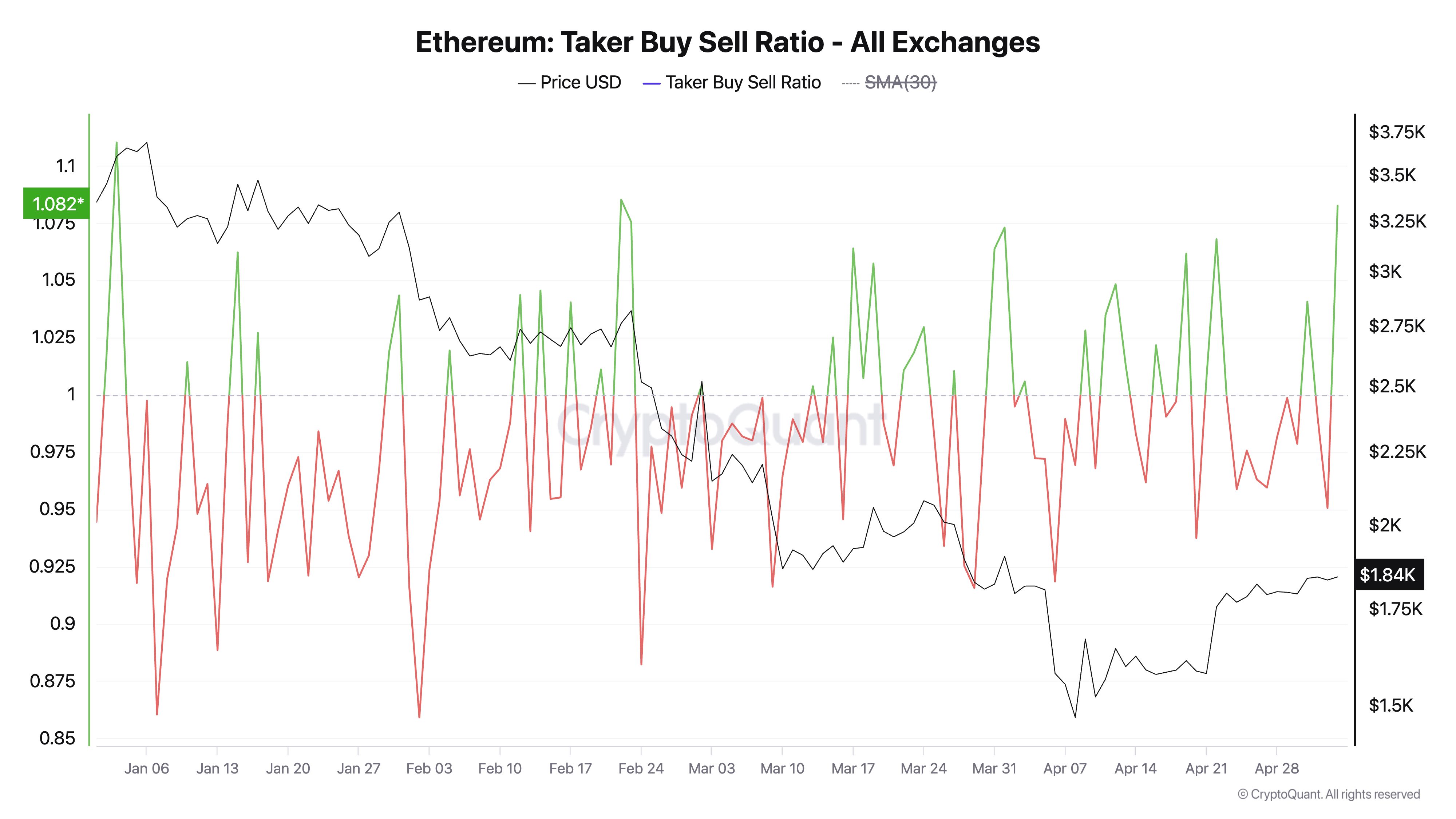

According to Cryptoquant, Eth’s Taker-Buy-Sell ratio is currently at 1.08, the highest since early April.

Ethereum Taker buying and selling ratio. Source: Cryptoquant

This metric measures the ratio of ETH’s futures market buying and selling. Values above 1 suggest that more traders are buying ETH contracts more aggressively than selling, while values below 1 indicate dominant sales pressure.

At 1.08, ETH Taker’s shopping and sales ratio is clearly leaning in buyer favor, reflecting an increase in confidence among traders that prices could continue to rise.

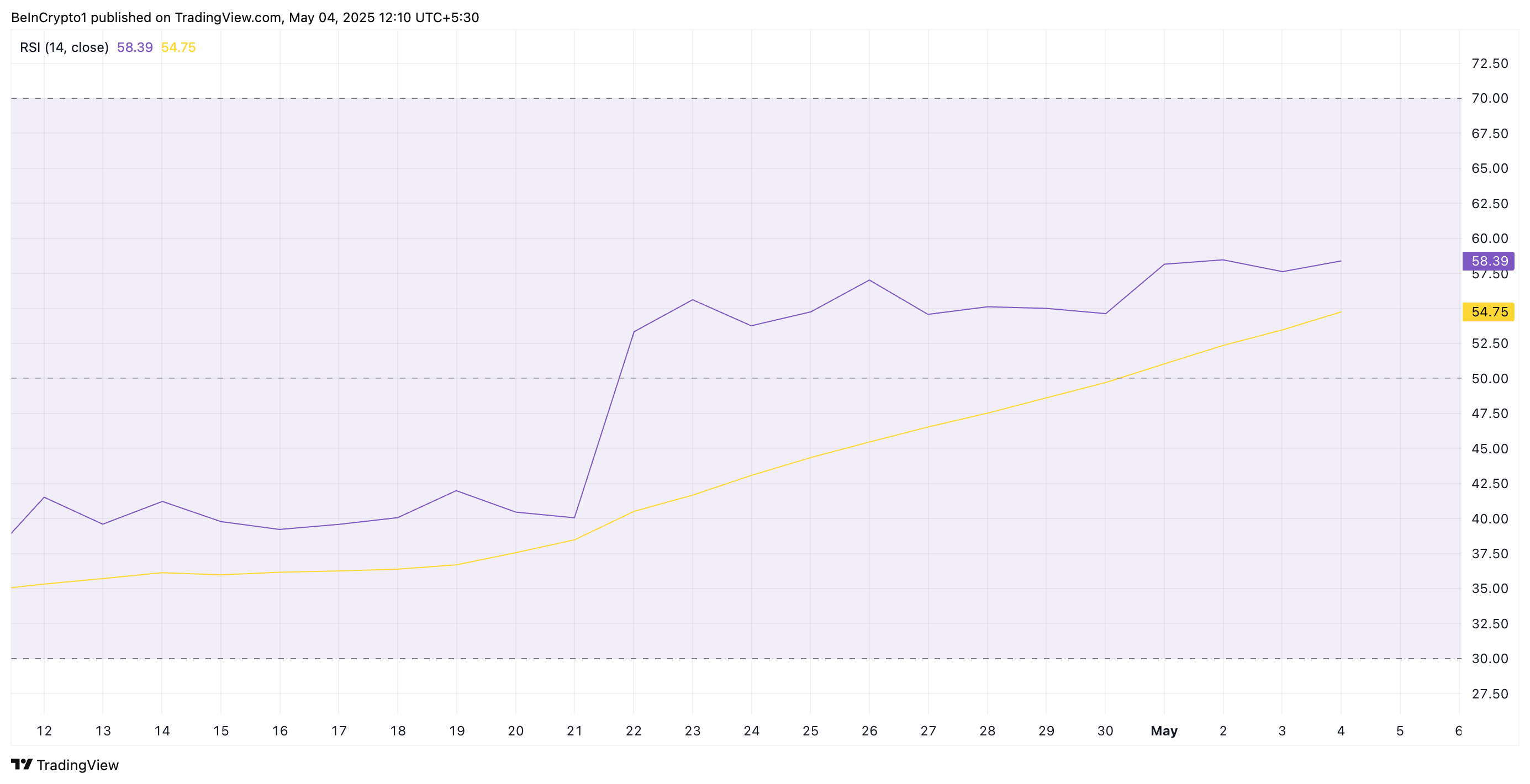

Furthermore, Altcoin’s relative strength index (RSI) continues to increase in favor of this bullish narrative. During the press, the mountain climbs at 58.39.

Ethereum RSI. Source: TradingView

The RSI indicator measures the market conditions for asset acquisitions and overselling. It ranges from 0 to 100, with values above 70 indicating that assets are being acquired in excess and are expected to decline. Conversely, values under the age of 30 indicate that the asset is being sold too much and can witness a rebound.

ETH’s RSI reading confirms the strengthened bullish bias against Altcoin and reinforces the view that it can benefit further.

ETH builds strength beyond short-term support

At current prices, ETH is above the 20-day index moving average (EMA), forming a price below $1,770.

The 20-day EMA measures the average price of assets over the last 20 days, giving weight to recent prices. When assets trade above this important moving average, they show short-term bullish momentum. This shows that recent prices have been higher than the average for the past 20 days. Traders often view this as a sign of underlying strength or early uptrends.

So, ETH can keep the rally towards $2,027 when it gains momentum when purchasing pressure.

Ethereum price analysis. Source: TradingView

Meanwhile, if purchasing activity is waning, the coin could lose its recent profits, falling below the 20-day EMA and reach $1,385.