Today’s Ethereum Price trades around $4,298, integrating the interior of the 4-hour chart tightening symmetrical triangle. Support is nearly $4,250 and resistance is $4,370. This means that the ETH is at a key point where it could break or even descend.

Ethereum prices are compressed in a triangular structure

ETH Price Prediction (Source: TradingView)

The Ethereum Price Action shows a repeating defense of the $4,250 zone. In this zone, 200 Emmas are consistent with trendline support. Overhead, 20 Emmas, close to $4,312, and 50 Emmas, around $4,351, will keep the cap down and create a narrow trading range.

Related: Dogecoin (Doge) Price Forecast: Rising ETF Odds Spark Bullish Moment

The RSI is close to 46, meaning there is a low momentum and no clear direction. If a buyer pushes prices above $4,370, the next goal is $4,500 and $4,700. If the price does not exceed $4,250, if sales pressure is picked up, the price could drop to $4,100, potentially $3,900.

Analysts compare cycle patterns with Bitcoin

$eth is doing exactly what $BTC did its final cycle.

However, Bitcoin received a 20% correction after hitting the previous ATH.

This means that Ethereum can lower the level from around $3.8k to $3.9,000 before the new ATH. pic.twitter.com/jxemwj09qz

– Ted (@tedpillows) September 6, 2025

Market strategist Ted emphasized that Ethereum reflects Bitcoin’s past cycle structure. He noted that Bitcoin had revised nearly 20% after hitting an unprecedented high before resuming the uptrend. That logic allowed Ethereum to launch towards a new high before retesting the $3,800-$3,900 range.

This cycle-based analysis gives attention to traders who are immediately betting. The weekly chart shows ETH is approaching the multi-year wedge limit, with the $4,300-4,400 zone as a key pivot for long-term positioning.

Attention from leak signal investors

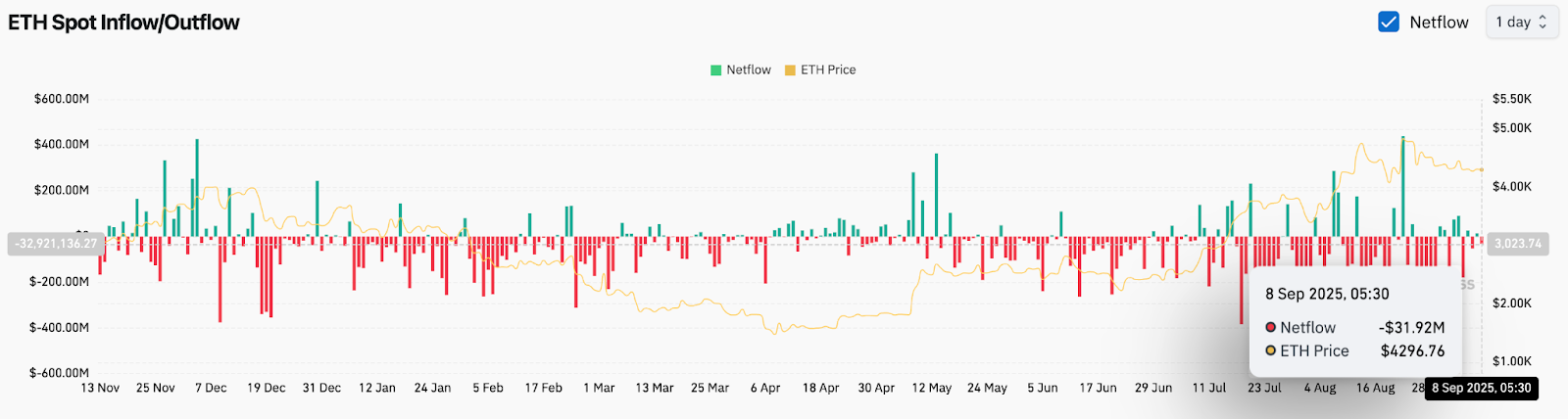

ETH Netflows (Source: Coinglass)

On-chain data shows $31.9 million left the network on September 8th. In other words, holders are keeping ETH away from the exchange. While sustained outflows can mean accumulation, short-term meetings can mean less liquidity.

Since late August, spot flow has been unstable due to alternating bursts of inflow and outflow. With more than $550 million inflows still not maintained, analysts warn that ETH may be short-term and critical breakout fuel short-term.

Related: XRP (XRP) price forecast for September 9th

Technical outlook for Ethereum prices

The key resistance is $4,370, followed by $4,500 and $4,700. Support levels will be $4,250 and $4,100, with deeper risks towards $3,800 if the seller regains control. RSI and EMA clusters emphasize the compression stage, suggesting the volatility expansion is imminent.

A confirmed breakout of over $4,370 will intensify bullish convictions, and losing $4,250 could result in an extension of consolidation or a correction.

Outlook: Will Ethereum rise?

Ethereum’s short-term trajectory depends on whether buyers can defend $4,250 while overcoming a resistance of nearly $4,370. Analysts remain divided, and cycle comparisons refer to possible corrections, but broader adoption trends supporting long-term Bull cases.

As long as the ETH is above $3,800, the structure supports the ultimate benefit. September will allow traders to closely monitor volume checks in breakout attempts, as Ethereum can decide whether to gather towards $5,000 or retrace it before reopening uptrends.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.