Today’s Ethereum prices trade at around $2,528, reflecting a mild daytime rise after consolidating most of last week. However, ETH continues to trade within deadlines, putting pressure on resistance in the $2,580-$2,600 zone and supporting nearly $2,500, so the Bulls remain cautious. The low Ethereum price volatility during this period suggests that breakouts may be approaching as momentum develops around the June 21st option expiration date.

Why are Ethereum prices rising today?

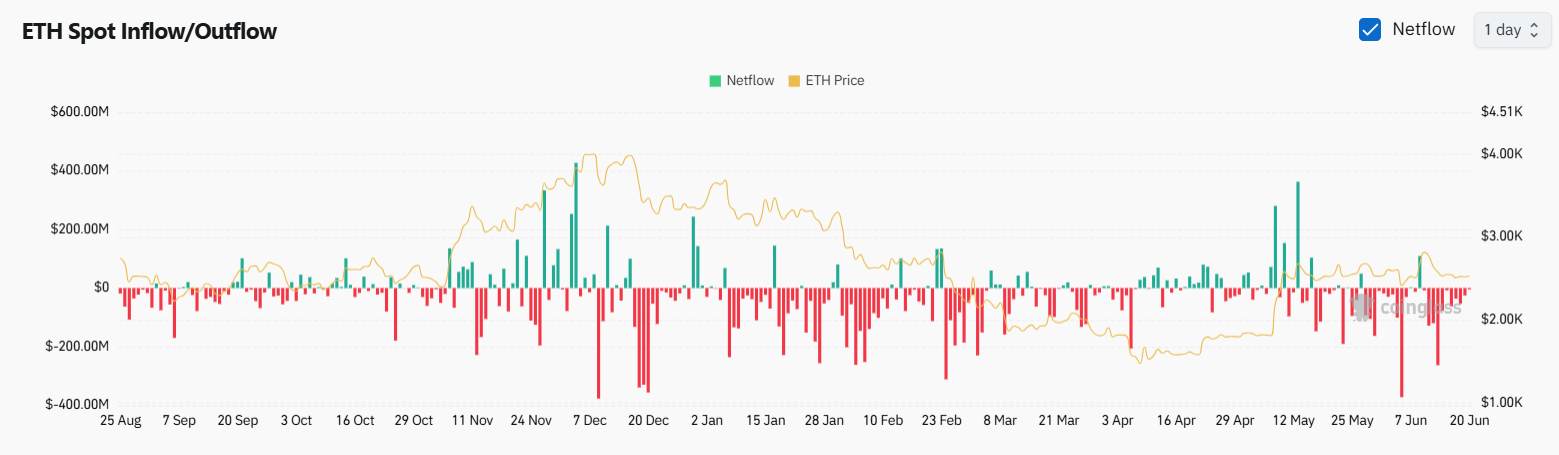

ETH Spot Inflow/Outflow Data (Source: Coinglass)

Over the past 48 hours, Ethereum has seen net flow rates of over $82 million across spot exchanges, according to Coinglass data. This sustained negative Netflow is usually seen as a sign of long-term accumulation as whales and institutions move refrigerated or independent assets. Prices have not yet exploded upwards, but these spills help explain why Ethereum prices are at least slightly rising as exchange supply becomes more tight.

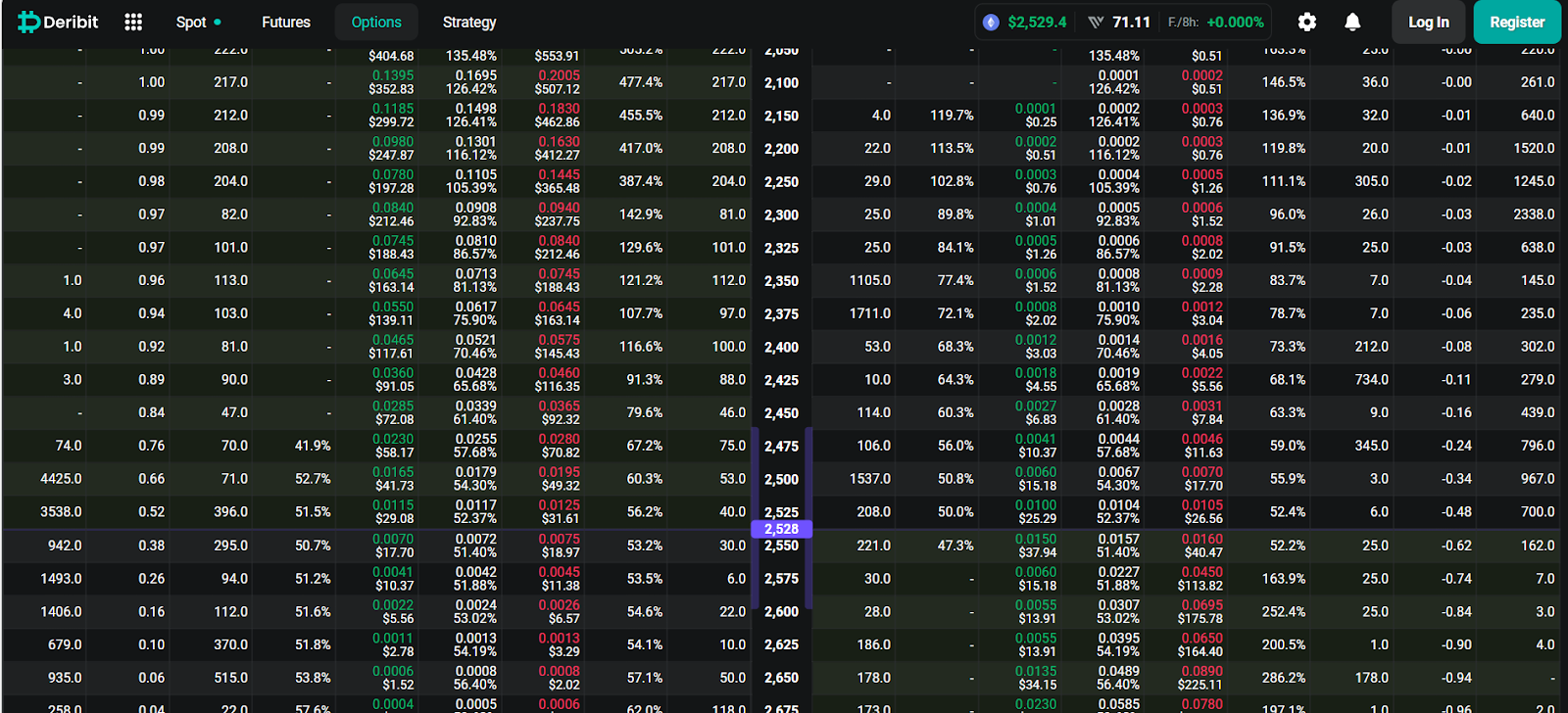

ETH option chain data (source: DELIBIT)

This on-chain trend is further supported by derived data. The June 21 option chain shows a number of open profits concentrated at strike levels of $2,500 and $2,600, indicating that a large number of traders are positioned for potential moves within or within this range. If the Bulls are able to hold ETH over $2,500 than they expire, they could force a short cover or delta hedge activity that raises prices through key resistance.

What will be the price of Ethereum?

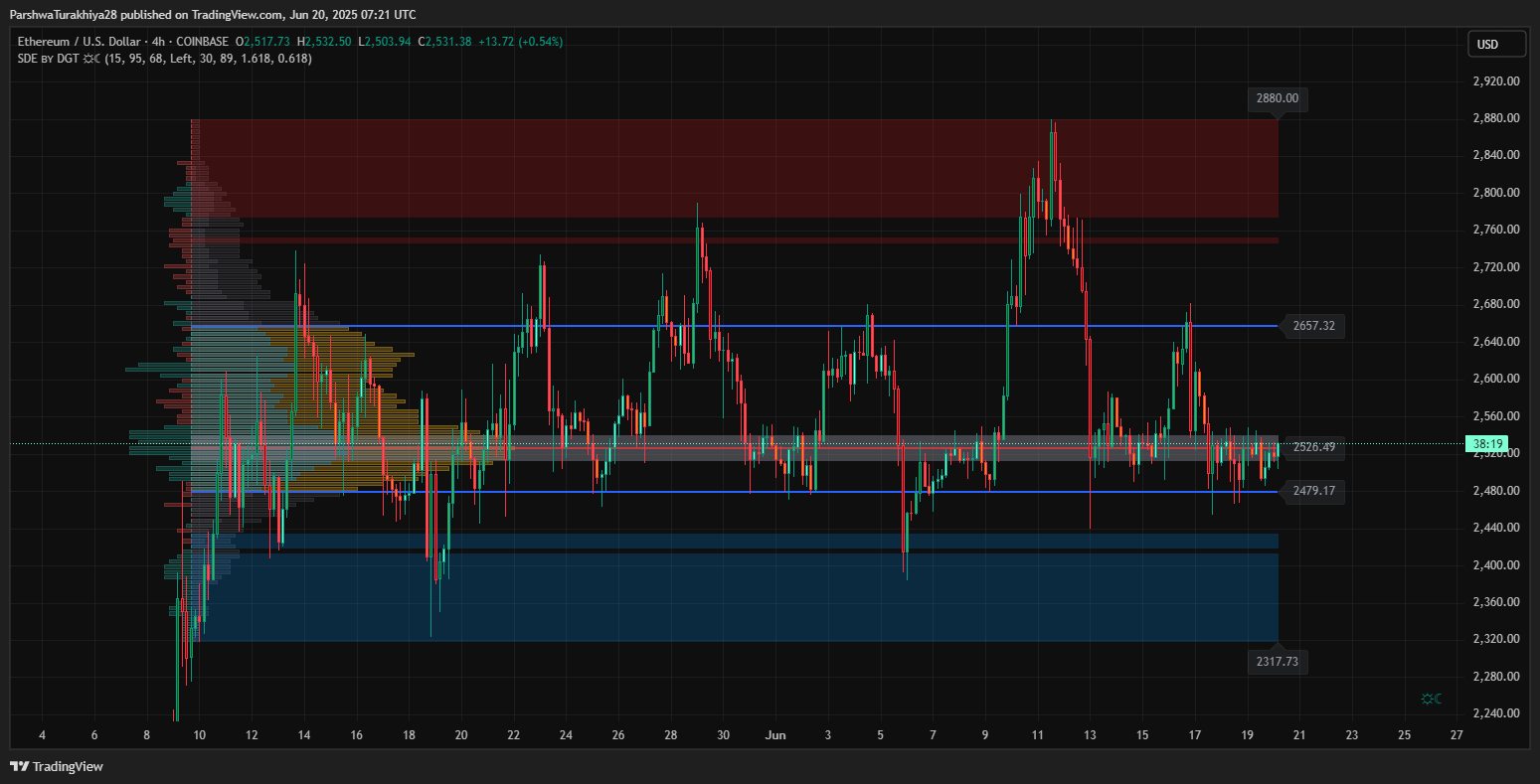

ETH Price Prediction (Source: TradingView)

The Ethereum price action on the 4-hour chart shows a distinct compression pattern formed between a support rise of nearly $2,457 and a downward resistance of $2,659. ETH remains locked inside this narrow wedge after multiple failed breakout attempts over the past week. This harsh structure often precedes volatility spikes, and current levels suggest that the market is on the brink of directional movement.

ETH Price Prediction (Source: TradingView)

On the four-hour chart, Ethereum remains locked within the tightening channel structure, with multiple low highs pointing to potential bear pressure. Bollinger Band is contracted and shows the period of volatility suppression at Ethereum prices, which often precedes the suppression. The midline of the Bollinger Band is located at $2,526 along the current price action. This suggests that the market is still undecided.

EMA clusters (20/50/100/200) from $2,504 to $2,565 will continue to function as dynamic resistance. The upward momentum remains in the cap until Ethereum Price has a strong closure of over $2,580.

ETH Price Prediction (Source: TradingView)

The 30-minute chart RSI shows a modest recovery to 57.44, but the previous bearish release on June 17 still remains in the background. Plus, the 30-minute chart supertrend just turned red again at $2,530, indicating a lingering short-term sales pressure.

Ethereum price updates as volatility approaches the inflection point

ETH Price Prediction (Source: TradingView)

Updates to Ethereum prices across the time frame show coil structure. On the daily charts, ETH remains bound by range, but is structurally bullish, holding a major support area far above, ranging from $2,384 to $2,457. As long as this zone is retained, the bullish prospects for the medium term remain intact, especially given the low structural rise seen since late April.

ETH Price Prediction (Source: TradingView)

From a smart money perspective, the 4-hour chart shows repeated changes in character (choch) and structural breakdown (BOS) patterns, but no major liquidity grabs have been made to promote breakouts. Volumes are clustered around the $2,520-$2,530 zones, and are identified as control points. Without a critical change in fluidity beyond this band, Ethereum prices could continue to continue its side-to-side integration.

ETH Price Prediction (Source: TradingView)

Volume profile analysis also reveals key liquidity nodes ranging from $2,500 to $2,530, serving as pivot zones for several weeks. This large cluster strengthens its role as an important battlefield. A critical closure above this band could pave the way for the next major zone of resistance at $2,700-2,750.

Short-term Ethereum price forecast and key levels

For the time being, traders should be aware of $2,457 in support and $2,580 in resistance levels. Once ETH exceeds $2,580 in volume, the next upside target is $2,657, closely followed by $2,700 and $2,750. On the downside, if you fail to hold $2,457, your ETH could be exposed to a deep retracement of $2,384.

With consistent spot spills, options expired and stringent technical setups, Ethereum prices look poised for potential breakouts. The short-term direction depends on regaining the resistance zone, but the wider structure remains constructive. Traders should monitor volume checks and breakout momentum of nearly $2,580 to measure whether Ethereum price spikes are on the horizon or if integrations are further ahead.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.