Ethereum’s recent push above $3,000 has faced pressure as the risk of profits emerges.

On-chain signals and volume patterns suggest possible weakness in the short-term Ethereum price, unless the key level breaks.

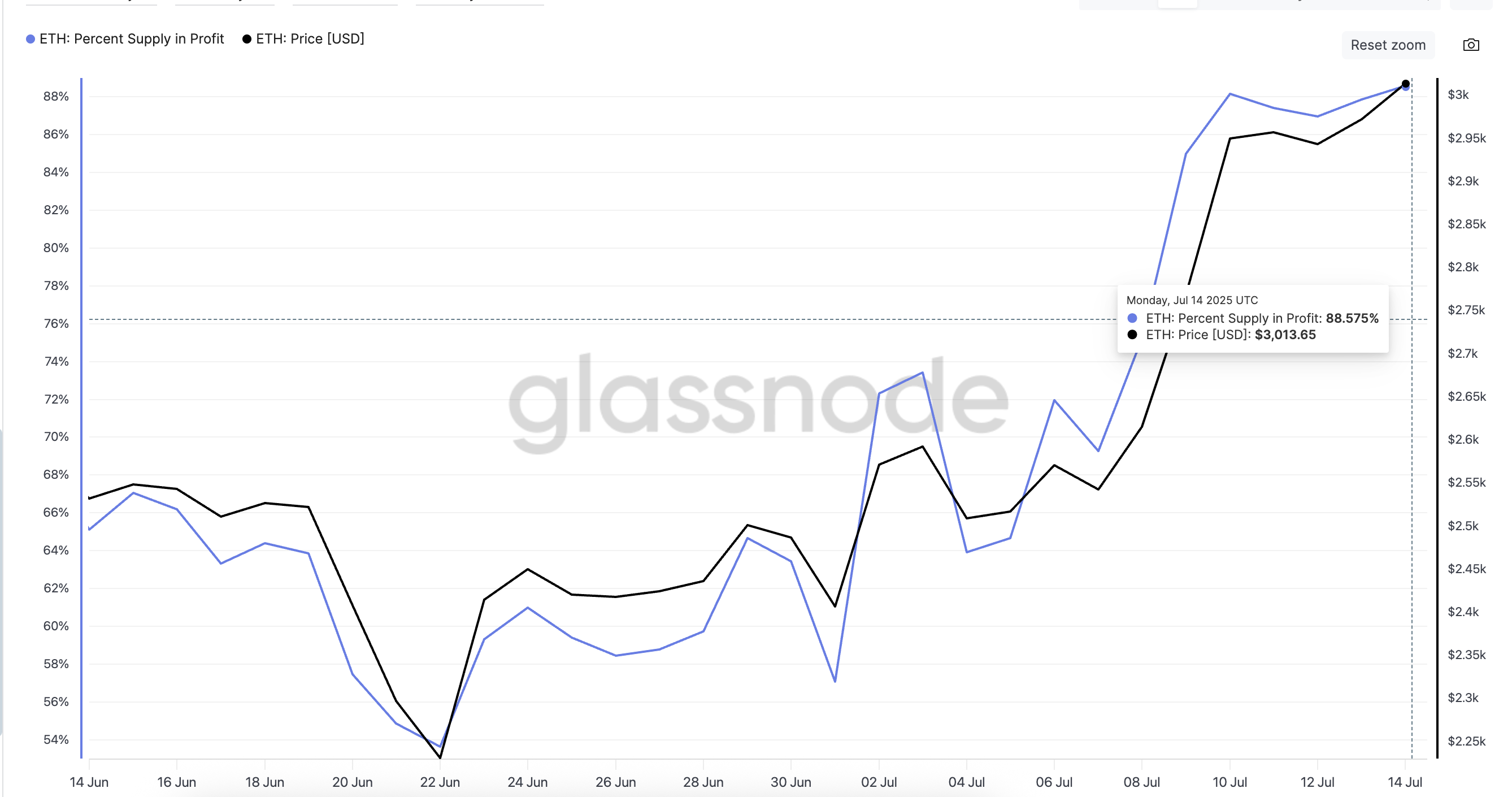

Over 88% of profit ETH may show local top

According to GlassNode, 88.57% of ETH supply was profitable as of July 14th, with prices reaching nearly $3,013. According to the one-month chart, short-term revisions tend to continue with each surge in profit margins for ETH holders.

Ethereum price and supply (profit) percentage: GlassNode

The supply rate of profit metrics tracks the percentage of distribution ETHs whose acquisition costs are below the current market price. The indicator spikes often correspond to overheated gatherings and post-rally fatigue zones. This is what ETH is currently working on.

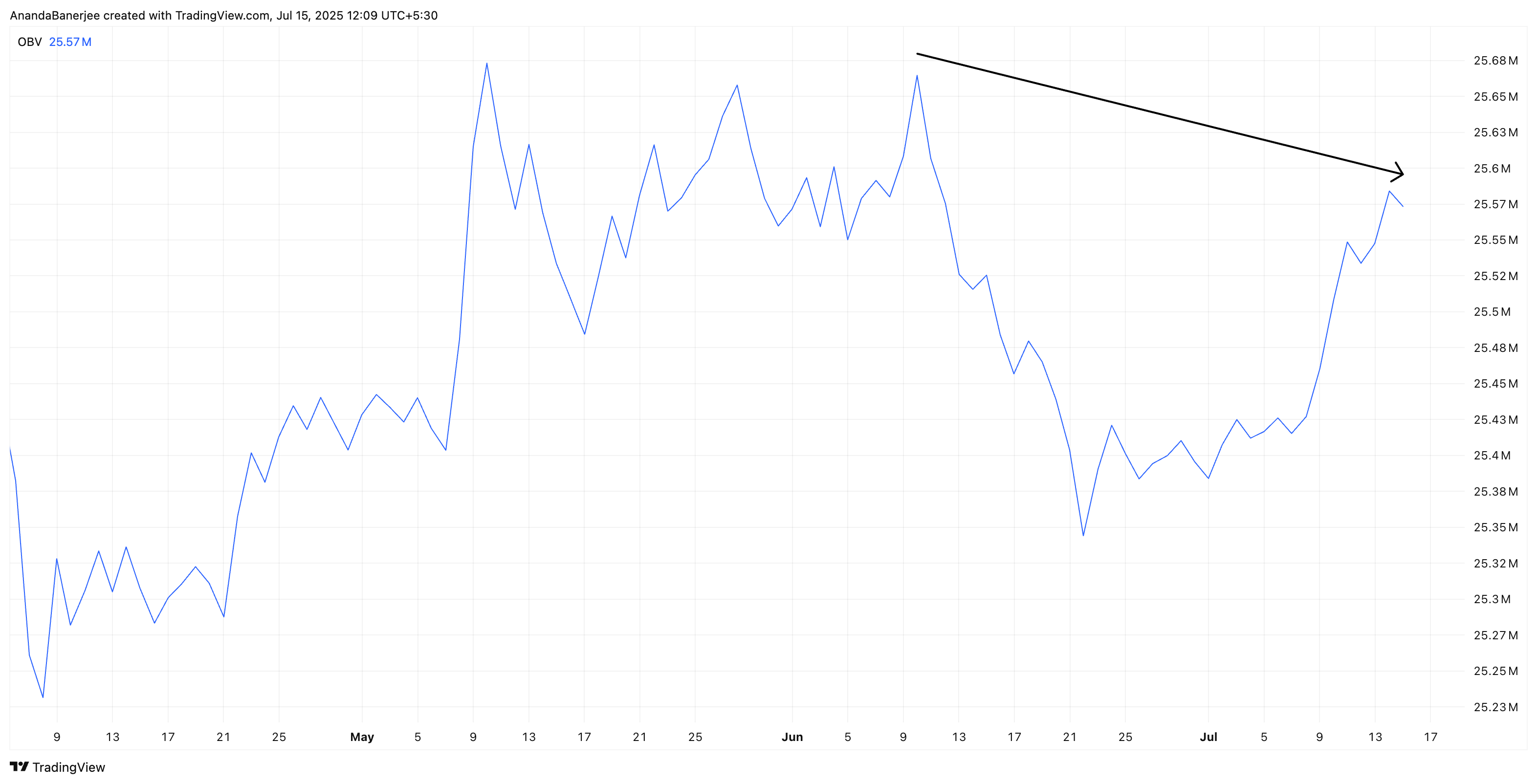

Obviously branching will undermine the strength of the price

Ethereum prices continued to rise from June 11th to July 14th, but the On-Balance Volume (OBV) formed a lower high, confirming bearish divergence. This means fewer traders are taking part in the current leg, the red flag for sustainability. Here, this risk is flagged here, suggesting a price adjustment.

Despite the fixes occurring, the OBV has not returned and poses another correction threat in the short term.

ETH obv analysis: tradingView

obv measures volume flow by adding volume on the up day and subtracting it on the down day. If the OBV can’t keep up with the price, it suggests that it weakens the accumulation behind the scenes or increases the strength of the seller.

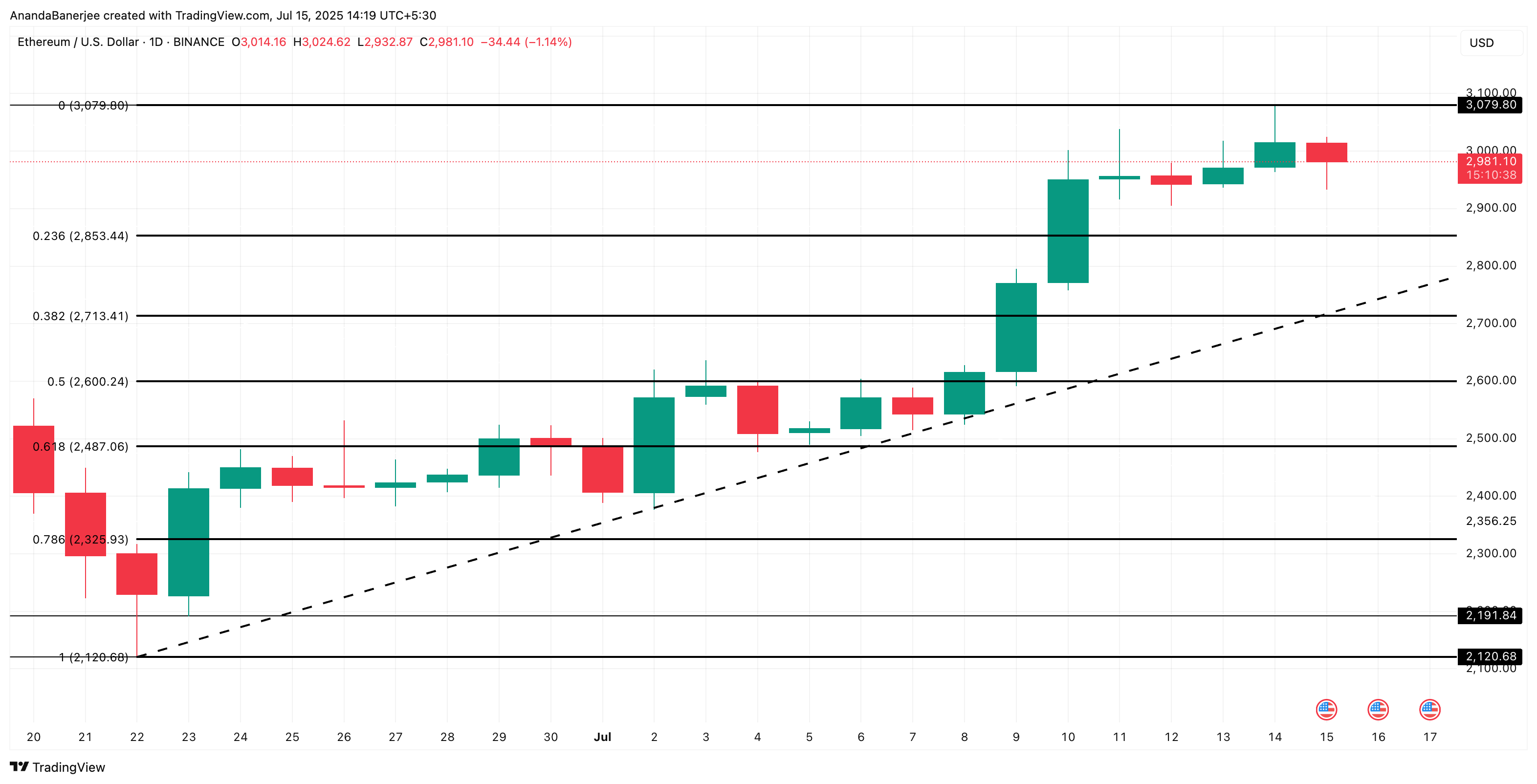

Fibonacci Levels provide support for major ETH prices

The ETH price hit a resistance of $3,079. After being rejected in this zone, the price is currently consolidated around $2,981.

Here is the instant retracement support for ETH:

- 0.236 Level: $2,853

- 0.382 Level: $2,713

Ethereum Price Analysis: TradingView

However, the ETH price chart suggests that $2,600 (0.5 FIB level) and $2,487 (0.618 FIB level) are the most important support zones. These must be violated because the overall structure becomes bearish.

As Ethereum matches the key breakout candle, the wider bullish structure will still be retained as long as Ethereum exceeds $2,713.

When Ethereum closes above $3,079 (a recent swing high) and OBVs start trending upwards, the short-term bearish hypothesis is invalidated. This indicates that you may update your purchase conviction and open a path to a higher level.

Until then, divergence of profits and volumes will draw attention, especially as ETH hovered at historically saturated profit levels.