Ethereum (ETH) has grown more than 10% over the past seven days as the market shows signs of new activity. However, key technical indicators reveal a mix of strength in trends from buyers and weakening of careful optimism.

ETH is currently fighting a critical zone of resistance that can define whether the rally will continue or fade. With momentum still vulnerable, it could be a decisive month for Ethereum’s next major move.

Ethereum trends weaken sharply when bears are nearby

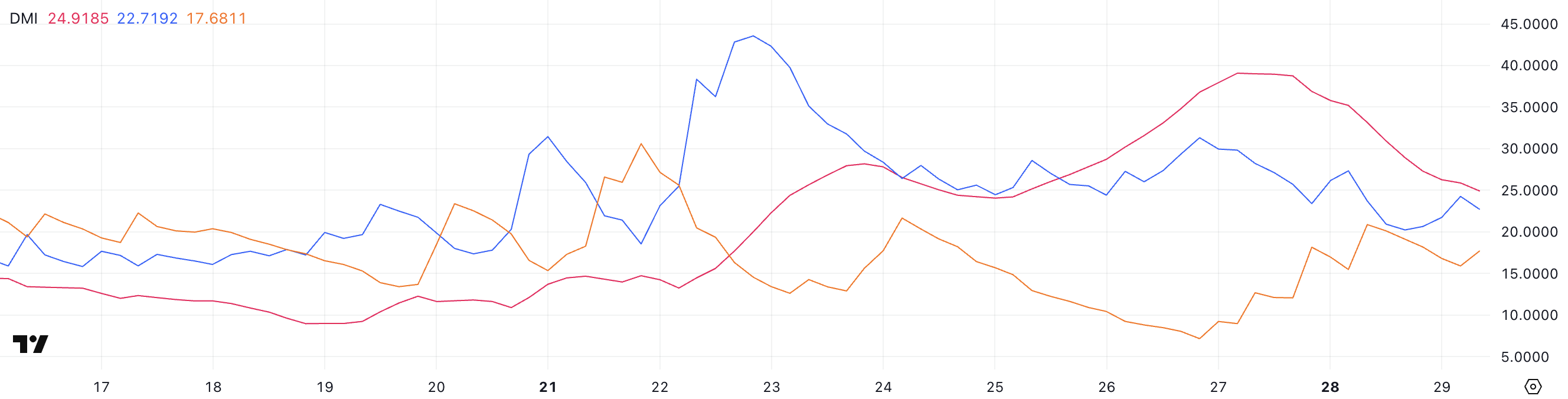

Ethereum’s DMI chart shows ADX is currently at 24.91, a sharp drop from 39 two days ago. ADX, or the average directional index, measures the intensity of a trend, whether rising or falling.

In general, ADX reads above 25 show a strong trend, while values below 20 suggest that the market is in a period of trading that is bound to weakness or range.

The sudden drop in ADX indicates that Ethereum’s recent momentum is quickly losing its strength. Without new trading pressures, ETH could remain stuck in a more volatile, horizontal pattern in the short term.

ETH DMI. Source: TradingView.

On the other hand, directional indicators show clear shifts. Tracking bullish pressure +DI fell to 22.71, down three days ago and from 31.71 yesterday, from 27.3.3.

In contrast, -DI rose from just 7.16 to 17.68 from 15.64 three days ago and yesterday. Yesterday, the gap between buyers and sellers was almost closed, suggesting that +DI is 20.91 and 20.1 at -DI, with sellers almost regaining market control.

This weakened momentum and the strength of the trend, which reduces the risk of lowering Ethereum prices, if buyers can’t adhere to critical levels. However, if the Bulls can hold the ground and regain momentum, ETH could still make another attempt at recovery.

ETH RSI climbs after a sharp drop: Will recovery be retained?

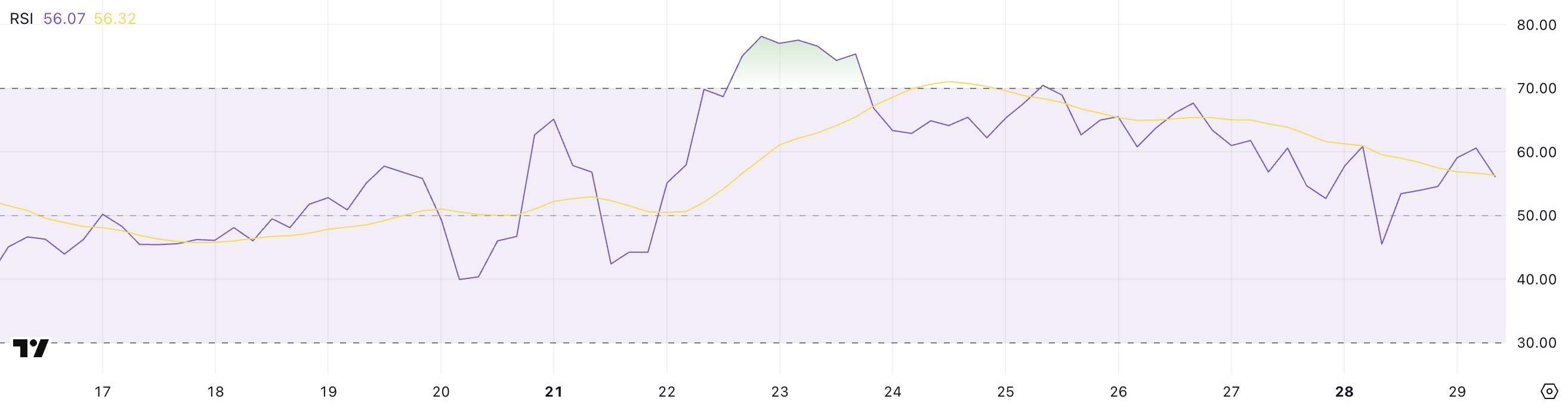

Ethereum’s RSI currently sits at 45.5 to 56 a day ago after reaching 70.46 four days ago. The relative strength index (RSI) is a momentum index that measures the speed and magnitude of price movement.

Typically, RSIs above 70 suggest that assets may be over-acquired and pullbacks may be required, while RSIs below 30 indicate conditions of over-selling and potential rebounds.

Measurements between 30 and 70 are considered neutral, with a level of about 50 often informing the market at decision points. Ethereum’s RSI’s sharp swing over the past few days reflects recent unsettling feelings about ETH.

eth rsi. Source: TradingView.

Once the RSI returned to 56, Ethereum regained momentum after immersing itself in neutral territory. Readings over 50 are slightly bullish, suggesting that buyers have begun to reaffirm some degree of control, although not overwhelming.

If RSI continues to rise towards 60 or later, it could potentially show a new push to the top of ETH prices.

However, once momentum stalls again and the RSI retreats, the recovery will lose steam and suggest that Ethereum can return to a wider integration or correction stage.

Ethereum fights critical resistance when breakouts and breakdowns are on the horizon

Ethereum Price has attempted several attempts over the past few days to break resistance levels for $1,828. If ETH can decisively break and hold this level, you can open the door and increase your momentum.

The next major goal is $1,954, and if bullish momentum remains strong, further rally to $2,104 could be rolled out. Ethereum was able to ultimately test $2,320 with an even more aggressive uptrend, marking a significant bullish expansion.

These levels are key to watching as they can define the strength and sustainability of breakouts over the next few days.

ETH price analysis. Source: TradingView.

On the downside, if Ethereum fails to maintain its current level and the trend reverses, the first important support to watch is $1,749. A break below that could lead to a move to $1,689.

As sales pressures intensify, ETH could further extend the downtrend, with key support levels coming at $1,537 and $1,385.

Losing these levels shows a deeper correction, suggesting that recent recovery attempts are temporary before a longer-term bearish phase enters.