Ethereum (ETH) has soaked more than 7% in the last 24 hours despite Trump’s 90-day tariff suspension. Key technical indicators suggest that a complete trend reversal may be unlikely in the short term.

BBTREND remains strongly negative, whale accumulation stagnates, and both are cautioned. Combined with a still-born EMA structure, Ethereum may need a stronger wave of purchase pressure before it can break out of the current downward trend.

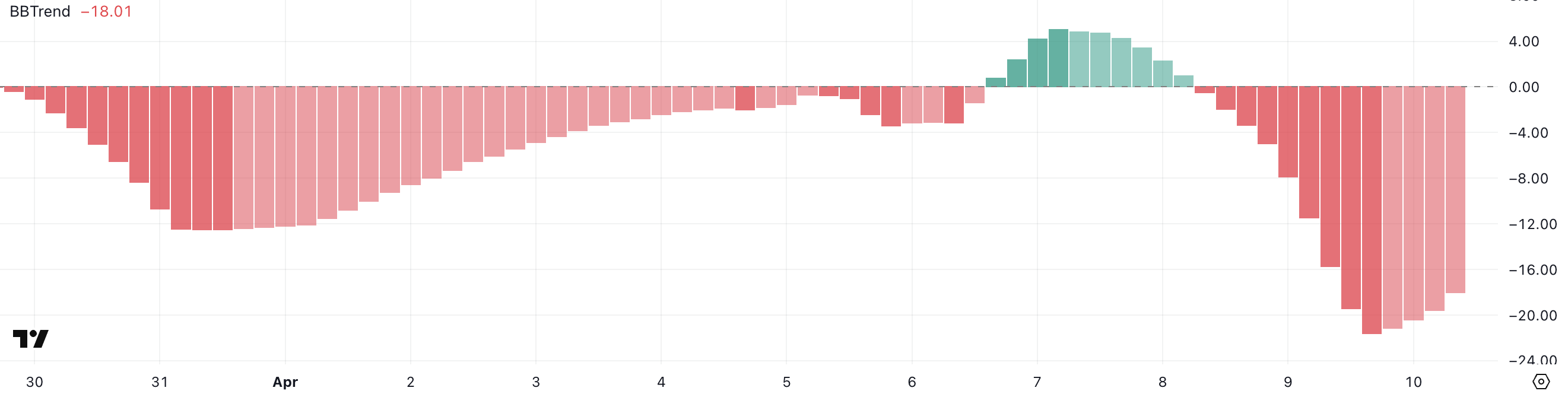

Eth Bbtrend is negative, but bigger than yesterday

Ethereum’s Bbtrend indicator has improved slightly, and is currently reading -18, rising from -21.59 just before Trump’s tariff suspension announcement.

This shift suggests that the bearish momentum may be beginning to fade, but it shows overall negative pressure. BBTREND (Band-Based Trend) is a volatility-based indicator that helps you measure trend strength and orientation using the relationship between price and bollinger bands.

Values above zero indicate bullish momentum, while negative values refer to bearish trends. The farther from zero, the stronger the conviction of direction.

ETH BBTREND. Source: TradingView.

ETH’s BBTREND has remained in negative territory since April 8th, reflecting the persistent weakness of recent sessions. While recent rises may suggest early stabilization, the current value of -18 suggests that Ethereum has not yet turned the broader trend.

For bullish confirmation, ETH should push Bbtrend back into ideal neutral or positive territory supported by volume and powerful price action.

Until then, the chart still points to the market in revision mode, but there are signs of a possible reversal.

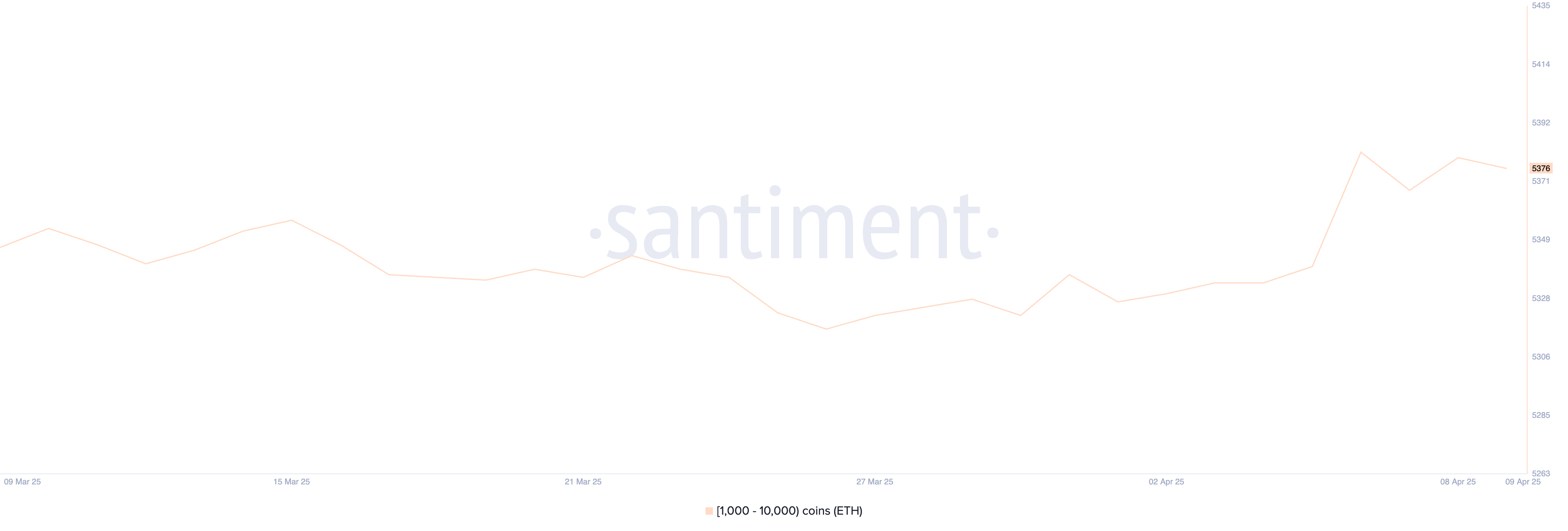

The whales have not yet accumulated

Between April 5 and 6, the number of Ethereum whales holding 1,000-10,000 ETH is showing a short rise in accumulation on lines ranging from 5,340 to 5,382.

However, the metric has since been stable, currently at 5,376, with little change recently.

Tracking whale activity is important. This is because these large holders often have the influence to move the market by starting big purchases during the dip or by developing their strength to earn profits.

Ethereum whale. Source: Santiment.

Recent stabilization of whale numbers suggests a waiting approach from key owners. After a short buildup spike, the whales seem to hold their position rather than actively buying and selling.

This means you’re back in confidence, but not strong enough to promote a big breakout.

As Ethereum sees the sustained upward momentum, the new rise in whale accumulation is a positive signal, indicating a growing conviction from the largest players in the market.

Are the current Ethereum surges temporary?

Despite Ethereum’s recent bounce after Trump’s tariff suspension, its EMA structure remains bearish, with the short-term moving average still under the long term.

This delayed alignment reflects ongoing negative side pressure, usually during relief gatherings.

When viewed alongside other metrics, such as the still negative BBTREND and stagnant whale accumulation, it becomes clear that Ethereum requires significantly more purchases to move to a confirmed uptrend.

ETH price analysis. Source: TradingView.

If that bullish pressure appears, Ethereum’s prices may be aiming to test resistance at $1,749, where a breakout will allow you to open a pass up to $1,954, or even $2,104. It could be driven by macro development, like the recent approval of options SEC trades on BlackRock’s Ethereum ETFs..

However, once momentum fades, there is a risk that prices will enter another correction stage.

The main support is $1,412, and if that level fails, ETH could fall below $1,400 and potentially revisit the territory of $1,300.