Ethereum (ETH) price forecasts show possible breakout signs as several factors show bullish momentum increases. The rise in technological patterns and institutional investment suggest that Ethereum could enter a new phase of growth.

Ethereum (ETH) price chart shows bullish pattern formation

According to recent technical analysis, Ethereum’s current price action shows a downward wedge pattern. Downward wedges are usually bullish patterns that appear after downtrends, indicating sales pressure and potential reversals.

Source | x

The chart shows Ethereum, which combines two downward trend lines to form a narrowing range. Analysts note that intraweedge price consolidation often precedes sharp breakouts. The green arrows on the chart point upwards, suggesting that a breakout is expected soon.

Marketwatchers are paying close attention to the Ethereum (ETH) movement near the top trend line. Breakouts seen above this line validate bullish setups, especially when trading volumes are high. However, analysts warn that traders must monitor for possible false breakouts. There, prices may temporarily outweigh resistance, but may not be held.

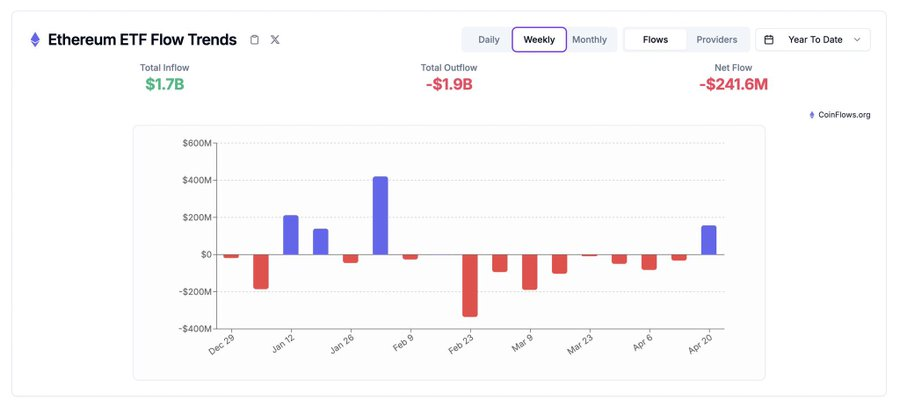

ETF inflows suggests increased investor trust

Investor preference perspectives can be identified through an analysis of the recently published weekly Ethereum ETF Flow Trends chart. Ethereum ETF recorded a total of $1.7 billion inflows in April 2025, with a net loss of $1.9 billion inflows that generated $241.6 million.

Source | x

The weekly influx during the latest period marks the largest since February 2025 despite negative netflow statistics annually. The giant blue bars in the chart show a fresh influx of Ethereum ETFs for the week ending on April 20, 2025.

Ethereum ETF suffered from continuing capital outflows from April 2025 until the start of large asset deposits. Analysts say the substantial financial movement appears to indicate that institutional investors are switching stances to Ethereum. The team will track upcoming weekly flow data to determine whether this current pattern of growth remains strong and therefore justifies a long-term market recovery.

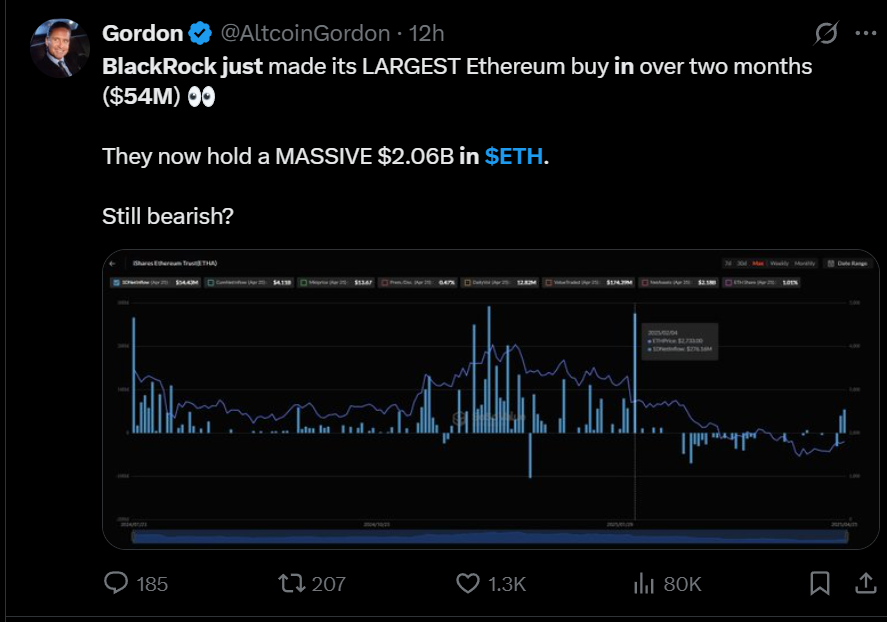

BlackRock will increase its holdings to over $2 billion

BlackRock has increased its holdings of Ethereum (ETH) through $54 million worth of over-the-counter (OTC) transactions due to its status as one of the largest asset management companies. Through this recent action, BlackRock has made its biggest Ethereum purchase since the last two months.

Source | x

The purchase has led BlackRock to own $2.06 billion worth of Ethereum (ETH). A BlackRock spokesman said the company is actively keenly looking into potential digital asset opportunities to expand its crypto portfolio.

Large institutions such as BlackRock have invested through considerable purchases, along with President Trump’s substantial Ethereum portfolio, helping to build stronger trust in related assets. Investors often see these actions actively as they occur during the setup of strong technology markets and increase ETF inflows.

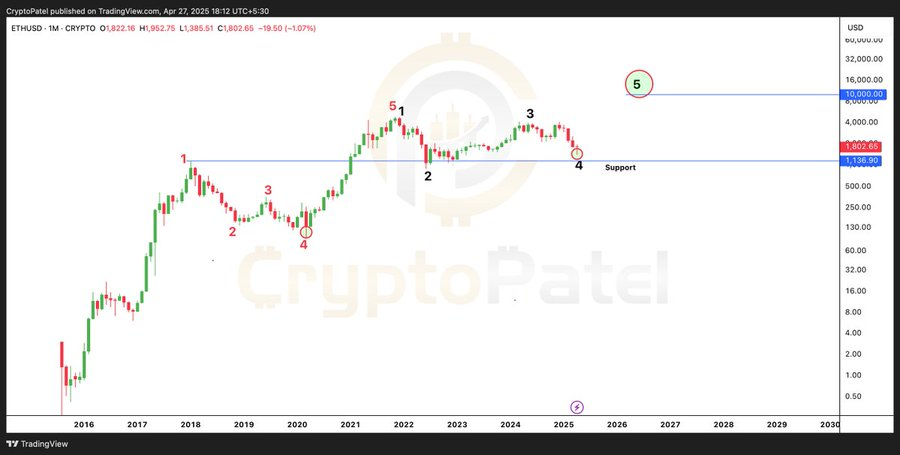

Elliott Wave Analysts suggest that Ethereum (ETH) will move to a price level of $10,000

Technical Crypto analyst Crypto analyst Cryptopatel’s price forecast and analysis revealed that ETH indicates the development of a 1-2-3-4-5 Elliott wave pattern across the price movement. Market prices reflect the emotional behavior of investors, and therefore show repeated wave movements under Elliott’s Wave theory.

Source | x

This diagram identifies five potential waves, with 1, 2, 3, and expected waves 5 displayed in the upward direction. Waves 2 and 4 represent corrective downward movement. Cryptopatel’s model shows that Ethereum can generate a price of up to $10,000 if 5-wave 5 is successfully developed.

To verify patterns within Elliott wave theory, certain retracement restrictions must exist between the waves and certain rules must be met. Analysts explain that targets can only be reached if Ethereum (ETH) price transfer is followed by wave structures that require it.