Ethereum’s bullish momentum accelerated this week, pushing Ethereum’s price today to a key $3,000 mark. The rally is supported by sustained breakouts from a declining trend line and clean landfills of previous zones of resistance. At the time of writing, ETH has traded nearly $2,980, marking fresh local highs with bullish continuing signals across multiple time frames.

What will be the price of Ethereum?

ETH Price Dynamics (Source: TradingView)

On the daily charts, Ethereum prices have broken cleanly above the resistance band between $2,715 and $2,750, stabbing a descending trendline that has been rising since early April. This move follows weeks of basic formation and accumulation within the $2,400-$2,600 range.

ETH Price Dynamics (Source: TradingView)

Prices are currently testing the next major resistance, nearly $3,000. This coincides with the $3,081 FIB 0.618 retracement from Swing High in November 2024. The previous supply zone and the break above bullish BO (structure breakage) of over $2,650 strengthens the structural inversion, supported by increased momentum and volume.

The weekly structure confirms this movement. ETH has posted the strongest bullish candle in over two months, collecting FIB 0.5 levels for $2,745, and focusing on the key pivot at $3,081. Above this level, your pass opens at $3,525 (FIB 0.786), and will ultimately reach $4,106 at its 2024 high.

Why are Ethereum prices rising today?

ETH Price Dynamics (Source: TradingView)

The current breakout is driven by both technical momentum and bullish foundations. From the lens of the Smart Money Concept, multiple chocks (character change) signals have been engulfed in bullishness last week. This structural change has led to fresh demand and driven breakouts.

On-chain action reinforces this optimism. Encrypted data shows that the number of Ethereum deposition addresses has dropped to 23,000, indicating a drop in selling pressure. Investors appear to be moving ETH to self-reliance rather than exchange, which has historically been bullish.

Despite a slight increase in the ETH Exchange Reserve (now 18.9m), general market behavior is bullish. The growth of ETH utilities in settlement infrastructure and tokenization, particularly the defi and facility grade financial rail, has added strong fundamental support to this gathering.

Momentum index shows intensity, but look at the divergence of RSI

ETH Price Dynamics (Source: TradingView)

In the four-hour time frame, Ethereum price action remains aggressively bullish. Currently, prices are well above the 20/50/100/200 EMA. The 200 EMA is close to $2,534 and offers dynamic support in the event of a price receding.

The Bollinger bands in this time frame have expanded significantly, reflecting the volatility expansion phase. The current candle structure shows a strong upward aggression, but suggests that Upper Wick will generate a short-term profit of nearly $3,000.

ETH Price Dynamics (Source: TradingView)

The 30-minute chart shows that the RSI has cooled slightly from 69 to about 60, suggesting a temporary momentum pause. However, while MACD remains above neutral, MACD shows a flat histogram after the early bullish cross, indicating integration rather than immediate reversal.

Long-term structure: Ethereum approaches the vertex of a multi-year triangle

ETH Price Dynamics (Source: TradingView)

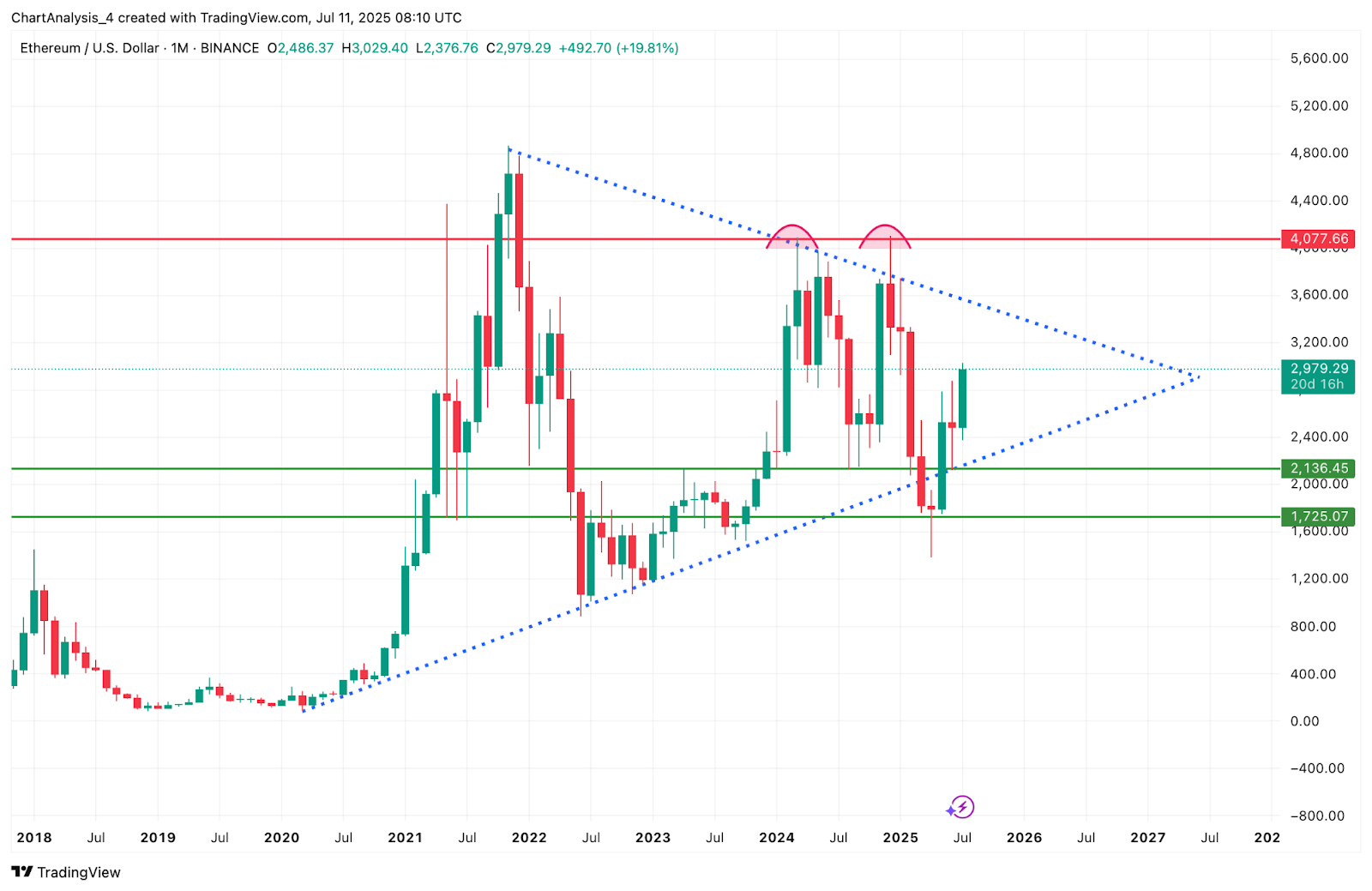

In the monthly time frame, Ethereum prices are currently trading near the vertex of a multi-year symmetrical triangle. This pattern has been formed since 2022, with clear compressing lower highs and higher bass towards convergence. Today, Ethereum prices are $2,979, just below the upper limit of this formation.

This compression zone is important for long-term price action. A breakout seen above a falling blue dotted resistance could indicate the onset of a new macroup trend. Meanwhile, a denial near this level could extend integration, with support at $2,136 and then $1,725 as the main downside buffer of $1,725.

Of note, the $4,077 level, a double-top pattern formed around the main zone of resistance. When Ethereum’s price action surpasses the triangle and regains $3,200-3,500, the $4,077 neckline becomes the ultimate bullish confirmation level, disabling the previous top heavy setup.

This macro pattern is essential. Not only is Ethereum gatherings in the short term, it is approaching a structural inflection point that allows it to define the rest of the direction from 2025 onwards.

ETH Price Forecast: Short-term Outlook (24 hours)

ETH Price Dynamics (Source: TradingView)

As ETH is approaching the psychological $3,000 level, traders should monitor bands between $2,945-$2,965 for potential support retests. The successful hold here could trigger pushes above $3,081, covering $3,200 and $3,525 (FIB 0.786).

If a short-term denial occurs, support is $2,800, followed by a breakout zone of nearly $2,715. Losing these levels could potentially invalidate breakouts, especially if prices fall below $2,650 again.

Given the bullish SMC confirmation, strong EMA alignment, and bull market sentiment, ETH remains ready to continue.

Ethereum Price Prediction Table: July 12, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.