On-chain data shows that Ethereum supply on the exchange has plummeted to an all-time low as investors continue to withdraw ETH.

Ethereum supply on exchanges has been on a downtrend lately

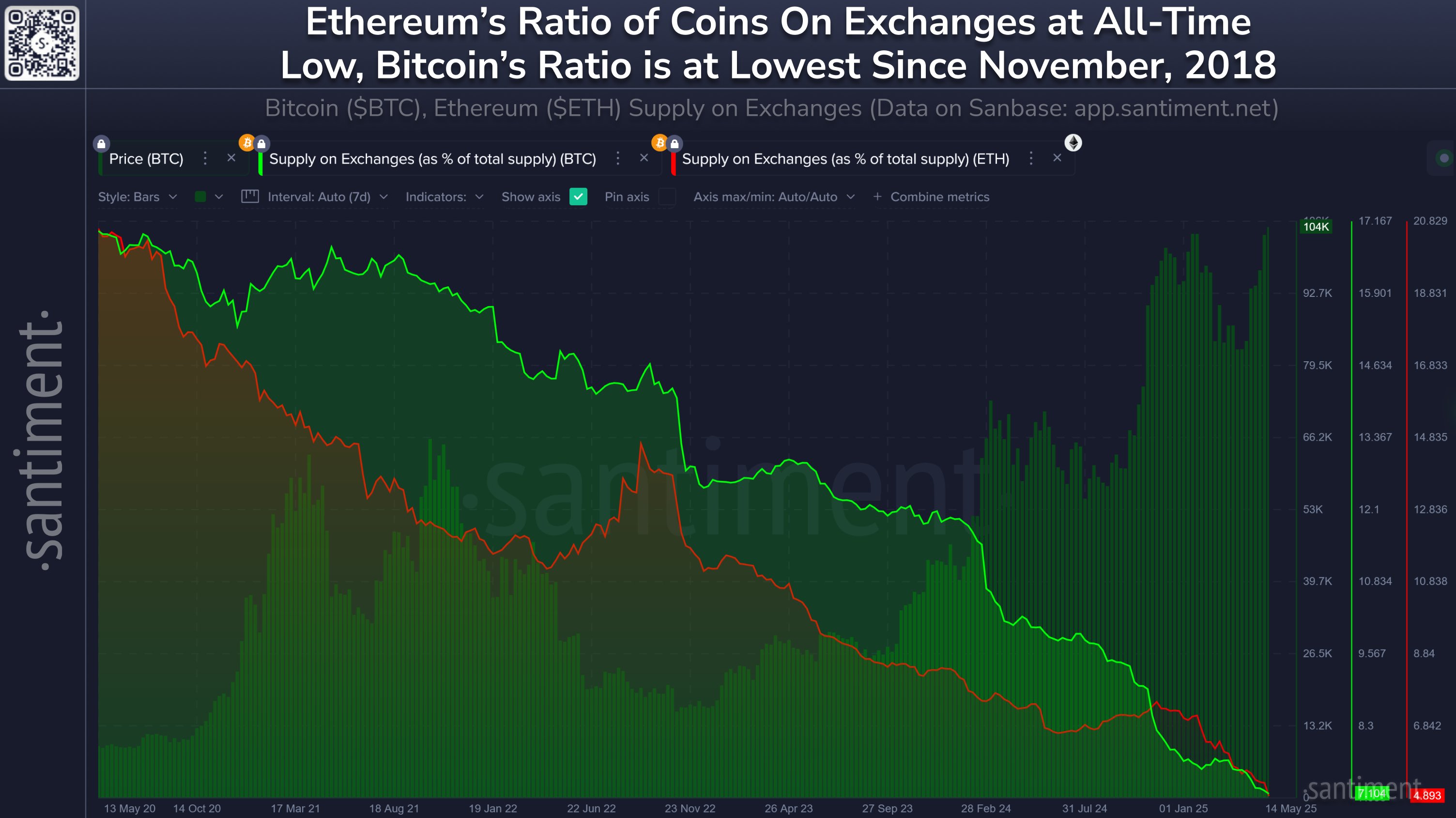

In a new post on X, on-chain analytics firm Santiment discusses the latest trends in the supply of Ethereum exchanges. “Exchange Supply” refers to an indicator that measures the percentage of total ETH supply in wallets currently attached to centralized exchanges, as the name already suggests.

When the value of this metric increases, it means investors are depositing net tokens on these platforms. This kind of trend can have a bearish effect on the price of a coin, as one of the main reasons an owner can transfer coins to exchange is for sales-related purposes.

On the other hand, the indicator goes down, which means that the supply is away from the exchange. Generally, investors will withdraw the coin into a self-supporting wallet if they plan to hold it for the long term. So this trend is bullish for cryptocurrencies.

Now, here is the chart shared by the analytics company.

The value of the metric appears to have been following a downward trajectory for a while now | Source: Santiment on X

As shown in the graph above, Ethereum supply in exchanges shows a long-term downward trend, but there was a period of temporary deviation.

One such stage came at the time of the bull’s running towards the end of 2024.

However, in the months since the peak, the indicators return to a downward trajectory, suggesting that holders have resumed accumulation. Today, the metric sits at 4.9%. This is the lowest ever recorded.

On the same chart, Santiment also includes data on supply for Bitcoin exchanges. The number one cryptocurrency appears to have seen a trend in net leaks over the past few years, and unlike ETH, there have been no notable examples of deviations.

Over the past five years, investors have withdrawn 1.7 million BTC from the exchange. This decrease brings the metric value to 7.1%. This is the lowest since November 2018. During the same period, ETH holders removed 15.3 million tokens of assets from these platforms.

What should be kept in mind is that while the exchanges played a central role in the market years ago, that is no longer technically. The emergence of funds (ETFs) traded on exchanges means that there is currently another major gateway to the sector, so exchange outflows may not have the exact same impact as before.

ETH Price

At the time of writing, Ethereum fell by more than 2% last week.

Looks like the price of the coin hasn't moved much recently | Source: ETHUSDT on TradingView

Featured images from charts on Dall-E, santiment.net, and tradingview.com

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.